- Bitcoin selling pressure rose as short-term holders saw profits.

- MVRV ratio indicated that long-term holders may not sell.

Over the last month, Bitcoin’s [BTC] price fell after reaching the $30,000 mark. Inasmuch, many short-term traders capitalized on this price correction and began accumulating BTC after the prices fell.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

BTC under pressure

However, over time, these short-term traders saw profits. According to Glassnode’s data, most short-term holders began seeing profits after BTC’s price surpassed $25,200. At press time, BTC’s price was $26,765.18, according to CoinMarketCap.

This indicated that many short-term holders were already profitable. This increase in profits could incentivize these holders to sell their holdings and drive down the price of Bitcoin.

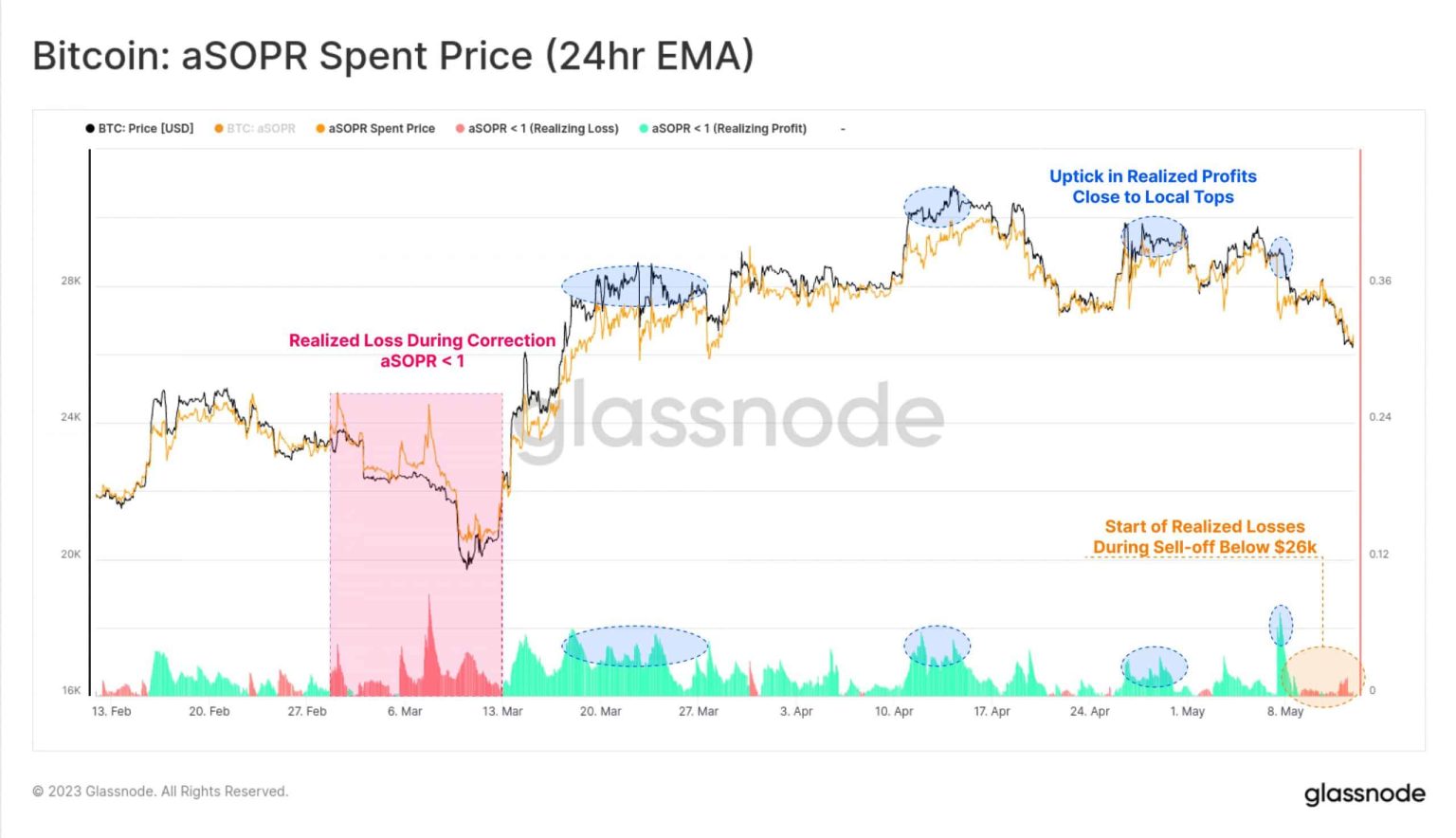

Interesting behavior was observed by other nonprofitable traders as well. According to the SOPR (Spent Output Profit Ratio) many addresses were selling their BTC at a loss as the SOPR reached below 1.

SOPR is a tool that measures whether Bitcoin holders are selling at a profit or loss. During market corrections, some Bitcoin holders who bought near the top may panic and sell their coins at lower prices, resulting in realized losses. SOPR tracks this behavior and can help identify potential bottoms in the market.

When SOPR falls below 1, it indicates that more coins are being sold at a loss than a profit. This can be a signal for a potential bottom in the market, as most sellers who bought near the top have now exited their positions.

Source: Glassnode

However, the same selling pressure that was faced by short-term holders wasn’t seen by addresses who have held their BTC for larger amounts of time. According to Santiment’s data, the MVRV ratio had declined significantly over the last few weeks.

This indicated that BTC was no longer in an overbought position and long-term holders had little incentive to sell their holdings.

Source: Santiment

Is your portfolio green? Check out the Bitcoin Profit Calculator

Tricks of the Trade

Despite these positive factors, traders remained bearish towards BTC. According to Coinglass, the number of short positions taken against BTC increased materially. In the past few days, the percentage of all short positions taken increased from 50 to 52%.

Only time will tell whether the traders turn out to be right in the long run.

Source: Coinglass