- BLUR’s price has dropped by 98% since it launched on 14 February.

- Blur continues to see increased user activity.

Blur’s governance token BLUR has suffered a massive 98% drop in its value within just 20 days of its launch, according to CoinMarketCap data.

Following a few months of anticipation, the zero-fee non-fungible token (NFT) marketplace released its governance token on Valentine’s day.

As community members began claiming their airdropped tokens and trading the same, BLUR’s price shot up to almost $50 on the same day.

However, almost instantaneously, it soon began its descent. At press time, the alt traded at $0.6915.

Is your portfolio green? Check out the Blur Profit Calculator

Profit lines are blurred

A look at the alt’s performance on a daily chart revealed that many BLUR holders have since begun distributing their holdings.

Analysis of key momentum indicators has shown no signs of accumulation activity since 14 February, indicating that many of the airdropped users were only interested in profiting from the tokens and selling them off.

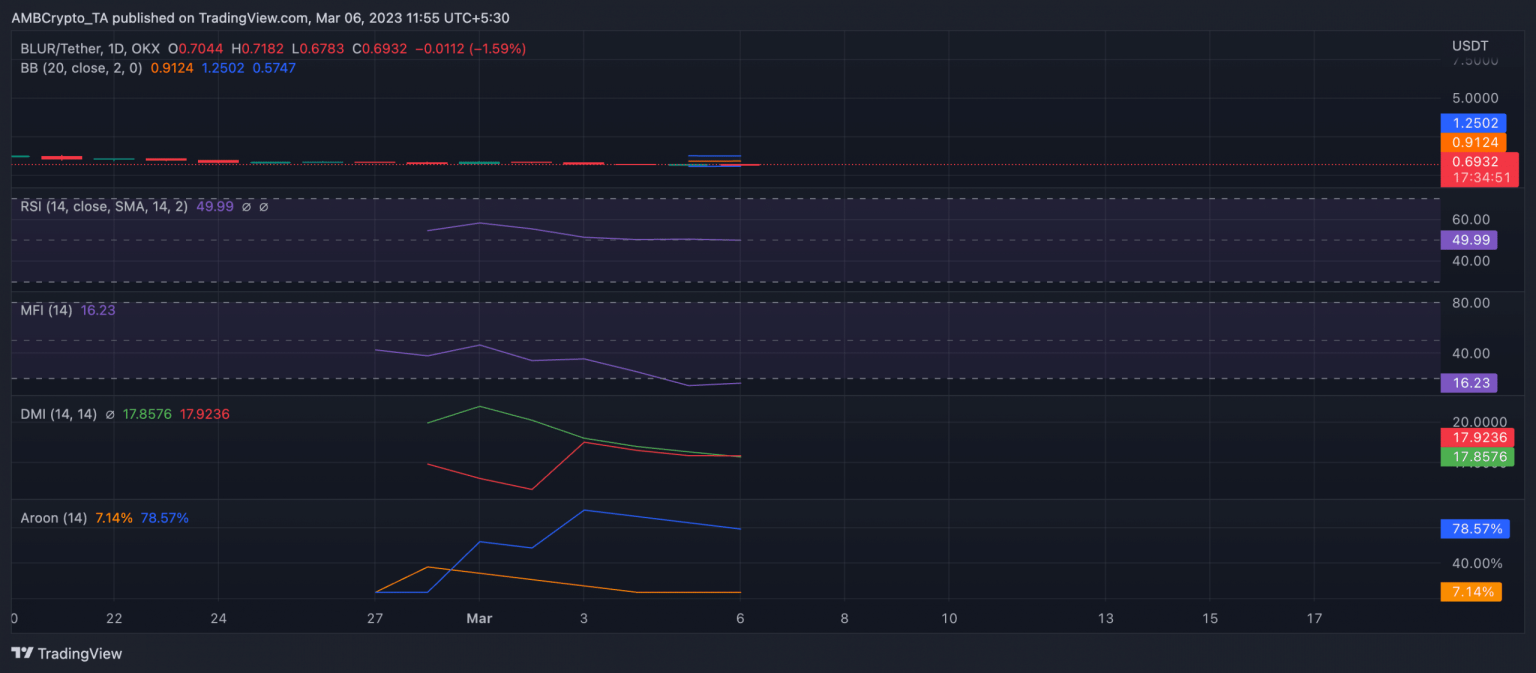

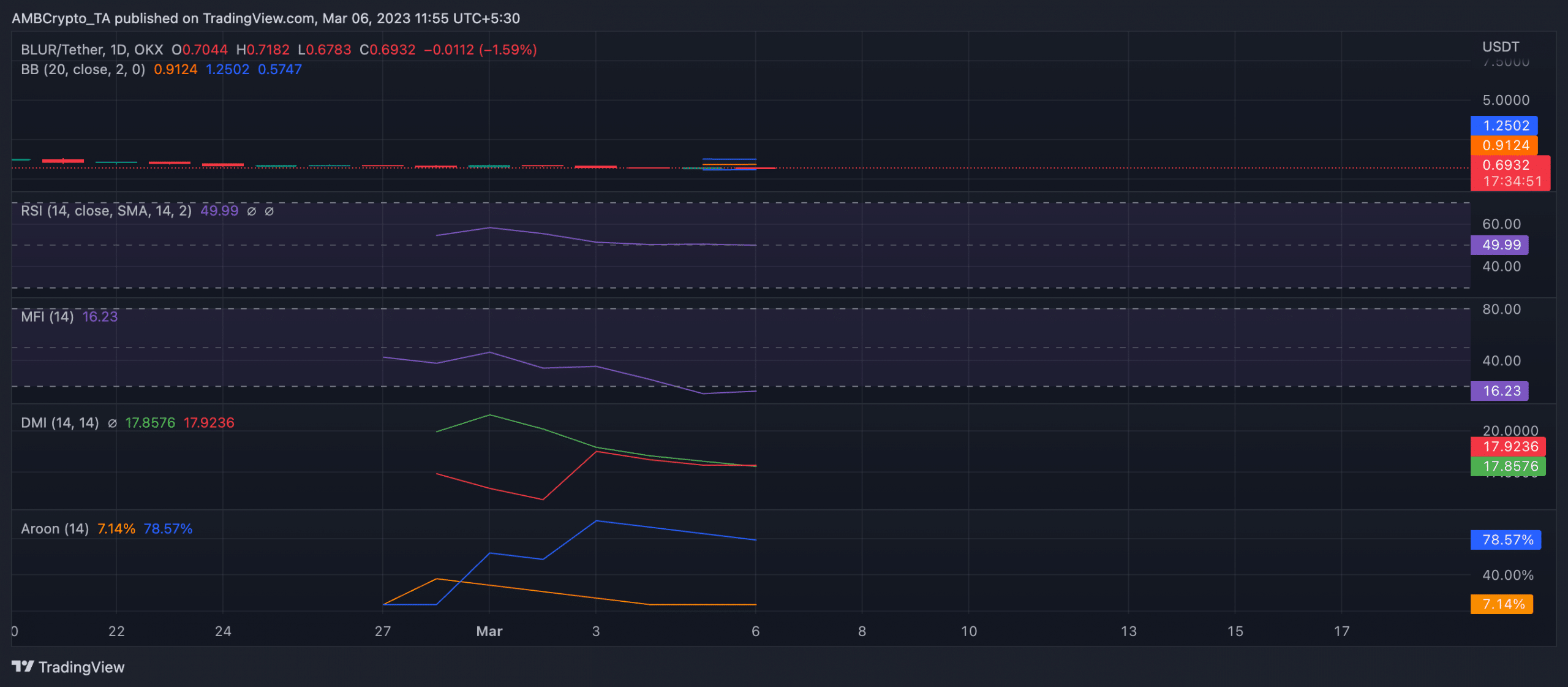

With significant distribution still ongoing at press time, Blur’s Money Flow Index (MFI) rested deeply in the oversold region. It was 16.23.

Also, in a downtrend, the Relative Strength Index (RSI) lay below the 50-neutral position at 49.99

Further, the Directional Movement Indicator (DMI) confirmed that selling pressure exceeded buying pressure as the BLUR sellers had control of the market as of this writing.

