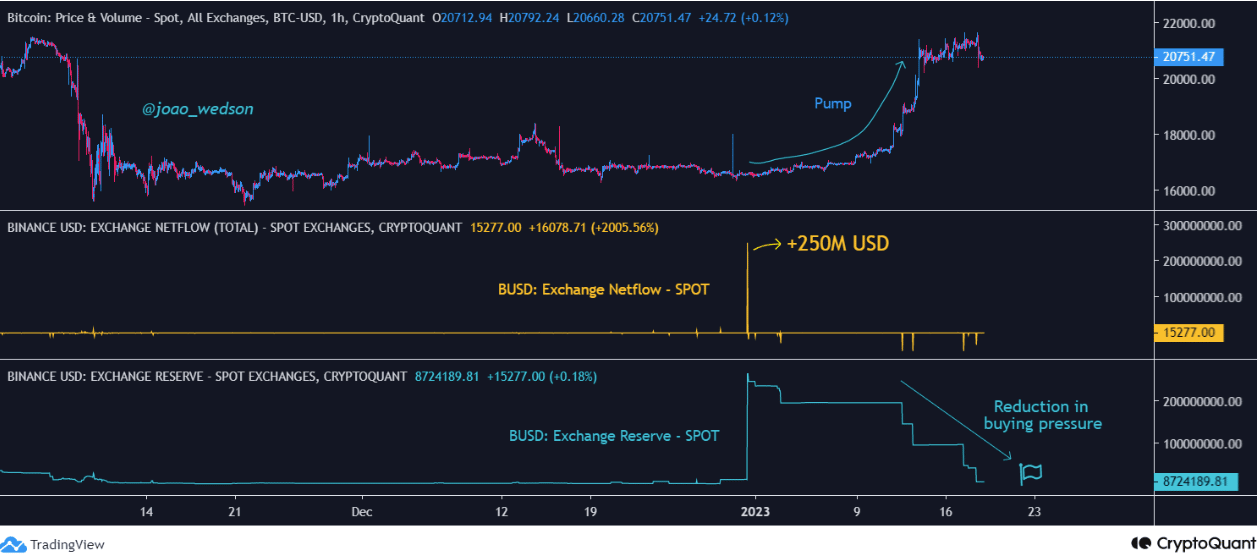

- Stablecoin inflow has been met with a decrease in Bitcoin reserves.

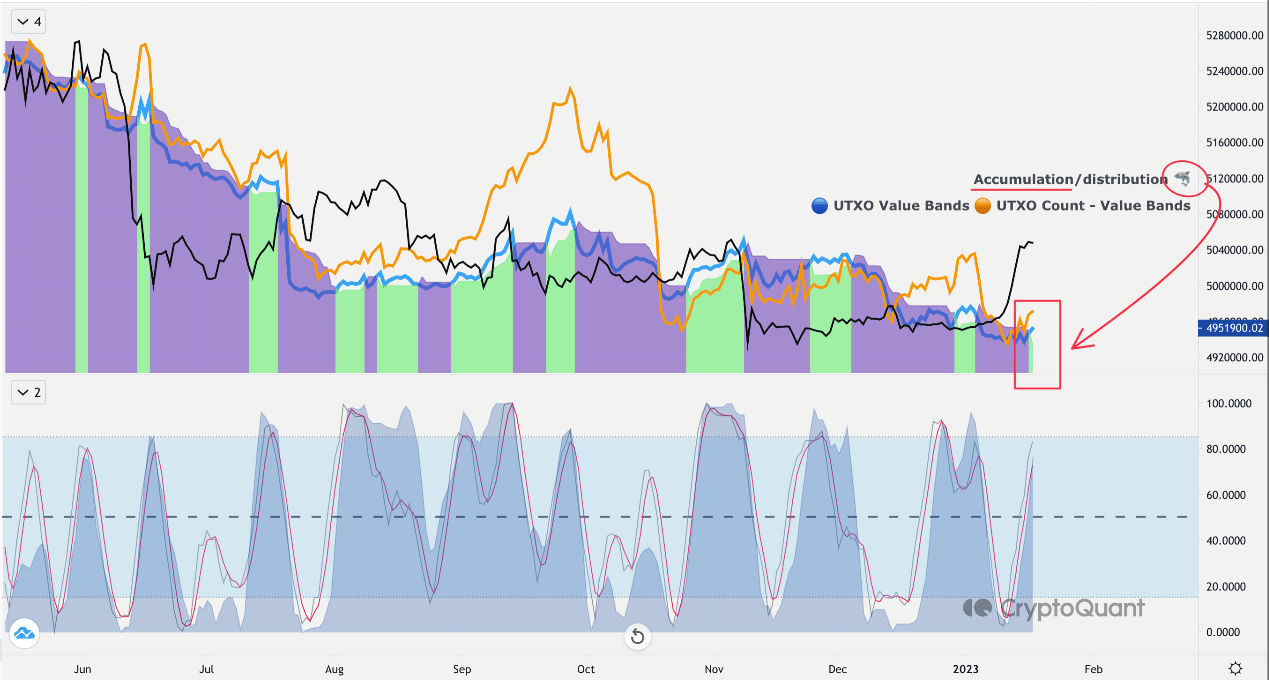

- Whales behavior could help BTC regain bullishness provided the UTXO value bands maintain status quo.

