- BTC’s whales have decreased their holdings gradually since April.

- Despite the decline in whale accumulation, the coin remains a profitable asset.

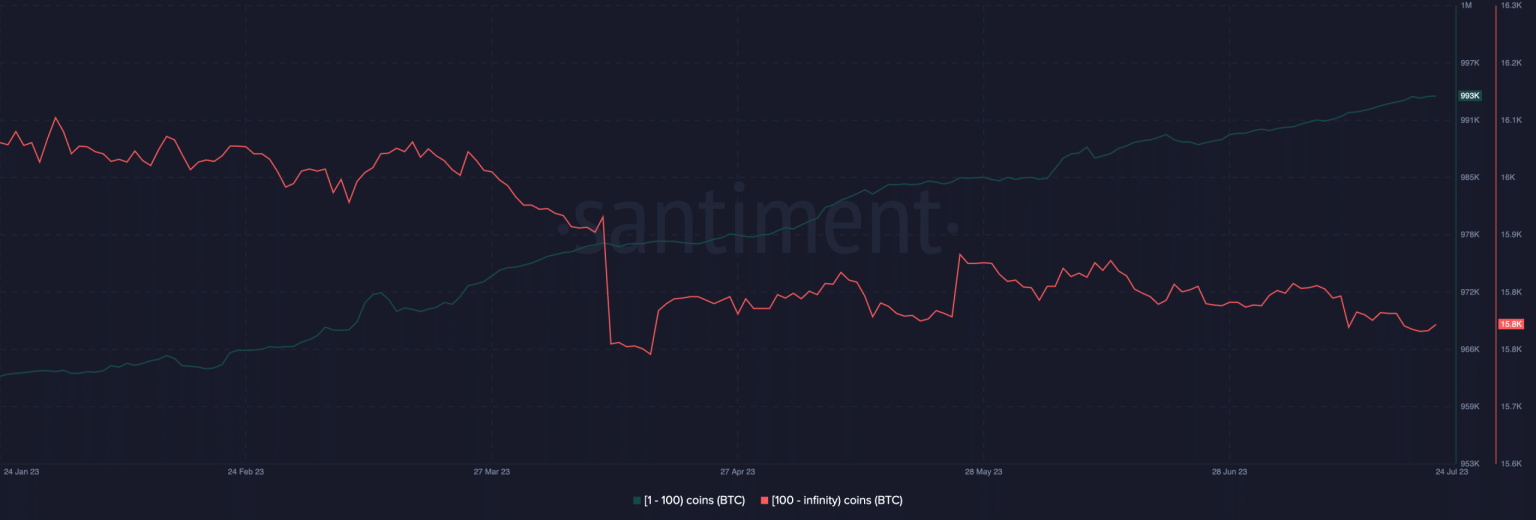

As Bitcoin’s [BTC] price continues to face resistance at the crucial $30,000 psychological price level, whale holdings have experienced a slight decrease, data from Santiment showed. According to the on-chain data provider, while the “shark wallets” count has climbed steadily in the last 60 days, “whale wallets” have decreased during the same period.

???????? #Bitcoin has rebounded back above $30k this weekend, and it’s recommended to keep an eye on the number of large addresses as summer progresses. If the 100+ $BTC wallet line begins rising again, another breakout greatly increases in probability. https://t.co/qKgrKeCHxL pic.twitter.com/g9A4i6ApFE

— Santiment (@santimentfeed) July 23, 2023

Read Bitcoin’s [BTC] Price Prediction 2023-24

Different cohort, different vibes

According to Santiment’s Supply Distribution metric, the various holders of BTC are divided into wallet groups. This metric measures the total amount of BTC that each wallet group currently holds. For example, the 1-100 coins cohort includes all wallets holding between 1 and 100 BTC at each relevant time.

These wallet groups are further categorized into “shrimps,” “sharks,” and “whales.” In this classification, “shrimps” are characterized as holders of less than one coin, “sharks” represent holders of 1 to 100 coins, and the term “whales” is used to describe addresses holding 100 coins or more.

Per data from Santiment, shark wallets have increased in number over a six-month period. With a cumulative of 993,000 wallets holding between 1 and 100 BTC at press time, their count has rallied by 3% since the year began.

Conversely, the count of whale wallets began a descent in April and has since fallen mildly by 1%. At press time, this cohort of BTC investors comprised 15,851 addresses.

Source: Santiment

BTC whales, where art thou?

BTC traded below $30,000 at press time. Per data from CoinMarketCap, the number one cryptocurrency exchanged hands at $29,793. In the last month, the coin oscillated within a very narrow tight range and only managed to trade above $31,000 briefly on 13 July.

A strong correlation exists between increased whale activity and a jump in BTC’s price. As noted by Santiment, “If the 100+ $BTC wallet line begins rising again, another breakout greatly increases in probability.” Therefore, a rally in BTC whale holdings might be necessary for BTC to break above $30,000.

Is your portfolio green? Check the Bitcoin Profit Calculator

Interestingly, while the market continued to trade sideways, BTC remained a largely profitable investment asset for many. Data from Santiment revealed that the asset’s Market Value to Realized Value ratio (MVRV) laid above the center line at 48%.

At this MVRV value, if all BTC holders sold their coins at the current price, they would generate an average profit of 48%.

Source: Santiment