- The average network efficiency of Bitcoin mining has improved due to the advancements in mining equipment.

- The share of renewable and cleaner sources like hydropower solar and wind have gone up considerably.

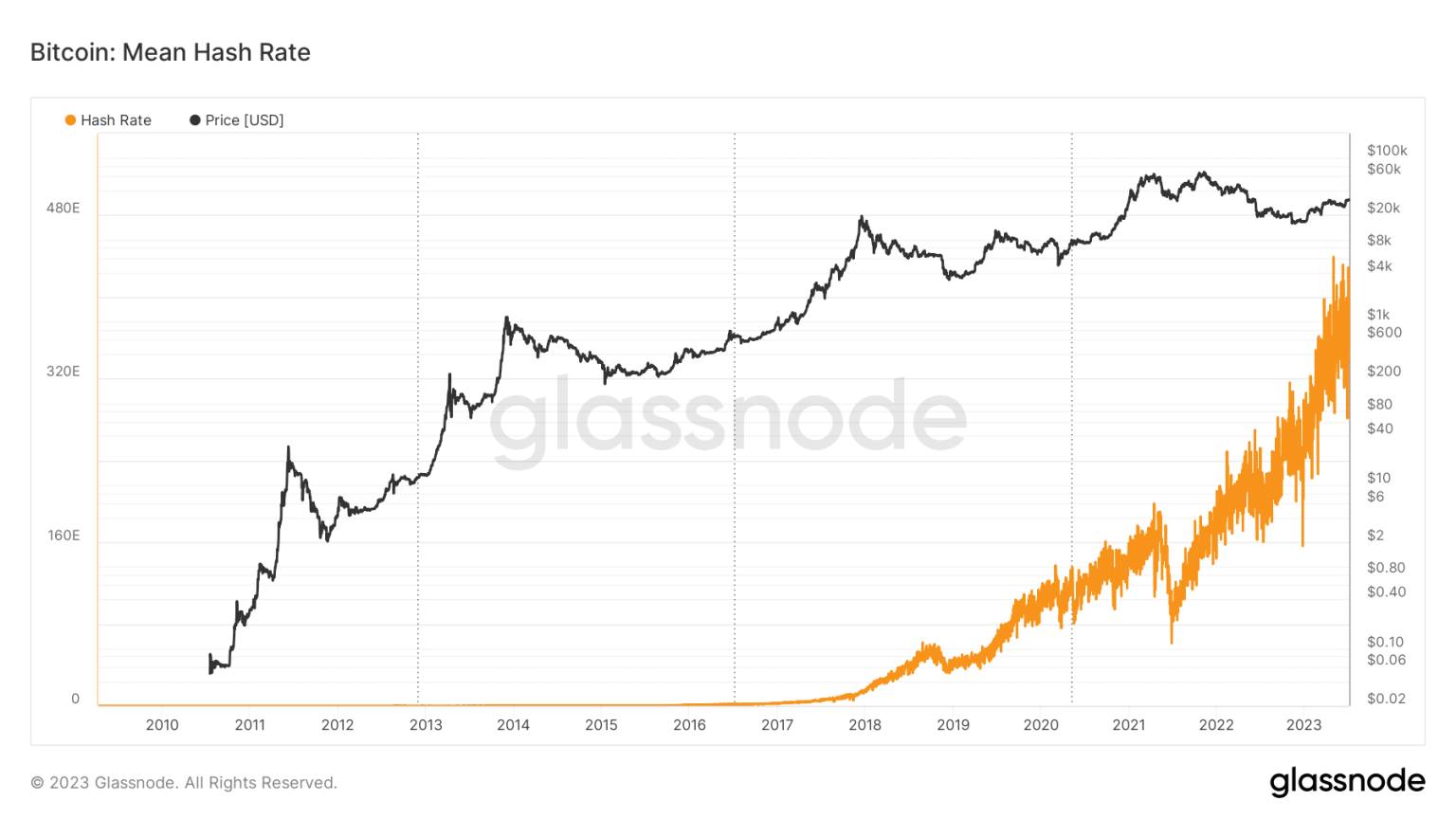

The intense debate around Bitcoin [BTC] mining has gone in tandem with the evolution of blockchain technology and cryptocurrencies. According to on-chain analytics firm Glassnode, the network’s hashrate has grown astronomically over the last five years, mirroring the sharp ascent in BTC’s value.

