- Bitcoin’s value has risen by over 100% since the year began.

- Most investors were holding at a profit at press time.

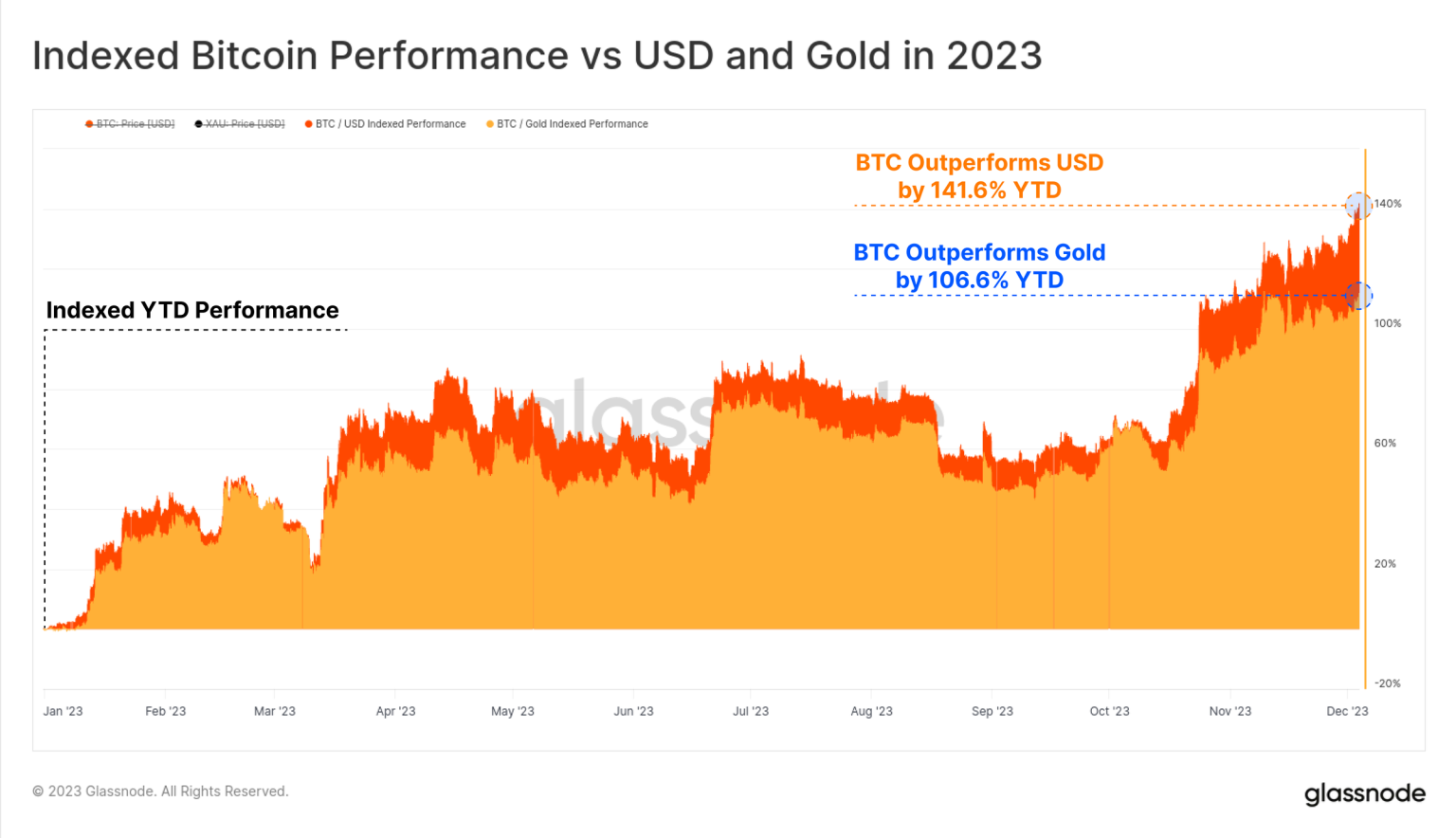

King coin Bitcoin [BTC] has maintained its position as one of the best-performing assets globally in 2023, outpacing traditional assets like gold and stocks, Glassnode found in a new report.

According to the on-chain data provider, a year-to-date assessment of BTC’s performance revealed a 140% growth in the coin’s value. Compared to gold, BTC’s price has more than doubled its value since the year began.

Most BTC holders are now in profit

With the coin exchanging hands at an 18-month high, Glassnode found that,

“The super-majority of Bitcoin holders are now back in profit, with a small proportion of them realizing those gains.”

At its press time value, BTC traded above the True Market Mean Price of $31,000. Therefore, many coin holders have seen their investments recover from the losses incurred during the 2022 bear market.

Assessing how profitable BTC investments have been, the coin’s price jump has significantly increased the proportion of coin holdings held in profit by its long-term holders.

The research firm further added,

“From the perspective of Long-Term Holders, the YTD rally has seen the proportion of their holdings held in profit increase from 56% to 84%. This has broken above the all time average value of 81.6%.”

With a Spent Output Profit Ratio (SOPR) of 1.46%, investors in this category can expect a guaranteed average profit of 46% for every coin spent.

As for the coin’s short-term holders:

“The Short-Term Holder cohort are almost entirely in profit, with over 95% of their holdings sporting a cost basis below the current spot price.”

Everyone wants a piece

Glassnode found further that there has been a surge in BTC’s YTD exchange volume momentum. It noted that this,

“Underscores an expanding interest from investors to trade, accumulate, speculate and otherwise utilize exchanges for their services.”

Read Bitcoin’s [BTC] Price Prediction 2023-24

Many anticipate favorable decisions over the Exchange-Traded Fund (ETF) applications pending before the U.S. regulators, institutional investors have steadily increased their BTC holdings.

Glassnode noted,

“Exchange deposits are currently dominated by investors moving increasingly large sums of money. This is potentially a sign of growing institutional interest as key ETF decision dates approach in January 2024.”