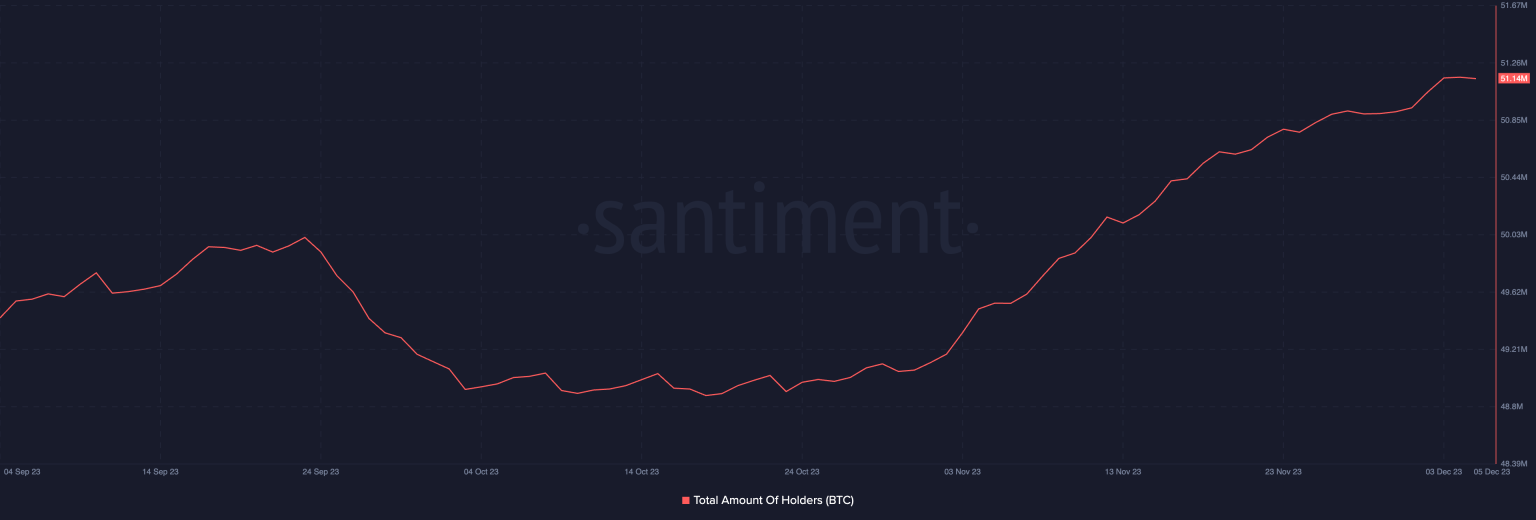

- The total number of addresses holding Bitcoin has exceeded 50 million.

- Demand has surged significantly in the past 24 hours.

Amid its rally above the $40,000 price mark for the first time since April 2022, the number of addresses holding Bitcoin [BTC] has surpassed 50 million.

Data from Santiment showed that there are 51.14 million BTC addresses with a balance.

With most of the year marked by growth in the general cryptocurrency market capitalization, the total number of addresses holding BTC has grown by 17% since January.

This new high comes at a price

At press time, BTC exchanged hands at $41,752. During the intraday trading session on the 4th of December, the leading coin briefly traded above $42,000 before experiencing a slight retraction.

With an increased demand for the coin in the last week, its value has risen by almost 12% in the last week, data from CoinMarketCap showed.

However, the spike recorded in BTC’s age-consumed metric on 4th December hints at an upcoming price volatility.

The age consumed metric tracks the amount of tokens changing addresses on a certain date, multiplied by the time since they last moved.

Typically, a surge in an asset’s age consumed metric suggests that a significant number of previously idle tokens have begun to change address. This suggests that there has been a sudden and strong shift in the behavior of long-term holders.

Conversely, when the metric experiences a decline, it means that long-held coins remain in wallet addresses without being traded.

This metric is used for tracking assets’ local tops and bottoms. This is because long-term holders are not often predisposed to swift movements of their dormant coins. Therefore, whenever this happens, it results in major shifts in market conditions.

Between 3rd and 4th December, BTC’s age consumed increased by almost 400%, jumping from 4.5 million to 23 million within the 24-hour period.

Demand continues to grow

As the king coin trades at an 18-month high, demand amongst spot traders has increased. The coin’s key momentum indicators observed on a daily chart were spotted in overbought regions at the time of writing.

For example, BTC’s Relative Strength Index (RSI) and Money Flow Index (MFI) values were 75.49 and 81.93, respectively. These suggested that coin accumulation overwhelmingly exceeded distribution.

Likewise, the coin’s Aroon Up Line (Orange) rested at 92.86%. When an asset’s Aroon Up Line is close to 100, it indicates that the uptrend is strong. It also suggests that the most recent high was reached relatively recently.