The positive directional indicator (green), at 17.85, was positioned below the negative directional indicator (red) at 17.92. A further decline in buying momentum is expected to push the negative directional indicator upward, solidifying the sellers’ hold on the market.

As mentioned above, BLUR clinched its highest price level of $45 on the day it launched. The Aroon Up Line (orange) at 7.14% confirmed this and hinted at a further price drawdown.

It is trite that when the Aroon Up line is close to zero, the uptrend is weak, and the most recent high was reached a long time ago.

Source: TradingView BLUR/USD

Realistic or not, here’s BLURs market cap in BTC’s terms

Blur’s grip on the market remains unrivaled, while OpenSea falters

Despite the steady fall in the value of its governance token, Blur continues to record increased user activity.

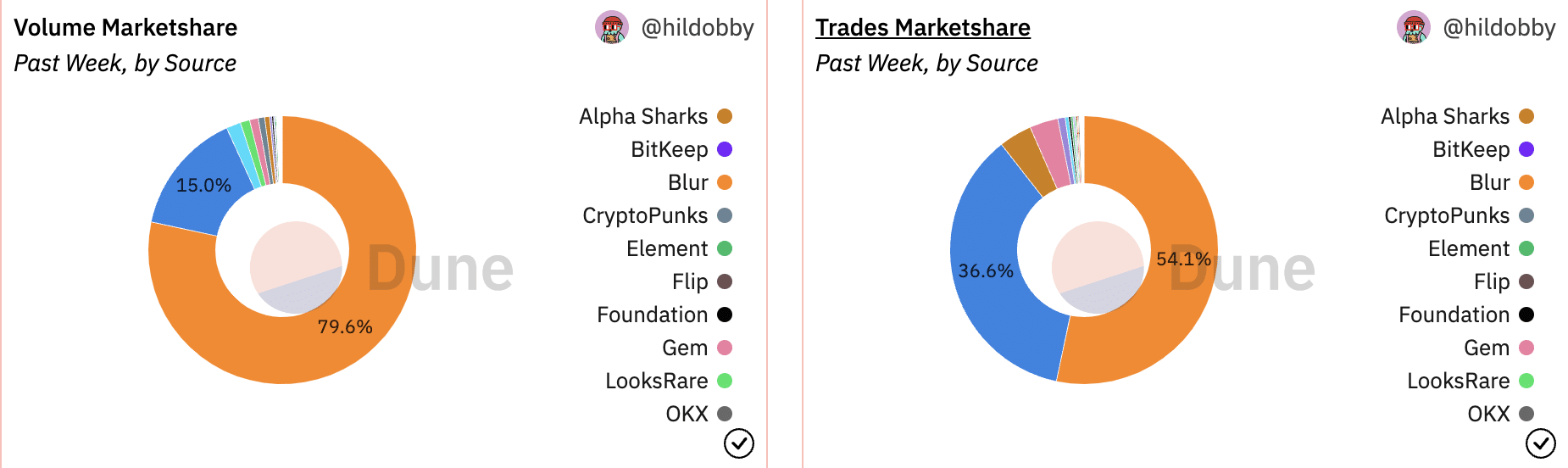

In fact, the NFT marketplace was responsible for 79.6% of the entire market sales volume in the last week.

OpenSea, on the other hand, contributed only 15% during the same period. Also, more NFT trades were completed on Blur than were completed on OpenSea in the last week, per data from Dune Analytics.

