- CME takes 37% of Bitcoin Open Interest volume.

- Bitcoin is yet to embark on a strong bull run in the wake of spot ETF approval.

As the approval for the spot Bitcoin ETF was gaining traction, so was its Open Interest, with CME recently taking the lead. What is the percentage of CME’s dominance, and what implications does this rising Open Interest have for BTC?

CME dominates Bitcoin Open Interest

As per a recent update from Glassnode, CME has surpassed all other exchanges in Bitcoin Open Interest volume. The post revealed that CME’s Open Interest reached a record-high dominance of 36%.

According to Coinglass data, at the time of writing, the BTC Open Interest on CME stood at nearly $6.4 billion. Binance and Bybit secured the second and third positions with over $4.2 billion and $3.3 billion, respectively.

Additionally, at the time of this update, only three other exchanges had Open Interests exceeding $1 billion.

A look at the Bitcoin Open Interest trend

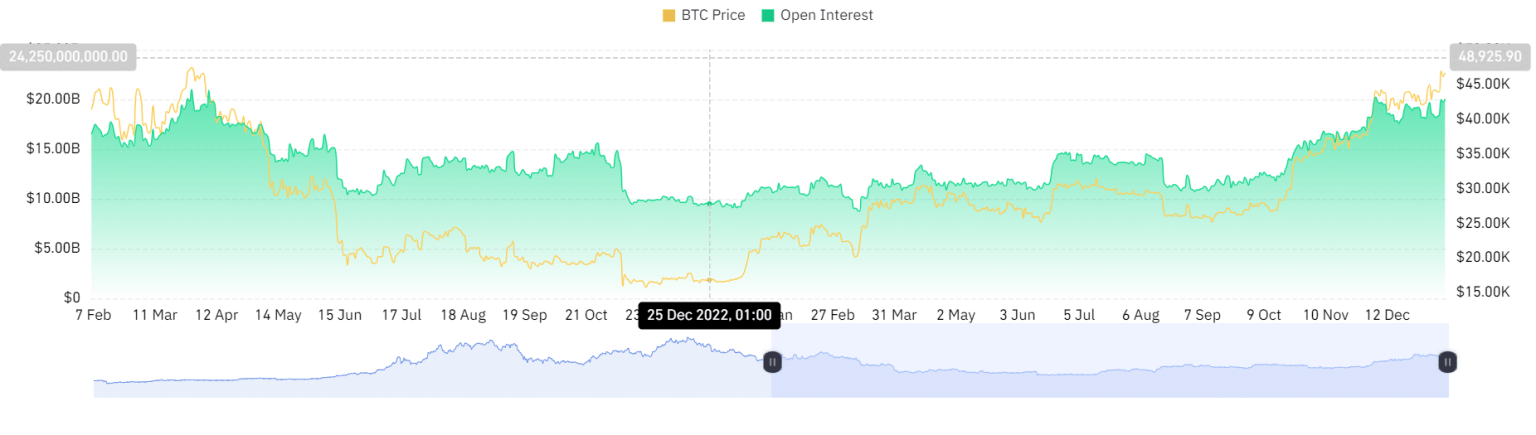

A recent examination of Bitcoin Open Interest showed that it has reached its highest point in the past nine months. At the time of this report, the Open Interest was over $20 billion across all exchanges.

The accompanying chart showed a steady climb in Open Interest since around October 2023.

Source: Coinglass

Also, this upward trend can be attributed to the widely anticipated approval of the spot ETF, which has heightened traders’ expectations. The notable surge is also influenced by the news of approvals initially dismissed as false, only to be confirmed later.

This increase signifies a growing presence of institutional investors in the derivative space. Additionally, it suggests that buyers are becoming more assertive in response to the recent developments.

Funding rate remains positive, but here is the catch

An examination of another crucial derivative metric, the Funding Rate, showed that long Bitcoin holders continue to maintain dominance.

At the time of this writing, Coinglass charts depict a positive Funding Rate of around 0.01%. Despite the prevailing dominance of long positions, the decline in the chart suggests a less aggressive stance among long holders.

Read Bitcoin (BTC) Price Prediction 2024-25

Furthermore, a daily timeframe analysis of BTC showed that although the price was over the $46,000 range, there was a slight downturn. As of this writing, it was trading at around $46,300, experiencing a slight decrease of less than 1%.

Considering this price trend alongside the current trajectory of the Funding Rate, it can be inferred that the BTC trend is leaning slightly bearish.

Source: Trading View