- On-chain data revealed that BTC’s ongoing performance is hinting at an imminent bear market end

- While many BTC holders remain in profit, the level of profitability has started to decline

In its latest report, on-chain analytics company Glassnode analyzed Bitcoin’s [BTC] on-chain performance. In doing so, it observed that the prevailing price movements resemble previous bear market bottoms.

According to the data provider, last week’s price decline to a low of $22,199 occurred alongside important price levels. These are related to older holders from the previous cycle and whale entities that have been active since the 2018 cycle, making it highly important.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Greater profit, entry of new money, and everything good

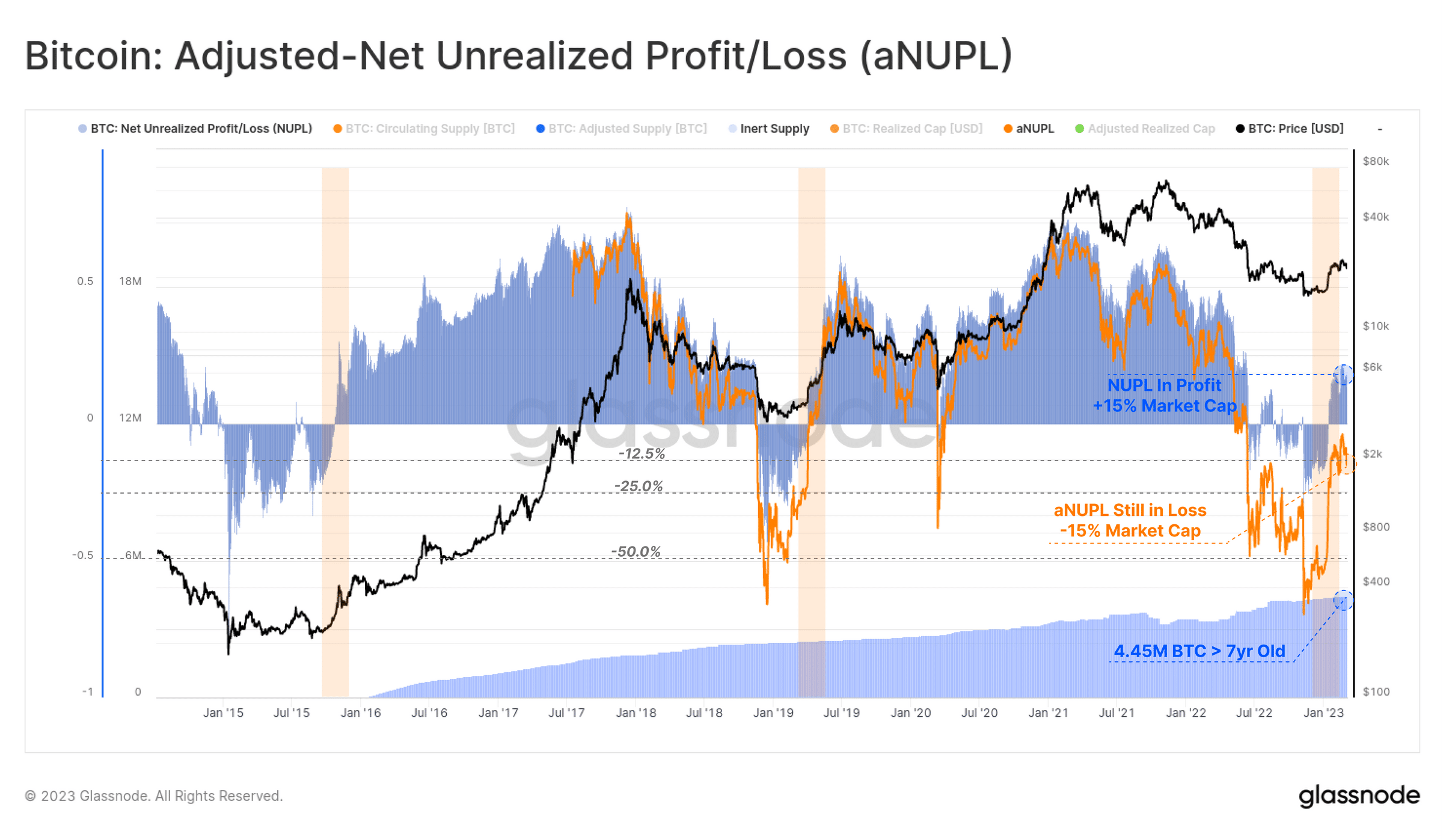

Glassnode assessed BTC’s Net Unrealized Profit/Loss metric (NUPL) and noted that “the current state of the market can be reasonably described as resembling a Transitional Phase,” which is common “in the later stages of a bear market.”

The NUPL metric determines whether BTC holders are currently experiencing unrealized gains or losses. It compares the average purchase price of all BTCs held by investors to the current market price. If the market price is higher, there is a net unrealized profit, while if the market price is lower, there is a net unrealized loss.

According to Glassnode, the weekly average of NUPL has changed from a state of net unrealized loss to a positive condition since mid-January. This is a sign that the typical BTC holder now holds a net unrealized profit of approximately 15% of the market cap, resembling transition phases in previous bear markets.

Nevertheless, Glassnode warned that the adjusted version of NUPL, which accounts for lost coins, showed that the market is only slightly below the break-even point. Simply put, this could still be regarded as being in a bear market territory.

Source: Glassnode

Apart from the NUPL metric, another indication of the “Transitional Phase” is the entry of new money into the market.

Glassnode considered the BTC’s Transfer Volume metric and found that the coin’s monthly Transfer Volume is up by 79% to $9.5 billion per day since early January. In fact, the report described this as a positive sign of growth.

Read Bitcoin [BTC] Price Prediction 2023-24

It, however, added a caveat that this is still well below the yearly average, which has been heavily influenced by a significant amount of FTX/Alameda-related wash volumes. Nevertheless, it remains a good indicator that the end of the bear market may just be underway.

Source: Glassnode

Furthermore, BTC’s Adjusted Spent Output Profit Ratio (aSOPR) revealed the “first sustained burst of profit-taking since March 2022.” However, Glassnode warned that the coin’s Realized Profit/Loss ratio revealed that profitability “has shifted back towards a transition phase.”

This means that BTC might not be as profitable as it was in January when the price experienced a boom. Hence, caution is advised.

Source: Glassnode

![Bitcoin [BTC]: As market hits ‘transition phase,’ here are the things to look out for](https://patrolcrypto.com/wp-content/uploads/2023/03/woc-10-03-1--1536x894.png)