- Bitcoin and ETH derivatives register healthy recovery alongside spot demand.

- However, demand is still relatively low as traders proceed cautiously.

The crypto market’s performance on a YTD basis has been different from the bearish performance last year. We have seen strong demand recovery, especially from the spot market.

A recent analysis revealed how Bitcoin and ETH derivatives demand faired during the same period.

Realistic or not, here’s ETH market cap in BTC’s terms

Research conducted by Deribit Insights highlighted some interesting observations about derivatives demand for BTC and ETH.

The analysis looks into multiple facets of the derivatives market. It notes that while bullish demand has returned since the start of 2023, the derivatives demand has been a bit restrained. Nevertheless, both BTC and ETH achieved substantial demand in particular segments.

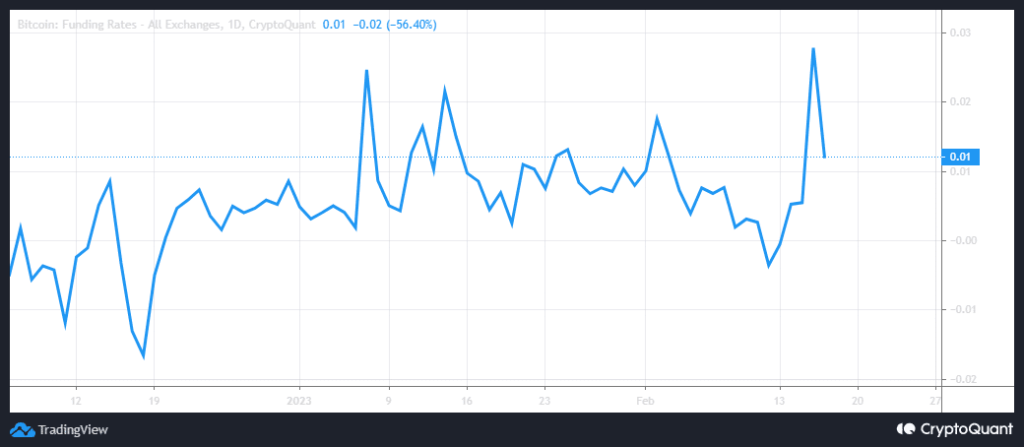

The Bitcoin and ETH funding rates

BTC’s funding rate registered some activity in January and even less in the first half of February. However, the latest rally triggered a large spike in Bitcoin funding rates to higher levels than spot demand.

Source: CryptoQuant

The most recent spike which peaked on 16 February marks the highest level of BTC funding rate seen so far on a YTD basis.

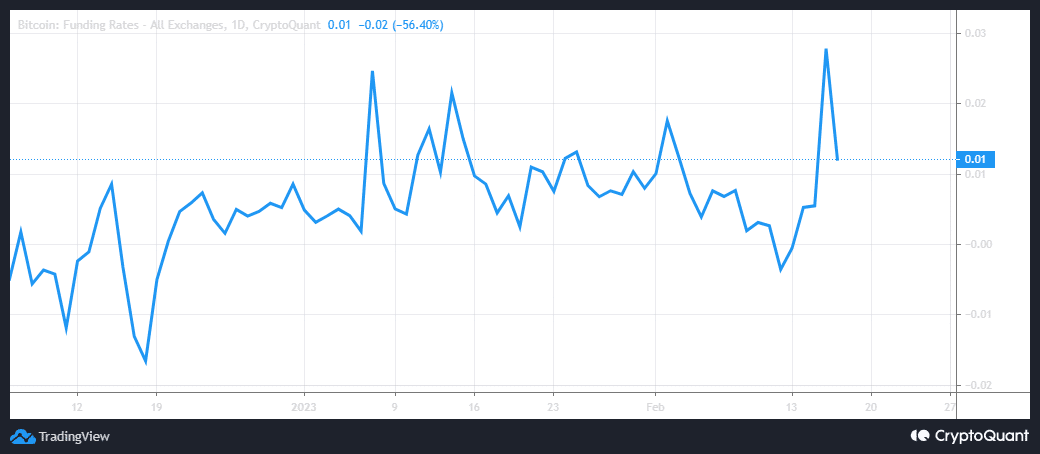

Things are a bit different on ETH’s side. It quickly surged from zero at the start of the year to 0.03 by mid-January. It fell to zero once again by mid-February followed by another spike in the last two days.

Source: CryptoQuant

Despite another spike, ETH’s funding rate did not manage to push to previous highs, thus indicating lower demand.