The euphoria around Bitcoin [BTC] might have come to an abrupt end after the king coin failed to register significant gains for the first time in the new year.

At press time, BTC was back at the $20,000 region despite calls to breakout farther. However, the price trend is not the only part that has changed in the Bitcoin system.

Is your portfolio green? Check out the Bitcoin Profit Calculator

The flow has now backtracked

When the market was in its boom era, there was a massive flow of stablecoins in exchanges. This action depicted investors’ resolve to grab a share of the accumulation and profit taking.

According to CryptoQuant analyst Joaowedson, there was a recent inflow of $250 million into the Binance USD [BUSD]. As this generated a lot of buzzes, it also impacted the BTC price uptick.

However, the inrush into the spot market meant that there was a decrease in the reserves. So, while there was increased buying pressure in pushing the price, the dip in reserve was also influential in driving down the demand.

Besides that, Joaowedson confirmed that the BUSD stablecoin flow tides have changed for the past few days as indicated by the data on CryptoQuant. This decrease means that only a few number of investors were participating in Bitcoin transactions.

Source: CryptoQuant

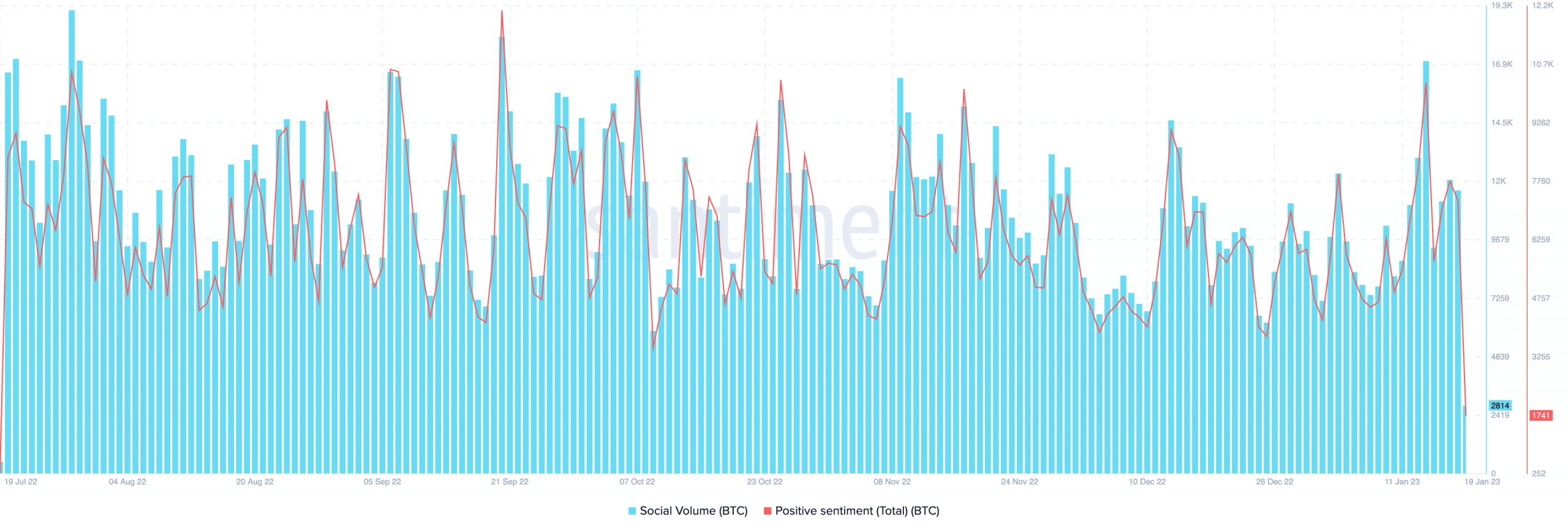

Concerning the social volume, data from Santiment showed that the metric was relatively at a low point compared to the previous peaks it had hit in the last 18 days. At the time of writing, the social volume was 2774.

The social volume displays how trendy an arbitrary search for an asset is. Since the volume had decreased, it implied that traders had filtered Bitcoin out of the top crypto searches.

Additionally, the positive sentiment accompanied the direction of the social volume with a glaring fall off. This means that investor perception of the coin was no keener.

Source: Santiment

Realistic or not, here’s BTC’s market cap in ETH’s terms

Will whales help with the BTC cause?

In another CryptoQuant publication, AxelAdler Jr admitted that there were still signs that the market could remain bullish. In defense of his stance, the analyst referred to how Bitcoin whales have massively accumulated the coin.

According to AxelAdler Jr, the Unspent Transaction Output (UTXO) value bands within the 1,000 to 10,000 range began scooping on 11 January. Those with 100 to 1000 also joined the party on 16 January.

Since this indicator displays the behavior of whales, the switch to the green zone shows evident whale presence in the market. Hence, a continual accumulation could influence the market broadly.

Source: CryptoQuant