- Bitcoin Taproot adoption boomed as there was a 5% increase.

- Miners faced the heat as selling pressure increased.

The recent increase in Bitcoin [BTC] Taproot adoption gave hope to holders. Notably, on 9 February, the adoption rate of Bitcoin’s Taproot had surpassed 5%. This increase in Taproot adoption, combined with other key metrics, suggested a positive outlook for Bitcoin.

Bitcoin Taproot adoption has breached 5% for the first time ever???? pic.twitter.com/lxezIbkObj

— Will Clemente (@WClementeIII) February 8, 2023

Is your portfolio green? Check out the Bitcoin Profit Calculator

Taproot is an upgrade to improve the privacy, scalability, and security of Bitcoin. It introduced new signature schemes and a flexible transaction structure, making transactions more efficient and private. The growing adoption of Bitcoin Taproot could improve the possibility of BTC growing its presence soon.

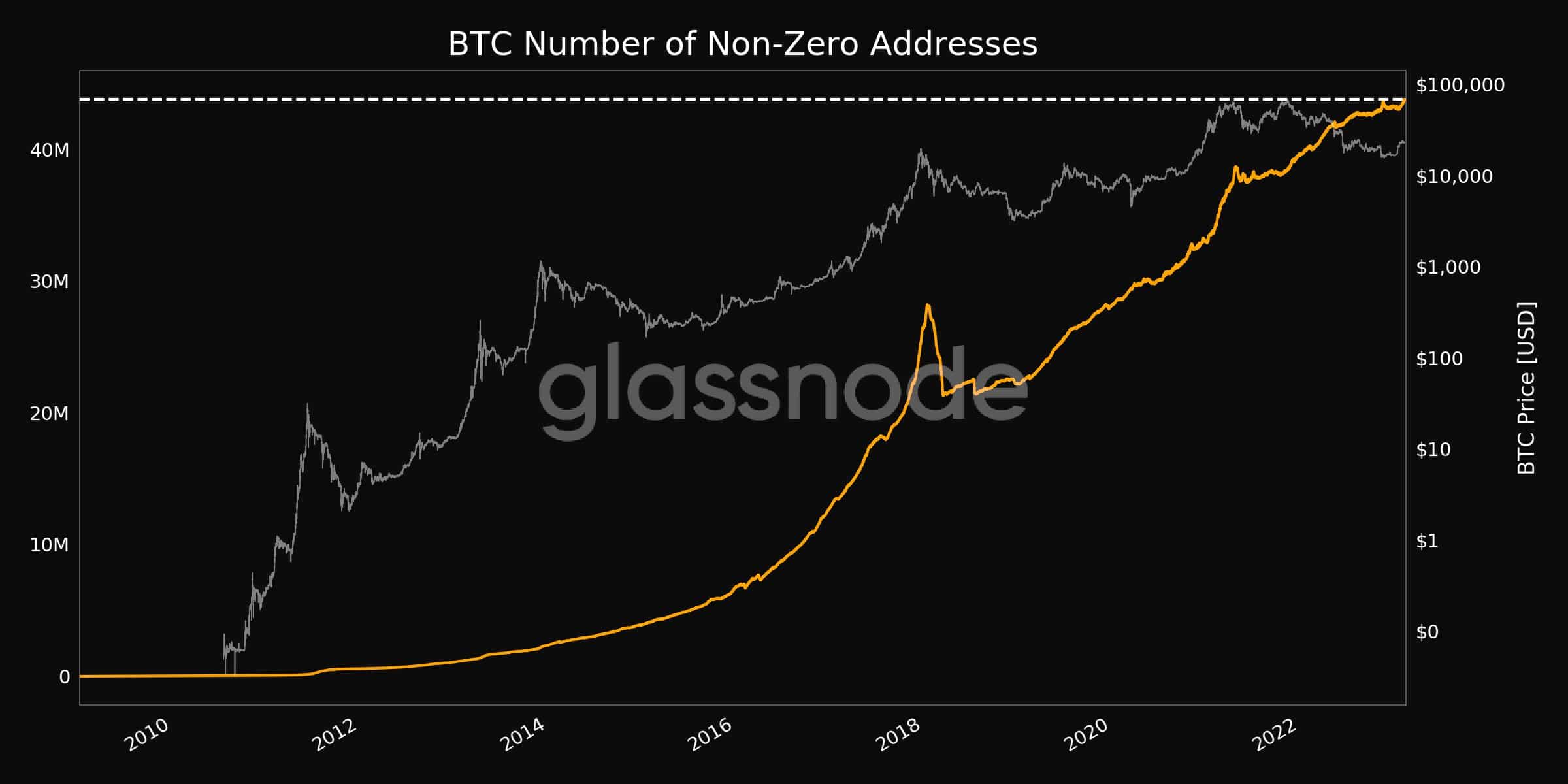

Another positive for Bitcoin during this period was the number of non-zero addresses on the Bitcoin network. These addresses reached an all-time high of 43.8 million, according to data provided by Glassnode. The high number of active addresses suggested that more people were using and holding onto their Bitcoin.

Source: Glassnode

There was also a decrease in selling pressure observed.

According to data from CryptoQuant, exchange reserves have declined over the past week. The decrease in exchange reserves indicated lower selling pressure, which was a positive sign for the market.

