- The recent rally in BTC’s price has put many holders in profit.

- Many holders are, however, inclined to sell, rather than hold.

In the first 30 days of 2023, Bitcoin’s price rallied significantly, causing many of its holders to hold unrealized profits. However, as BTC’s price consolidated and traded in a tight range since the beginning of February 2023, on-chain indicators suggested that a potential change in the market trend may be underway.

Read Bitcoin’s [BTC] Price Prediction 2023-24

The aforementioned report by Glassnode assessed the spending habits of large, small, long-term, and short-term BTC holders to uncover behavior patterns as the market trends shifted.

Finally, investors get to smile

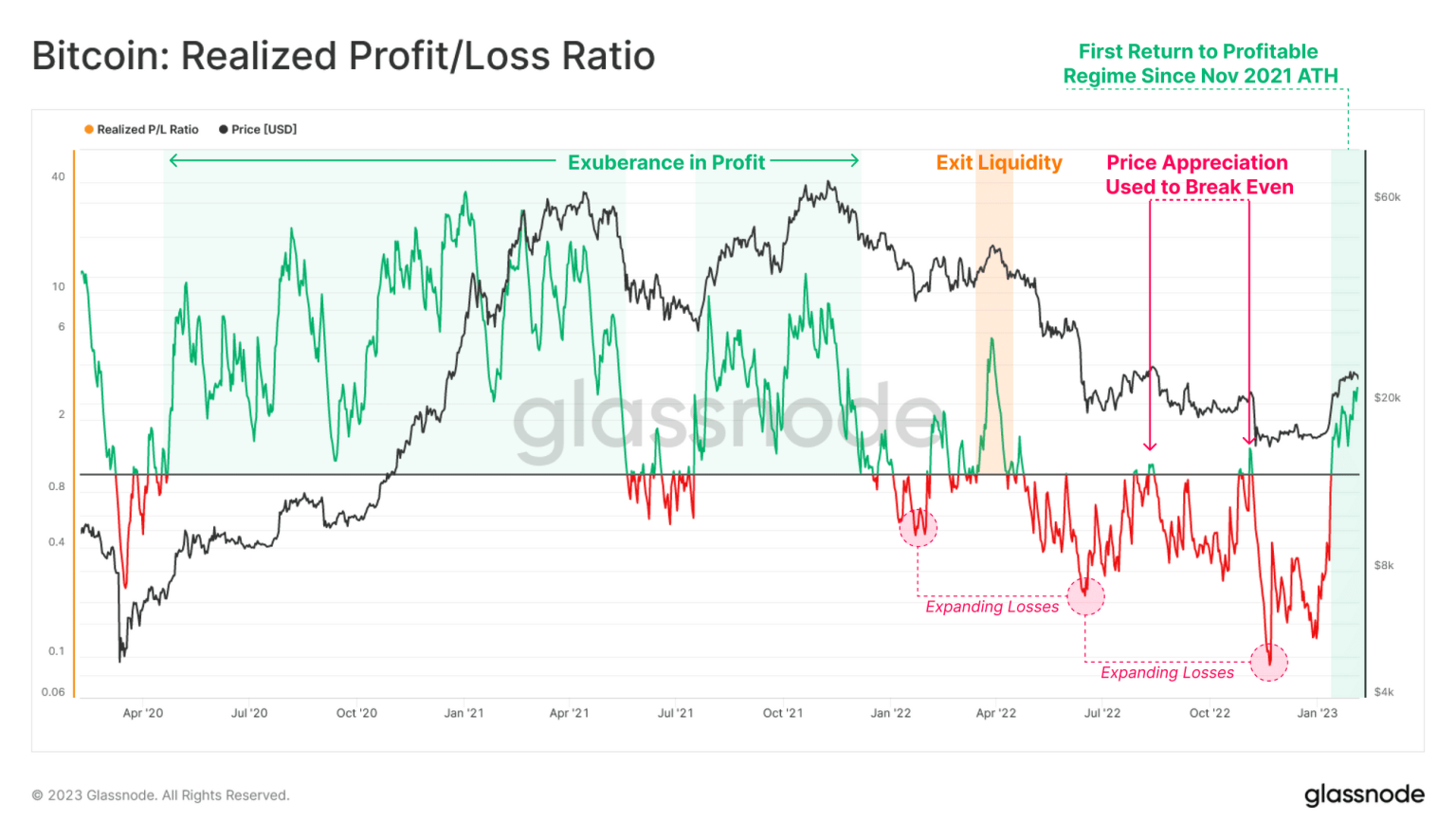

According to Glassnode, the recent surge in BTC’s price caused many of its holders to log profits on their investments. By analyzing BTC’s Realized Profit/Loss ratio, Glassnode examined the balance between profits and losses among BTC holders to identify shifts in dominance in the market.

