- Avalanche managed to secure a major partnership that could make it a stronger contender in the metaverse.

- AVAX sees low demand despite the hype around a new partnership and supports retest.

Avalanche could be about to spice things up in the metaverse thanks to a major development that might be a game-changer. The development in question is a partnership with Chinese tech giant Alibaba.

Is your portfolio green? Check out the Avalanche Profit Calculator

According to Avalanche’s official announcement, the two secured a partnership through which Avalanche will be the conduit for Alibaba’s metaverse pursuits.

The partnership will focus on Alibaba’s Cloudverse, the cloud computing segment of the Chinese company which already has millions of customers. Avalanche will provide the decentralized technology to support this metaverse endeavor.

Today, @alibaba_cloud announced that they are entering the metaverse–on Avalanche!

With Cloudverse, Alibaba Cloud’s millions of clients can easily deploy custom metaverses and unlock new dimensions for consumers.#Avalanche will provide all blockchain elements for Cloudverse???? pic.twitter.com/AlibhHjidN

— Avalanche ???? (@avax) May 4, 2023

The collaboration represented an important opportunity, especially for Avalanche which stands to tap into a wave of potential value and liquidity. The magnitude of the partnership cannot be understated considering that Alibaba is one of the biggest companies in the world.

Renewed hope for AVAX?

Major announcements involving partnerships that have the potential to bring in a wave of new users usually trigger higher demand for a cryptocurrency. However, this is not always the case, especially in situations where the expected change will happen gradually. Nevertheless, some of Avalanche’s on-chain metrics already registered a spike in excitement.

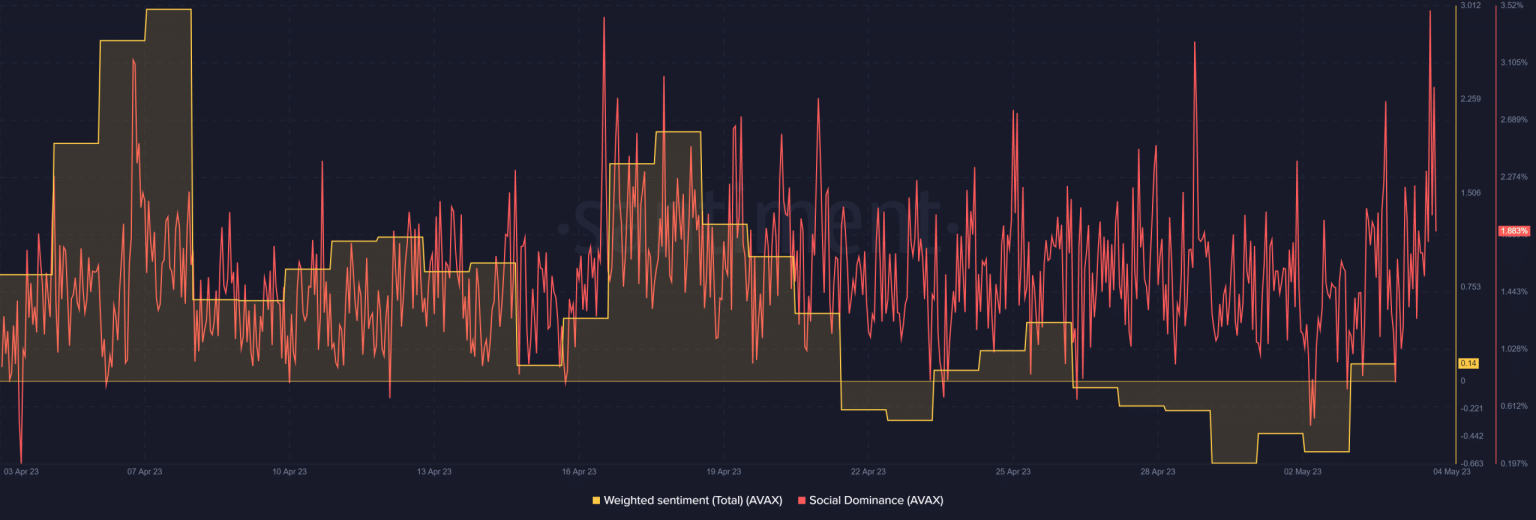

Investor sentiment improved slightly in the last two days, as reflected in the weighted sentiment recovery from its monthly low. Also, there was a large spike in social dominance, hence a significant gain in terms of visibility.

Source: Santiment

One of the ways to tell if the excitement has been converted into strong demand is to evaluate on-chain volumes. AVAX on-chain volume experienced a slight upside in the last 24 hours, although likely not strong enough to support enough bullish excitement.

Source: Santiment

Despite the lack of strong demand within the first 24 hours after the announcement, there was one key factor that may still support a strong bounce. AVAX’s price action had been trading within a tight range after finding support near the $16.50 price range. More importantly, the price was recently pushed into an ascending support line.

Source: TradingView

Realistic or not, here’s AVAX market cap in BTC’s terms

The same support level may act as a bounce-off zone if AVAX can secure enough bullish demand in the next few days. Its MFI already pivoted after previously registering outflows. Weak bullish demand or a surge in sell pressure may also manifest in the market sentiment shifts in favor of the bears.