Source: Glassnode

Read Bitcoin’s [BTC] Price Prediction 2023-24

What’s the fuss around mining?

The hashrate is a function of growing network traffic. As evident, the hashrate reached an all-time high of 439 exahashes per second (EH/s) on 1 May after the blockchain was overwhelmed by a record number of transactions.

A growing hashrate indicated that miners had to invest in more computational power to validate blocks. This, in turn, would lead to a greater demand for specialized mining equipment and electricity.

As the process is a big energy guzzler, it has been criticized by environmentalists and crypto naysayers of being one of the major emitters of greenhouse gases. And the criticism holds merit to a great extent.

It’s estimated that Bitcoin consumes electricity at an annualized rate of 129 terawatt-hours (TWh), as per the latest data from Cambridge Bitcoin Electricity Consumption Index. This was more than the entire annual electricity consumption of countries like Argentina and the UAE.

Source: Cambridge Bitcoin Electricity Consumption Index

As a result, the network’s total yearly emissions surged to 65.59 MtCO2e, greater than the annual greenhouse gas emissions of countries like Belarus and Papua New Guinea.

Despite these alarming statistics, there has been a noticeable shift in BTC’s mining dynamics over the last few years. This necessitated a closer examination.

Mining efficiency improves

According to a report by digital assets investment firm CoinShares, the average network efficiency of Bitcoin mining has improved due to the advancements of the mining equipment. It is common knowledge that specialized hardware, like Application-Specific Integrated Circuits (ASICs) are used to mine cryptocurrencies these days.

As per the graph below, the energy utilized for each tera hash of BTC mining has been continuously decreasing, a sign that miners were investing in more sophisticated ASIC mining devices.

Source: CoinShares

But while overall network efficiency has been improving, there have been periods where efficiency has dramatically plunged. Largely, these were the periods when BTC prices rallied, according to CoinShares’ research.

Miners compete to solve cryptographic puzzles and validate transactions. As an incentive, they get newly minted Bitcoins and transaction fees. Miners face difficulties during bear markets as the fall in Bitcoin’s price reduces their earnings and capacity to cover their mining expenditures.

Source: Glassnode

Conversely, bull markets make miners profitable. These two contrasting scenarios have been depicted in the above graph.

With more revenue at their disposal, miners start reintroducing less efficient mining units to the network, which were previously unprofitable. Hence, while miners’ profitability increases with an increase in price, the overall mining efficiency drops.

Geographical distribution of Bitcoin mining

Another factor which influences the carbon intensity of BTC mining is the type of energy source being used. Over the years, the share of renewable and cleaner sources like hydropower solar and wind have gone up considerably.

Even among fossil fuels, the use of natural gas has surged over coal. The global warming emissions from natural gas’ combustion are much lower than those from coal.

According to Coinshares, the increase in natural gas share was due to miners effectively utilizing flared gas, which was previously a useless byproduct of the oil extraction process, to power their mining equipment.

Source: CoinShares

The way mining activity has shifted across geographies in recent years has been major contributors to this noticeable shift. Countries like China used to be the epicenter of BTC mining at one point in time. However, it ceded its position to the U.S. after a blanket ban on cryptocurrency trading and mining in September 2021.

China, along with other Asian countries like Kazakhstan, are regions where fossil fuels are heavily subsidized. This incentivized miners to exploit these resources, resulting in higher carbon footprints.

Is your portfolio green? Check out the Bitcoin Profit Calculator

But as the mining activity has moved to the U.S., things have changed. The south-central state of Texas has dished out favorable policies and tax incentives to attract miners to its wind and solar power.

While the increasing carbon footprints caused by BTC mining deserve attention, in reality, they represent a miniscule 0.13% of the global emissions. However, it remains to be seen how these figures would hold up as global knowledge and demand for cryptos grows.