It found that after the steep decline in BTC’s price following its all-time high in November 2021, a regime dominated by losses plagued the market. This caused the leading coin’s Realized Profit/Loss ratio to fall below one.

However, the recent surge in price represented the first sustained period of profitability since April 2022. According to Glassnode, this indicated a potential shift towards a profitability-dominated market trend.

Source: Glassnode

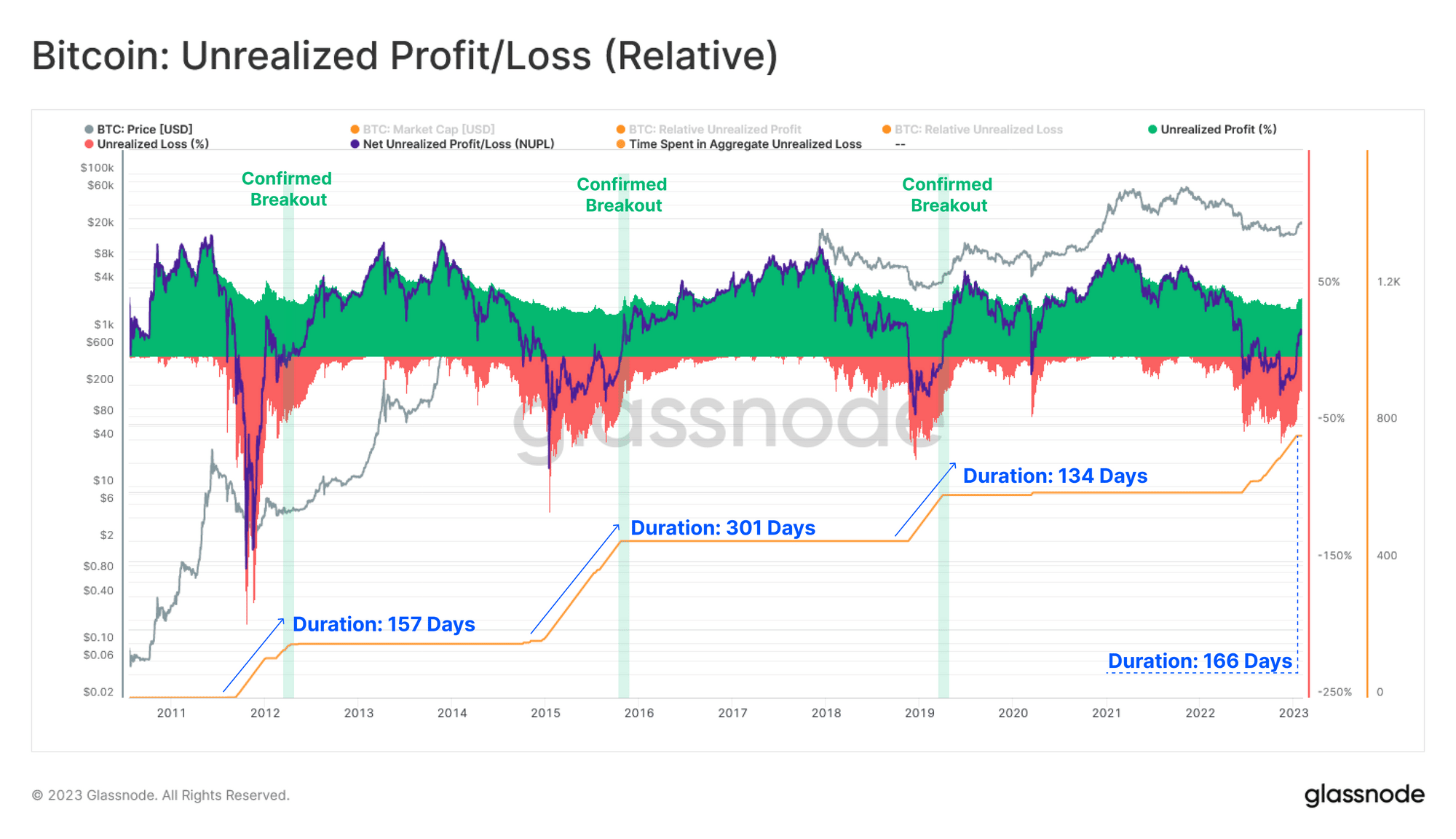

Further, Glassnode assessed BTC’s Net Unrealized Profit/Loss Ratio (NUPL) and noted that the recent increase in the leading coin’s spot price had put the market back in a state of unrealized profit, with the average holder now in positive territory.

Considering the historical performance of this metric, Glassnode said:

“Comparing the duration of negative NUPL across all past bear markets, we observe a historical similarity between our current cycle (166-days) and the 2011-12 (157-days) and 2018-19 (134-Days) bear markets. The 2015-16 bear market remains a standout with respect to bear market duration, experiencing a regime of unrealized loss nearly twice as long as the runner-up (2022-23 cycle).”

