- Tokens worth millions have been bridged over to the youngest L2 project.

- Base demonstrated clear advantages in transaction throughput and affordability.

Coinbase, the largest crypto exchange in the United States, formally launched the Base layer-2 scaling solution for the public, marking a watershed moment for the mainstream acceptance of Web3 technologies.

With its latest endeavor, Coinbase became the first publicly listed company to operate its own blockchain. The move raised hopes among Web3 proponents that similar revenue streams could be explored by other top fintech companies in the near future.

Base is open and Onchain Summer is here ????

Become a part of Base history by minting “Base Day One” to join the story of bringing the world onchain

Our story.https://t.co/qaDj7CBCMd pic.twitter.com/9PZCLQQV7p

— Base ????️ (@BuildOnBase) August 9, 2023

Surprisingly, shares of Coinbase plunged during Wednesday trading hours and closed at $84.34, representing a 4.2% drop from Tuesday’s close.

A ‘Base’ to the sprawling Web3 edifice

Base was the latest entrant to a burgeoning Ethereum [ETH] scaling solution market. The project was built on the OP stack, the software powering another prominent L2 blockchain, Optimism [OP].

In a blog post, Jesse Pollak, senior executive at Coinbase and in charge of the Base, indicated that the goal was to establish a platform to enable the development of millions of decentralized applications (dApps).

He added that more than 1oo dApps have already been deployed on Base. He said,

“We encourage builders to create amazing onchain products people will love, while we work on distributing those products to people all over the world. We believe this vision benefits everyone: builders, creators, businesses, and every day people.”

It should be recalled that Base was unveiled earlier in February as part of a testnet launch. Following this, the blockchain was thrown open to developers last month, enabling them to deploy their products and test the efficacy of the ecosystem.

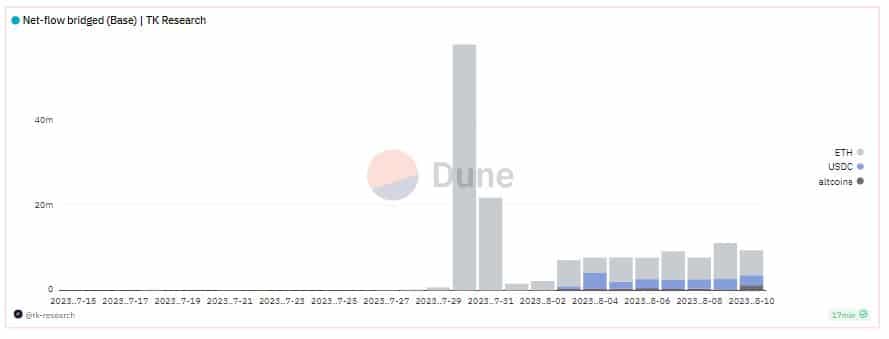

Since the developer-only release, the enthusiasm has progressively grown, with tokens worth millions getting transferred over to the newest L2 project. According to Dune, traders bridged a whopping $132 million in ETH as of this writing, constituting nearly 83% of all assets deposited.

Source: Dune

Interestingly, the bridged value reached a crescendo during the last weekend of July. The spike could be attributed to the explosive rise in BALD’s value, a native memecoin of the Base blockchain. Traders scrambled to get hold of the memecoin in order to make quick bucks.

However, the hopes of multiplying their gains crashed when the project became a victim of a rugpull. Since then, the price of the token has gone downhill, data from CoinMarketCap showed.

Network activity on the rise

The hiccup of BALD notwithstanding, Base has recorded impressive on-chain activity. As per a dashboard by blockchain analytics firm Nansen, active users and transactions on the network have continued to grow.

Additional data highlighted that the majority of users dealing with the L2 were bridging their assets. This was possibly done in order to grab other tokens trading on the native decentralized exchanges (DEXs).

Source: Nansen

Next in the list was the builder cohort, looking to leverage the blockchain’s innovative offerings to deploy cutting-edge Web3 applications.

It was fascinating to note that despite the fiasco, the clamor for BALD was intact with the memecoin still being one of the primary reasons behind users interacting with BASE.

Base goes past established names

Base started to carve out a niche for itself in the crowded ETH scaling landscape. According to L2Beat, the scaling solution zoomed past some of its seniors like Starknet and Polygon zkEVM to amass a total value locked (TVL) of 155 million.

The remarkable rise in TVL catapulted Base to become the fourth-largest L2 solution behind optimistic rollups like Arbitrum [ARB], Optimism, and the popular zk-rollup zkSync Era.

Demand for a scaling solution hinges around two critical factors – transaction throughput and affordability.

Data from L2Beat revealed that the average transactions per second (TPS) on Base was 5.81. This was better than Arbitrum’s 7.26, Optimism’s 7.07 and zkSync Era’s 10.72.

Source: L2Beat

Furthermore, there was a significant difference in the gas fees on Base when compared to base layer’s Ethereum numbers. A post by Nansen showed that average daily fees paid on Base was just $0.23, compared to $5.29 on Ethereum.

As Base is a Layer 2 that aims to bring the next billion users onchain, how do fees compare on Base from Ethereum?

We have that too!

As you can see, there’s a significant difference from Ethereum pic.twitter.com/5CCNOcTPFG

— Nansen ???? (@nansen_ai) August 9, 2023

The clear advantages in transaction latency and fees were expected to entice developers in hoards. However, only time will tell whether Base was just a flash in the pan or a beginning of many successful stories.