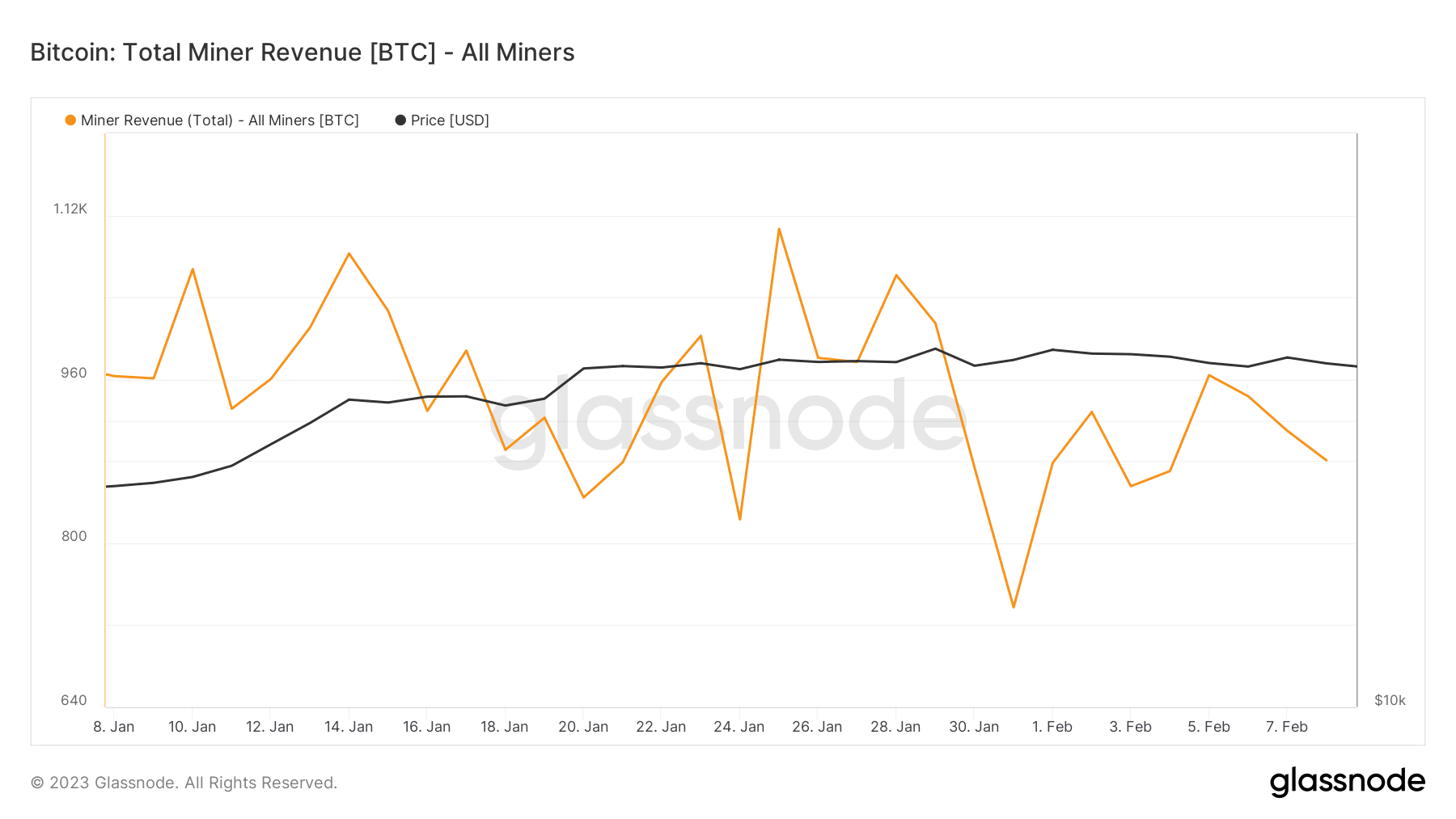

However, one factor that could increase selling pressure was miner behavior. Miners could sell their holdings if they were facing declining balances and decreased revenue. According to Glassnode’s data, the miner balance declined materially over the past month, reaching a one-month low of 1.8 million at press time.

???? #Bitcoin $BTC Miners’ Balance just reached a 1-month low of 1,822,891.794

Previous 1-month low of 1,823,291.941 was observed on 23 January 2023

View metric:https://t.co/cHhwgaCLee pic.twitter.com/8St5jRDkr9

— glassnode alerts (@glassnodealerts) February 9, 2023

Looking on chain

If the miner revenue continued to fall, the miners would be forced to sell their BTC to be profitable. Another factor that would increase the selling pressure on miners would be the declining revenue generated by them.

Source: Glassnode

