- Bitcoin hits new transaction volume milestone.

- However, miner revenue has been on a downfall.

The excitement that we saw in Bitcoin from January to part of March has no doubt died down. It is always a good idea to seek a broader perspective when there is a shift in the focus on price and into other areas.

Read Bitcoin’s [BTC] price prediction 2023-24

Bitcoin’s network volume is perhaps a good place to start. Have you ever wondered how much worth of transactions the network has facilitated since it was created? Well, according to a recent Glassnode analysis, Bitcoin has so far settled roughly $8.2 trillion worth since it started running.

Since inception, without requiring any third party authority, the #Bitcoin network has settled a staggering $8.2T in uncensorable transfer volume when adjusting for non-economic transactions.

????Epoch 1 Peak: $10.2M per Day

????Epoch 2 Peak: $476.1M per Day

????Epoch 3 Peak: $747.9M… pic.twitter.com/sI9fLREP3Y— glassnode (@glassnode) May 16, 2023

The network has been facing an unusual problem despite this impressive milestone. The Bitcoin network has recently been experiencing congestion but it is not necessarily connected to conventional transactions. Instead, the congestion was triggered by the recently launched BRC20 tokens.

According to recent reports, the Bitcoin network developers are currently contemplating solutions for this congestion problem. They are also divided on the matter because some believe that direct censorship of BRC20 transactions is the way to go, while others prescribe no action.

Bitcoin developers discuss network congestion caused by BRC-20s

Many developers have participated in the discussion, some suggest directly censoring such transactions, while others believe that this is how the system operates and does not require intervention. There are also… pic.twitter.com/XmLhoZbGOZ

— Wu Blockchain (@WuBlockchain) May 16, 2023

The impact on market participants

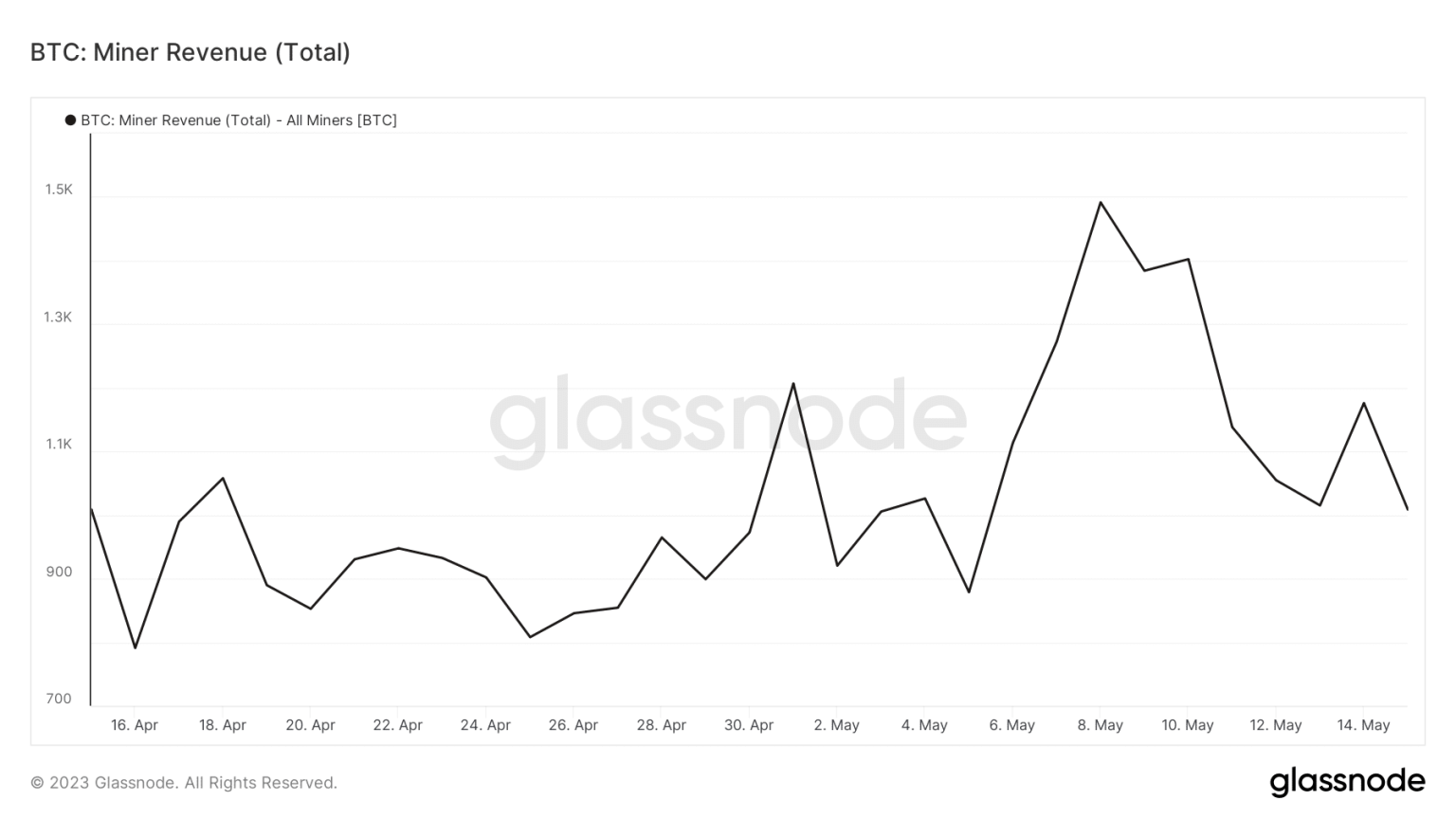

Perhaps the effects of the BRC20-induced transactions are a more interesting aspect of Bitcoin’s current predicament. Higher transactions often translate to more revenue for miners. While that was the case at first, we have to consider other factors. Bitcoin’s miner revenue witnessed an uptick in the first week of May. However, it has since reverted even though the BRC20 tokens are still fueling strong network activity.

Source: Glassnode

There might be a reasonable explanation for why the miner revenue has been tanking after a brief rally. Higher profitability has attracted more miners into the fold. This was evident by the surge in the Bitcoin network’s hash rate between 5 and 14 May. More miner participation results in a smaller share of the network revenue.

Source: Glassnode

The metric denoted in red is the Lightning network capacity which reflected the state of the Bitcoin network’s congestion. Although this increase in network activity is somewhat related to the demand for ordinal inscriptions and other BRC20 tokens, that demand has not necessarily been reflected in BTC’s price action.

Is your portfolio green? Check out the Bitcoin Profit Calculator

BTC exchanged hands at $27,049 at the time of writing. Its performance reflected a state of relatively low confidence among investors, hence demand has been low. This was especially compared to Bitcoin’s performance between January and March.