- From the top of $48,000 on the ETF approval day, Bitcoin has retreated 16%.

- Reading of the MVRV Ratio pointed towards an early bull market.

Bitcoin [BTC] picked some upward momentum on Tuesday, taking its 24-hour gains to 2.79% as of this writing, according to CoinMarketCap.

However, upsides have been far and few for the king coin since ETFs tracking its spot prices were cleared for trading in the U.S. on the 11th of January.

From the top of $48,000 on the ETF approval day, Bitcoin has retreated 16%.

A repetition of history?

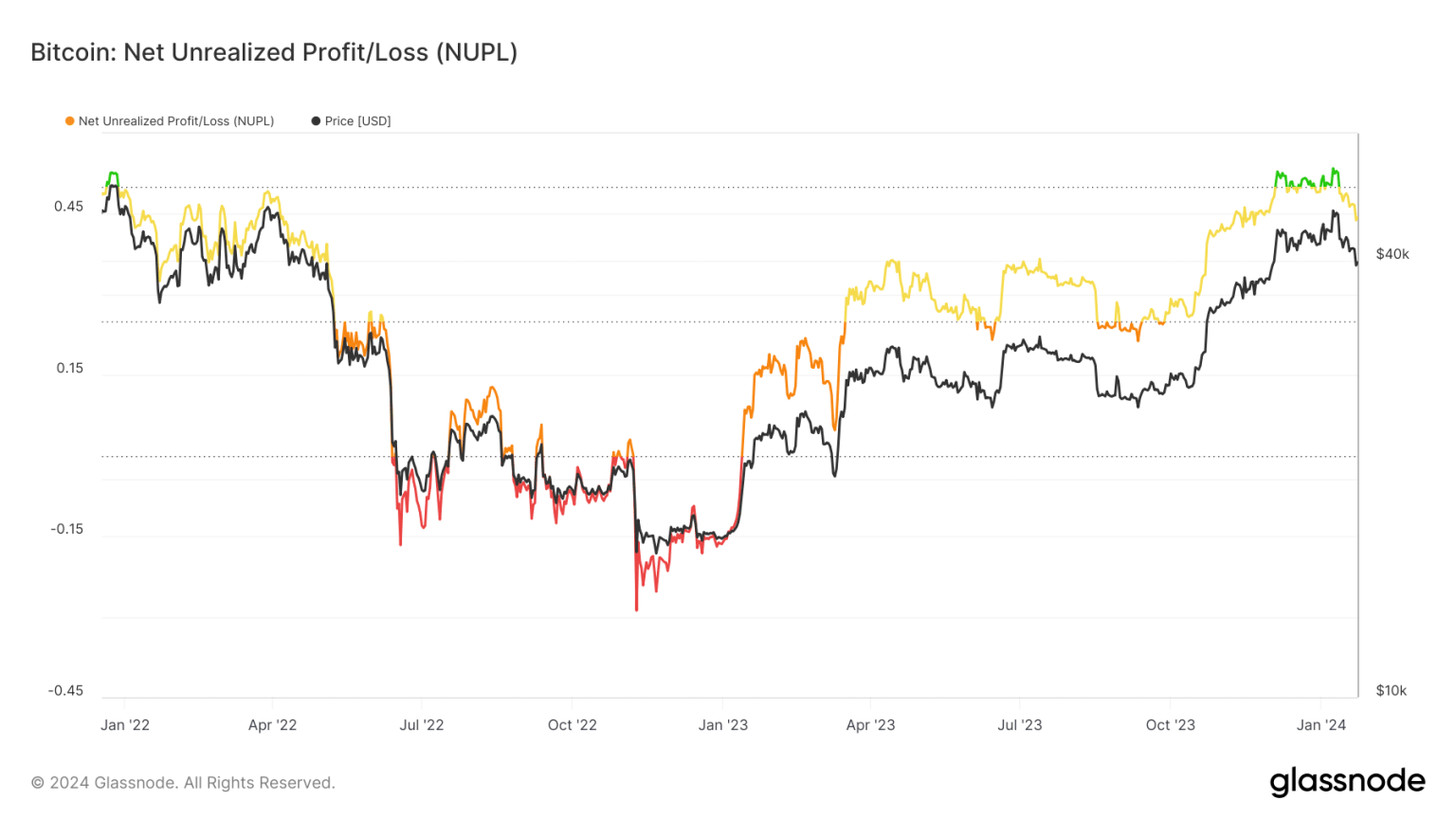

According to AMBCrypto’s analysis of Glassnode’s NUPL data, the Bitcoin market was witnessing a phase of anxiety after more than a month of belief.

Source: Glassnode

However, according to noted on-chain researcher Ali Martinez, this was just history repeating itself.

He stated that Bitcoin encountered several such phases in which belief was followed by brief anxiety, during which significant price corrections were seen. Martinez predicted,

“If history is any guide, this might be a temporary setback before the continuation of the uptrend.”

Relief? Not anytime soon

However, the reversal was not likely to occur immediately.

According to a separate analysis, Martinez used Fibonacci retracement levels to conclude that Bitcoin might dip as low as $32,000 before bouncing up.

On-chain fundamentals still look promising

To understand things further, AMBCrypto scrutinized CryptoQuant’s MVRV Ratio.

When MVRV is above 3.7, Bitcoin is said to be overvalued, leading to market tops. When it is below 1, Bitcoin is said to be undervalued or market bottoms.

As of this writing, the indicator was at 1.76, suggesting the early stages of a bull cycle.

Source: CryptoQuant

Additionally, about 77% of all Bitcoins in circulation were held at profit as of this writing, the highest since December 2021.

This was also above the 365-day moving average, indicating a shift in price trend to bullish.

Source: CryptoQuant

Read Bitcoin’s [BTC] Price Prediction 2023-24

These indications offered a considerably more positive picture for Bitcoin than its price charts.

Taking note of developments in the crypto market, Shivam Thakral, CEO of Indian cryptocurrency exchange BuyUcoin, said,

“The crypto market continues to witness selling pressure as Bitcoin ETFs have made entry and exit into the investment vehicle very easy. The next market mover can be the rate cut announcement by the US Fed which it signalled at the end of 2023.”