Source: Glassnode

Should you hold or sell?

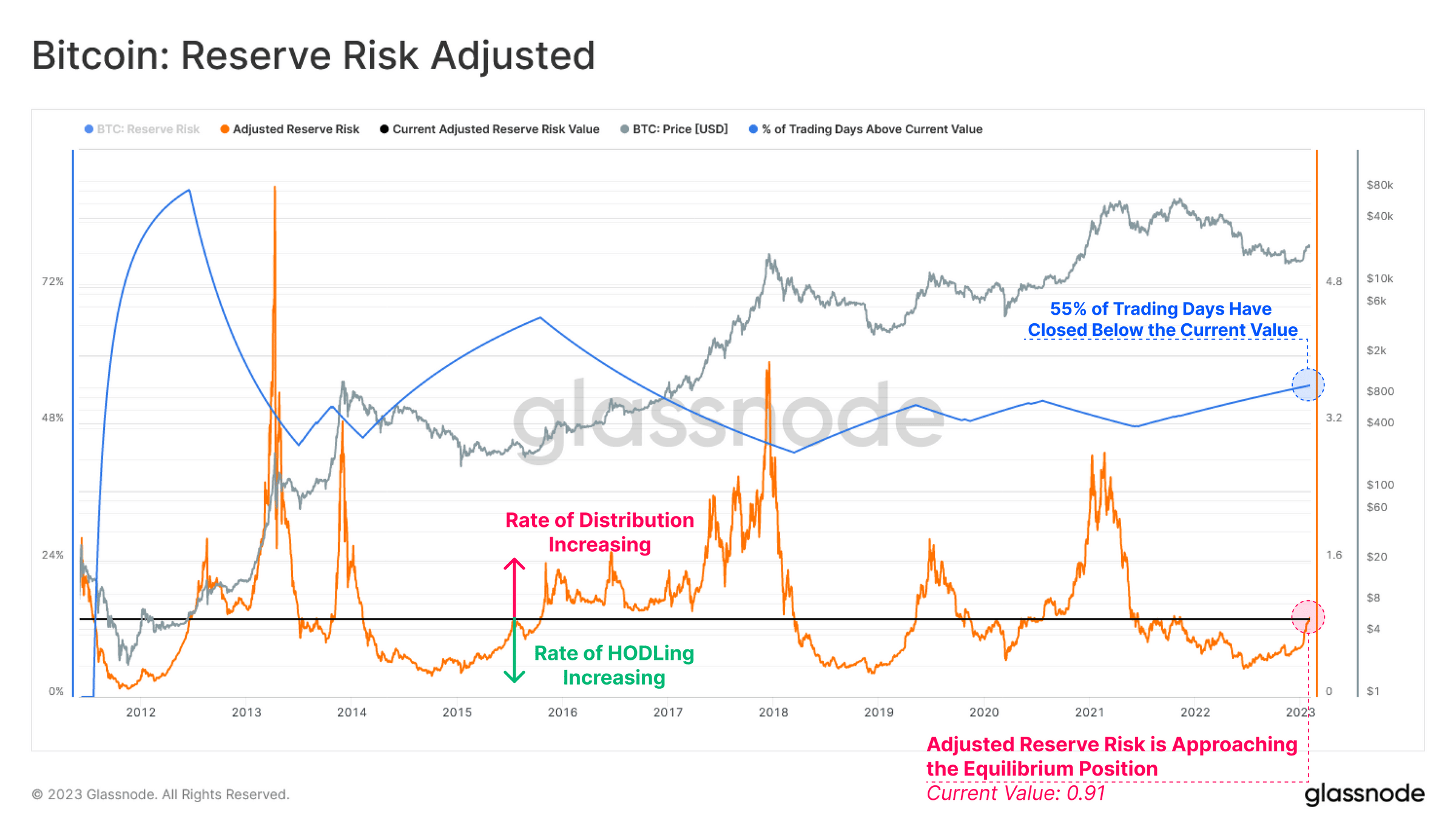

As for whether the market is tilting towards hodling or selling to realize a profit, Glassnode considered BTC’s Adjusted Reserve Risk metric. This metric offers insight into the behavior of long-term BTC holders. It measures the balance between the overall desire to sell and the actual selling of dormant coins.

As the metric approaches its equilibrium position, with 55% of all trading days below its current value, a change in market trends may be underway. This suggests that the cost of holding onto BTC is decreasing while the desire to sell is increasing.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Historically, when the metric surpasses its equilibrium position, it signals a shift from a holding-oriented market to a market focused on realizing profits, with capital moving from long-term holders to newer investors and speculators.

Source: Glassnode