- Transactions on the Bitcoin network soar to new highs attracting more mining revenue.

- Miner revenue also soared to a six-month high as of 1 May.

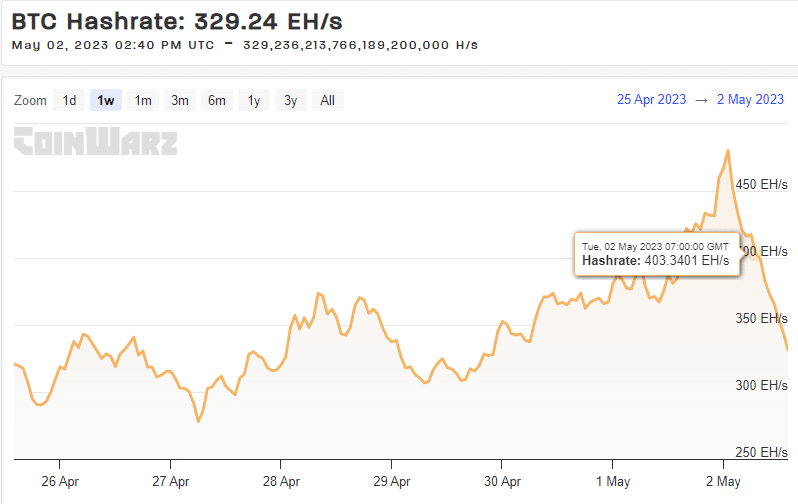

As the world waits for the crypto market to regain some price excitement, something interesting is happening on the Bitcoin [BTC] blockchain. Its hash rate experienced a noteworthy surge that may have something to do with the Bitcoin ordinals.

Is your portfolio green? Check out the Bitcoin Profit Calculator

At press time, Bitcoin’s hash rate stood at 473.87 EH/s and witnessed a rise in the last 24 hours. This observation was significant because it wasn’t only the highest weekly hash rate level, but also the highest ever. The main significance of this observation was that it highlighted a surge in miner participation in the market.

Source: CoinWarz

The hash rate spike was likely due to the rising Bitcoin ordinals inscriptions. They have been a key driving factor for organic transactions on the network other than BTC trading activities. This reflected a recent surge in Bitcoin daily transactions which also reached a new ATH on 1 May.

#Bitcoin daily transactions reached an all-time-high yesterday of 682,281.

With ordinal inscriptions on the rise, they are likely to be playing a big role in this increased usage. pic.twitter.com/ftutJKSGsD

— Binance (@binance) May 2, 2023

More daily transactions translate to higher miner revenue. This explains why Bitcoin’s hash rate increased as miners added more hash rate to take advantage of the revenue-generating opportunities. Glassnode’s miner revenue metric confirmed the same.

Source: Glassnode

Assessing the potential impact on Bitcoin’s price performance

Miner revenue soared to a new six-month high on 1 May. If you are like most, you are probably wondering whether the Bitcoin ordinals will have an impact on BTC’s price action. First, the ordinal inscriptions do not have a direct impact on Bitcoin demand even though transactions are on the rise. However, they would likely have an impact if Bitcoin miner reserves were up.

A closer look at Bitcoin’s on-chain data confirmed that the transaction count has been on the rise for the last few days. However, the situation is different for miner reserves, which, at press time were down to their lowest level in the last three months.

Source: CryptoQuant

Dwindling miner reserves are usually not considered a healthy sign for the market. This is because it shows a lack of incentives for miners to hold, which aligns with the prevailing market sentiment. The declining miner reserves explain the disconnect in the surging demand for Bitcoin ordinals and Bitcoin’s price performance.

How many are 1,10,100 BTCs worth today

BTC crashed by over 3% on 1 May, the same day that transaction count and hash rate soared to new ATHs. Bitcoin exchanged hands at $28,592 at press time after securing some bullish volumes. The price action did not share the same level of enthusiasm as the hash rate or transactions on the network.