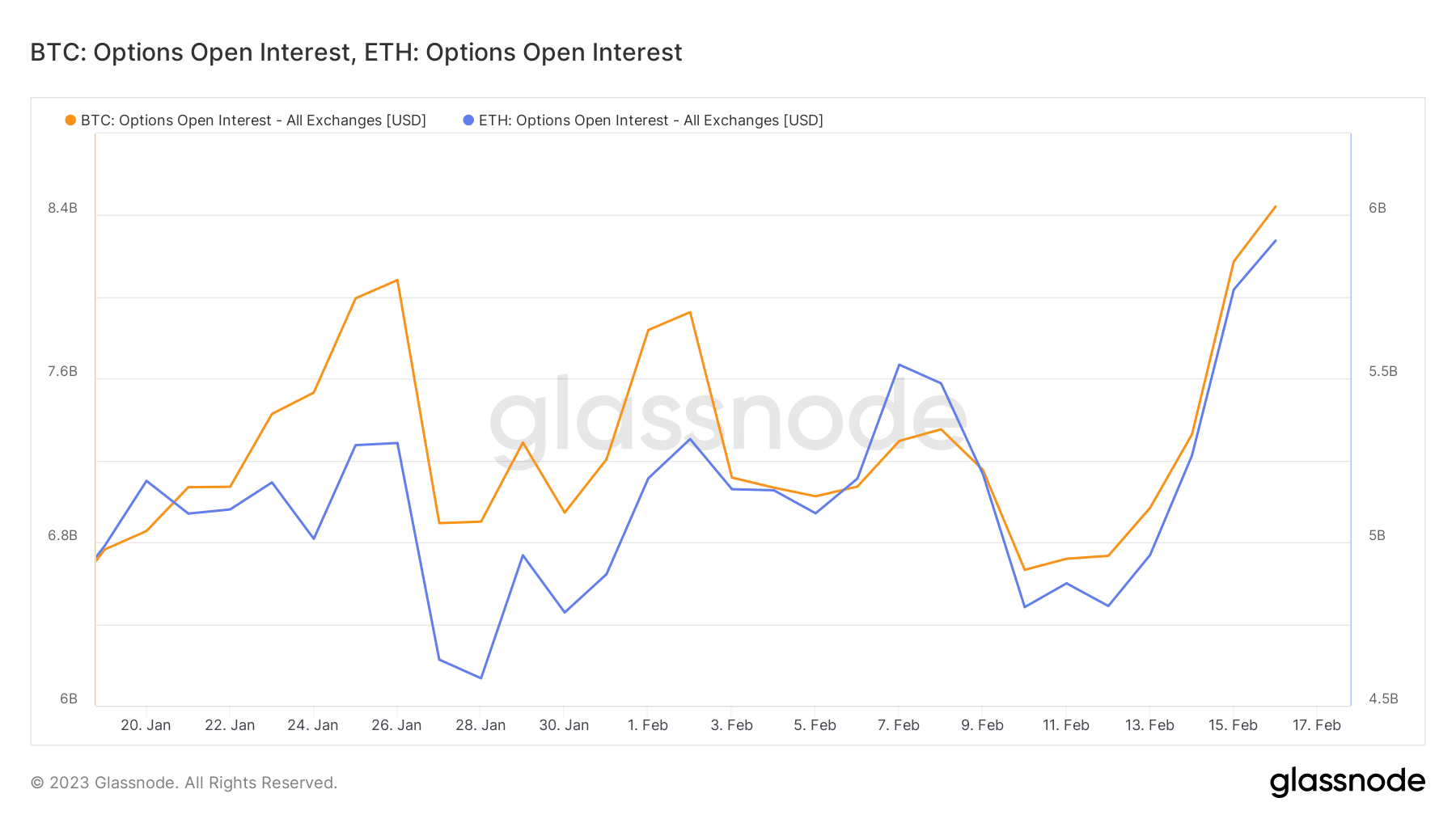

BTC and ETH Options open interest comparison

Bitcoin and ETH’s open interest metrics have been up and down for the last four weeks. More noteworthy is that BTC outperformed ETH in this regard at least for the second half of January. However, ETH’s open interest has been higher in February so far.

Source: Glassnode

In addition, both the BTC and ETH options open interest metrics are currently at a new YTD peak. Perhaps an indication of increased confidence in the market.

The Deribit report confirms that ETH and BTC annualized yields have recovered substantially in line with spot demand.

Conclusion

The common theme with the above findings is that derivatives demand for BTC and ETH are in recovery mode. However, there is still some restraint in the market.

The reason for this is that investors took on heavy losses and this has forced many to take a more conservative stance. We may, however, see a higher appetite for risk if the market goes through a state of euphoria as seen in 2021.