- Various addresses were accumulating BTC, thus, indicating broad-based interest

- Miner outflow witnessed an increase, thus indicating growing sell pressure

Based on data from Santiment, addresses of various sizes were accumulating Bitcoin [BTC] over the last few weeks. This accumulation could have played a role in the recent BTC rally.

The accumulation also indicated that not only whales but sharks and retail investors were also joining the BTC buy party. This wide range of addresses accumulating Bitcoin signified a broad-based interest in the kingcoin, and a strong indication of a bull market.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

???? A definitive explanation on why #crypto prices have bounced:

????10-100 $BTC wallets added 105,600 #Bitcoin in past 10 weeks

????100-1,000 $BTC wallets added 67,000 #Bitcoin in past 8 weeks

????1,000-10,000 $BTC wallets added 37,100 #Bitcoin in past 10 dayshttps://t.co/sGLqJLxGVD pic.twitter.com/kpQimOXmeO— Santiment (@santimentfeed) January 14, 2023

Hash-ing it out

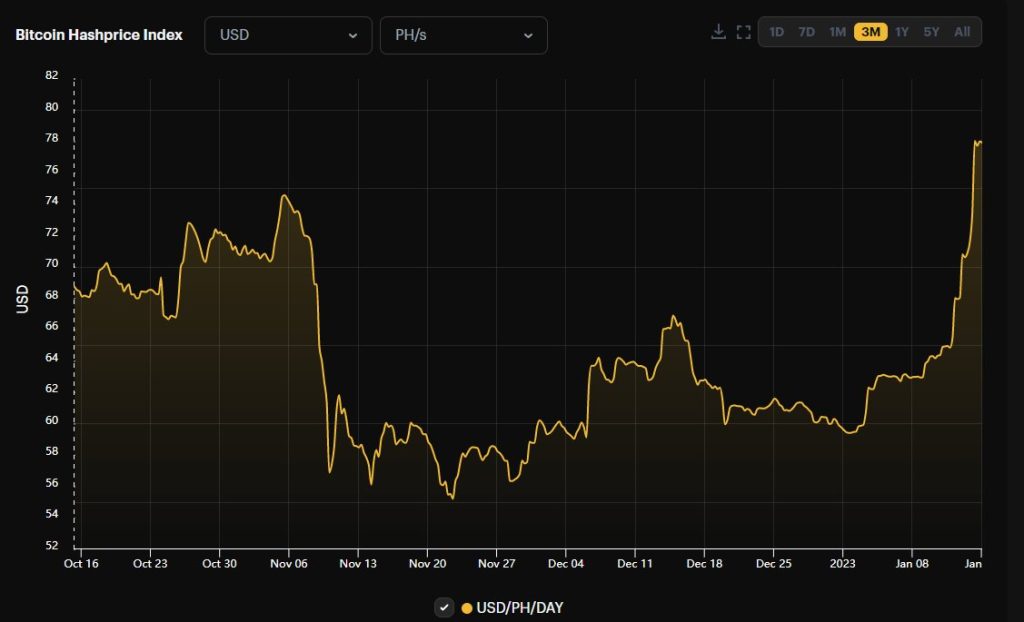

Furthermore, hash prices also witnessed an increase that could have an impact on Bitcoin miners. Hash rate is a measure of the power of the miner’s computational effort, and high hash rates can be an indication of miners’ confidence in the long-term value of Bitcoin.

As hash prices increase, more miners are willing to join the network, and this can lead to an increase in the security of the network. A higher hash rate also means that more miners are willing to compete for block rewards, which can lead to more mining difficulty, making it harder to mine Bitcoin.

Source: Hashrateindex

However, miner outflow was also increasing, according to Glassnode. The miner’s outflow volume (7d MA) also reached a one-month high of 88.111 BTC.

Miner outflow refers to the transfer of mined Bitcoin from the miner’s wallet to another wallet. This indicated that miners were selling their BTC instead of holding onto it which could be a bearish sign.