Source: Dune Analytics

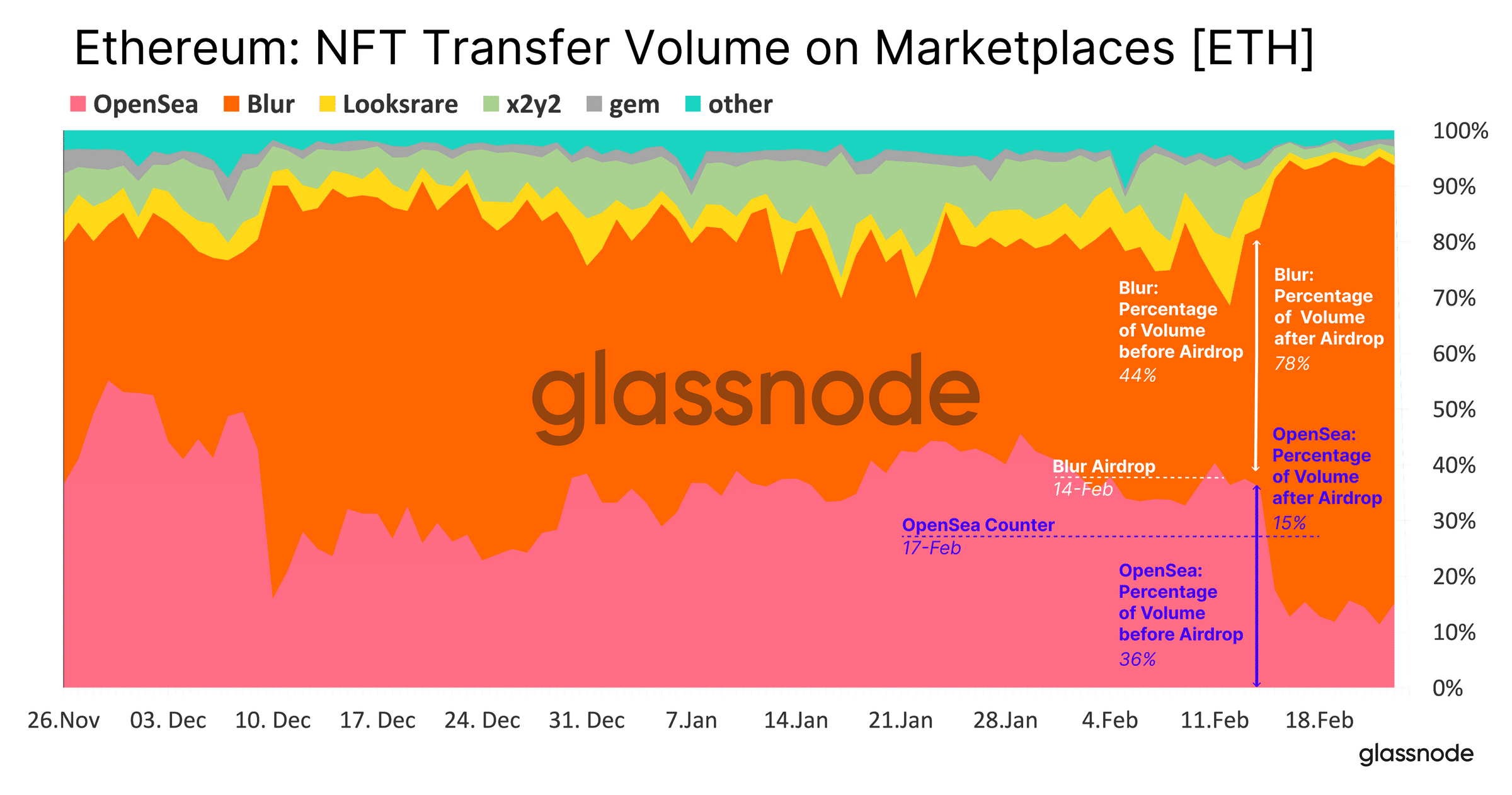

Glassnode, in a recent report, noted that the surge in Blur’s market share came after its token AirDrop on 14 February.

Prior to the AirDrop, the NFT marketplace, and aggregator held 48% of the total NFT transfer volume in the market.

However, after the AirDrop, its NFT transfer volume soared to 78%, greatly impacting OpenSea. As a result, OpenSea’s NFT transfer volume fell by 21% in the aftermath of the BLUR AirDrop.

Source: Glassnode

According to data from Dune Analytics, 360 million BLUR tokens were airdropped on 14 February. With a 60-day window period to claim these tokens, 342.92 million BLUR tokens have been claimed so far by eligible users of the NFT marketplace.

Once the 60-day window to claim the airdropped tokens elapses, it remains to be seen whether this will culminate in a decline in NFT’s marketplace usage, which could potentially restore OpenSea to its previous level of prominence.