However, the declining MVRV ratio of Bitcoin suggested that BTC holders won’t be selling their positions soon. A decline in the MVRV ratio suggested that fewer BTC holders could make a profit if they sold their positions.

Even though most addresses holding BTC are short-term investors, as suggested by the negative long/short ratio, it appeared that all the investors were willing to wait to sell their holdings for a profit.

Source: Santiment

How much is 1,10,100 BTC worth today?

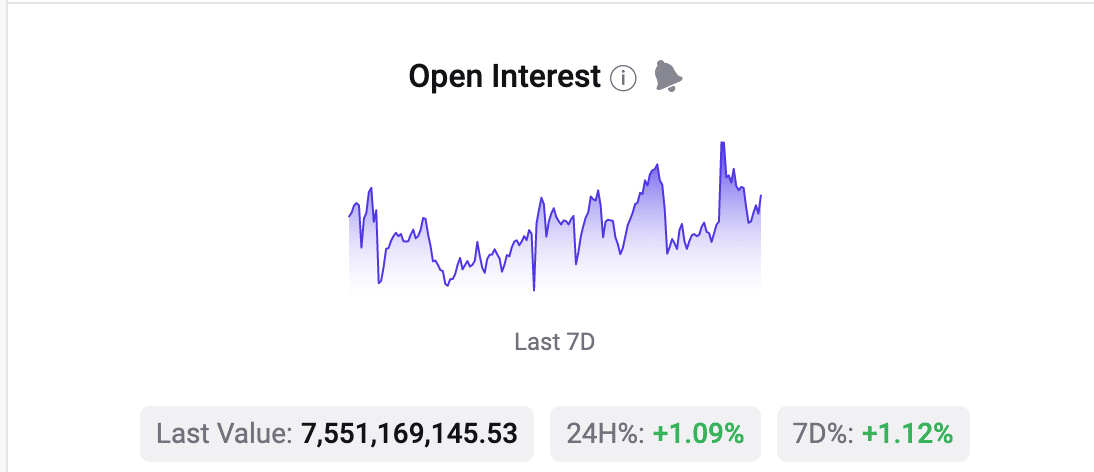

During this period, the Open Interest for Bitcoin also increased. As Open Interest increased, it indicated more liquidity and attention coming to the Bitcoin derivatives market. However, an increased Open Interest also brought with it extra volatility.

Source: Crypto Quant

With factors both for and against it, only time will tell which direction BTC will go in the future.

![Bitcoin [BTC]: Will increasing Taproot adoption boost prices?](https://patrolcrypto.com/wp-content/uploads/2023/02/FofMQE7XsAApXVK-1536x768.jpeg)