HODLers dilemma

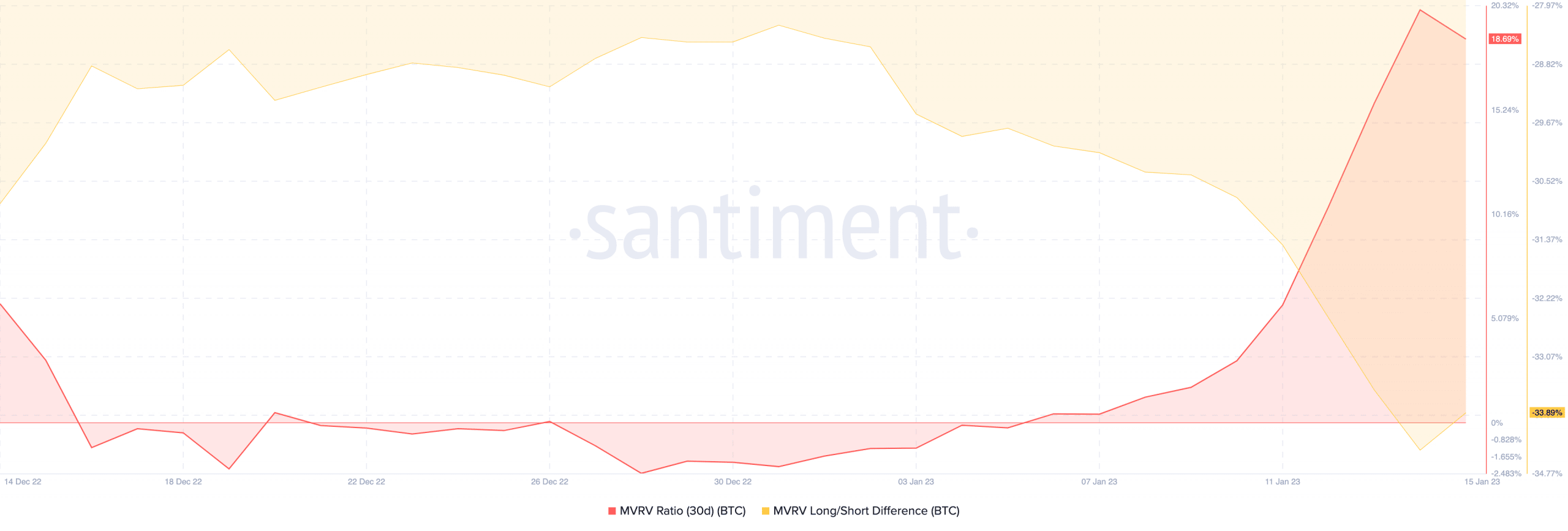

However, there were other bearish indicators present in the market as well. According to Glassnode, the number of addresses in losses decreased. Coupled with that the MVRV ratio for Bitcoin increased. The growing MVRV ratio indicated that if the majority of the addresses sell their positions, they would be doing so at a profit.

How many are 1,10,100 BTCs worth today

Many short-term investors were observed to be profitable over the last week as was evidenced by the declining long/short difference. This could potentially lead to higher selling pressure for Bitcoin.

Source: Santiment

Another bearish indicator was the growing funding rate for Bitcoin. According to maartunn on CryptoQuant, funding rates for Bitcoin hit a 14-month high. Funding rates are the amount paid by traders in a long position to traders who are in a short position.

In previous occasions where funding rates were as high as they were on 15 January, Bitcoin had a pullback. This could be a cause for concern for traders as it suggests that there may be a high level of leverage in the market. This coud lead to a more violent price move if sentiment changes.

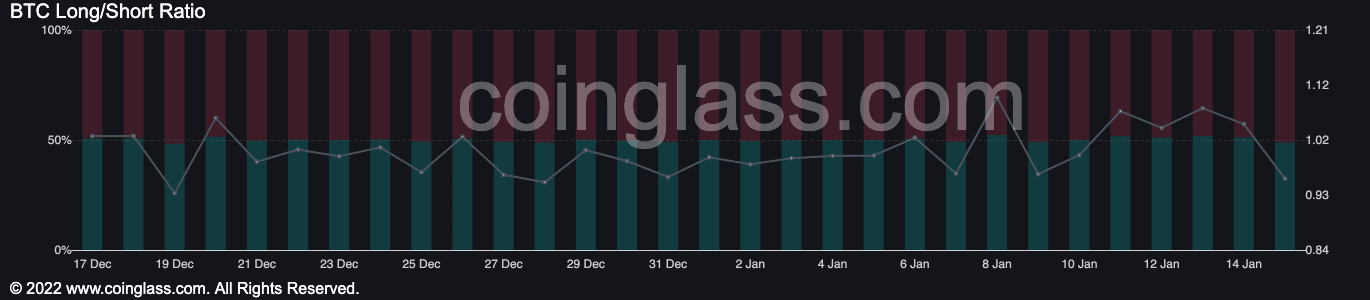

Lastly, traders sentiment was slowly getting negative as well. According to coinglass, the percentage of short positions being taken on Bitcoin was 51.02% at press time.

Source: coinglass

It is yet to be determined whether the traders shorting BTC will turn out to be correct. At press time, the price of Bitcoin was $20,730.97 and it fell by 1.23% in the last 24 hours.