- Bitcoin’s illiquid supply change remains high as the accumulation trend persists.

- Bitcoin forms new support and resistance as it remains in the $30,000 price range.

Despite Bitcoin’s [BTC] price remaining in the $30,000 range, the trend of accumulating this digital currency has persisted. According to recent data provided by Glassnode, the level of Bitcoin’s illiquid supply indicates that the race of hodling has commenced.

Read Bitcoin Price Prediction (BTC) 2023-24

Bitcoin HODLing continues

As hodling continued to dominate, the Bitcoin Illiquid Supply Change remained remarkably high, reaching levels near the peak of its cycle. Per Glasnode, a substantial influx of coins was being directed into wallets with minimal or no spending history, with an impressive monthly rate of over 194,500 BTC.

This surge of Bitcoin (BTC) flowing into the possession of illiquid entities, such as network participants who rarely spend their holdings, is occurring at its swiftest pace in half a year.

Furthermore, this trend strongly suggested a preference for accumulation among long-term investors. Funds’ steady and gradual flow into illiquid wallets provides further evidence of this ongoing accumulation process.

The market is quietly accumulating Bitcoin, indicating an underlying demand despite recent regulatory challenges. Additionally, this accelerated accumulation signified a decrease in available supply. This could potentially pave the way for a price rise.

Microstrategy joins BTC accumulation trend

In a recent development, institutional investors made a notable stride in their BTC accumulation efforts. Microstrategy, for instance, successfully acquired over $300 million worth of BTC, further adding to the ongoing accumulation trend. This significant move reflects the continuous accumulation by institutional players and individual investors and underscores the enduring interest from institutions.

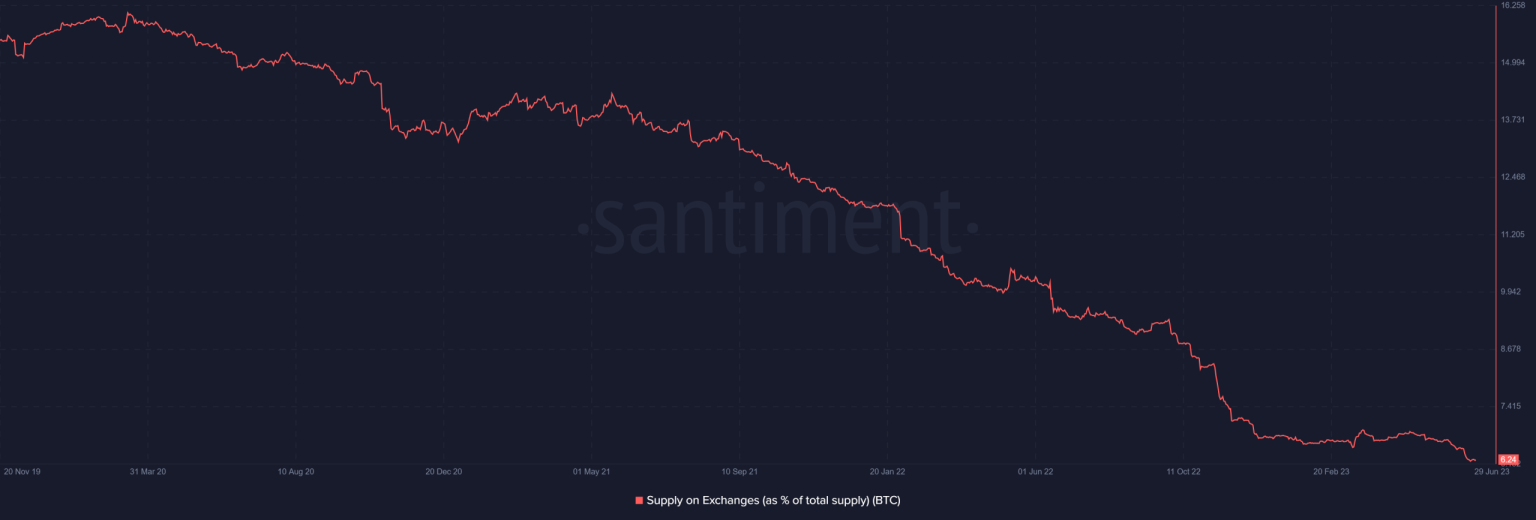

Furthermore, the dwindling supply of Bitcoin on exchanges serves as an additional testament to the illiquid nature of this asset. According to the Santiment chart, the available supply stood at approximately 6.24 at the time of writing. This metric indicates that despite the ongoing accumulation by individuals and institutions, there are no signs of a sell-off or significant supply entering the market.

Source: Santiment

This collective behavior suggests a strong belief in the long-term value of Bitcoin, as investors are holding onto their assets rather than engaging in profit-taking. The sustained accumulation from various market participants underscores the confidence in Bitcoin’s prospects and its potential for continued growth.

How much are 1,10,100 BTCs worth today

Bitcoin price move

At present, Bitcoin has experienced a modest uptick in value. On the daily timeframe chart, BTC had remained within the $30,000 price range, with a trading price of approximately $30,500, representing an increase of nearly 1%. Notably, a new resistance level appeared to be emerging at around $31,600, while support remained steady at approximately $29,000.

Source: TradingView

Additionally, BTC had moved away from the overbought zone according to its Relative Strength Index (RSI). Although the RSI line had experienced a decline, indicating a decrease in momentum, Bitcoin continued to exhibit a strong bullish trend.