NFT

Art Blocks has led the charge for blockchain-based generative art, but the more than $1.4 billion worth of secondary market NFT sales registered to date across its collections have taken place on external platforms. But that may no longer be the case going forward, as the company today announced the launch of its own specialized secondary marketplace.

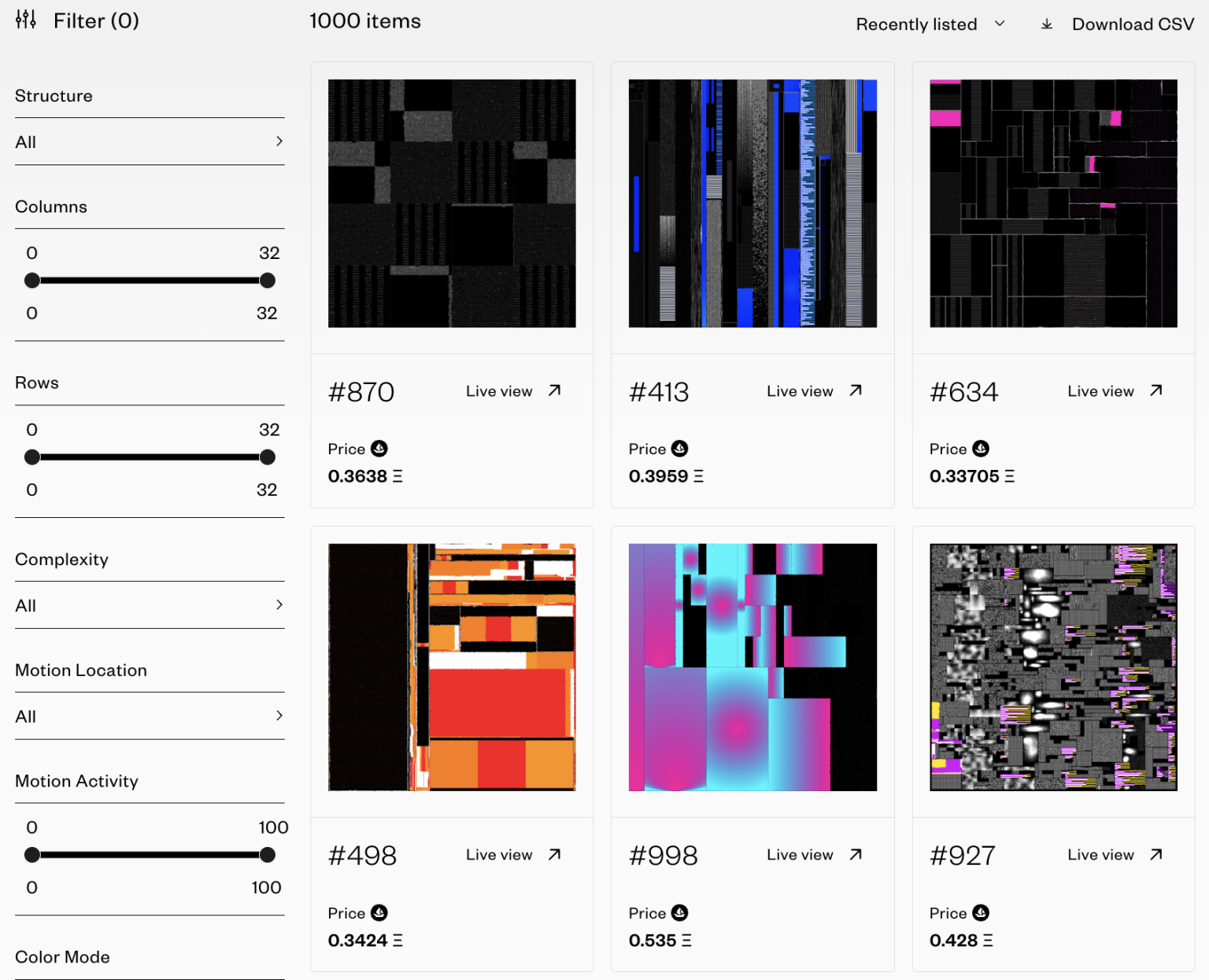

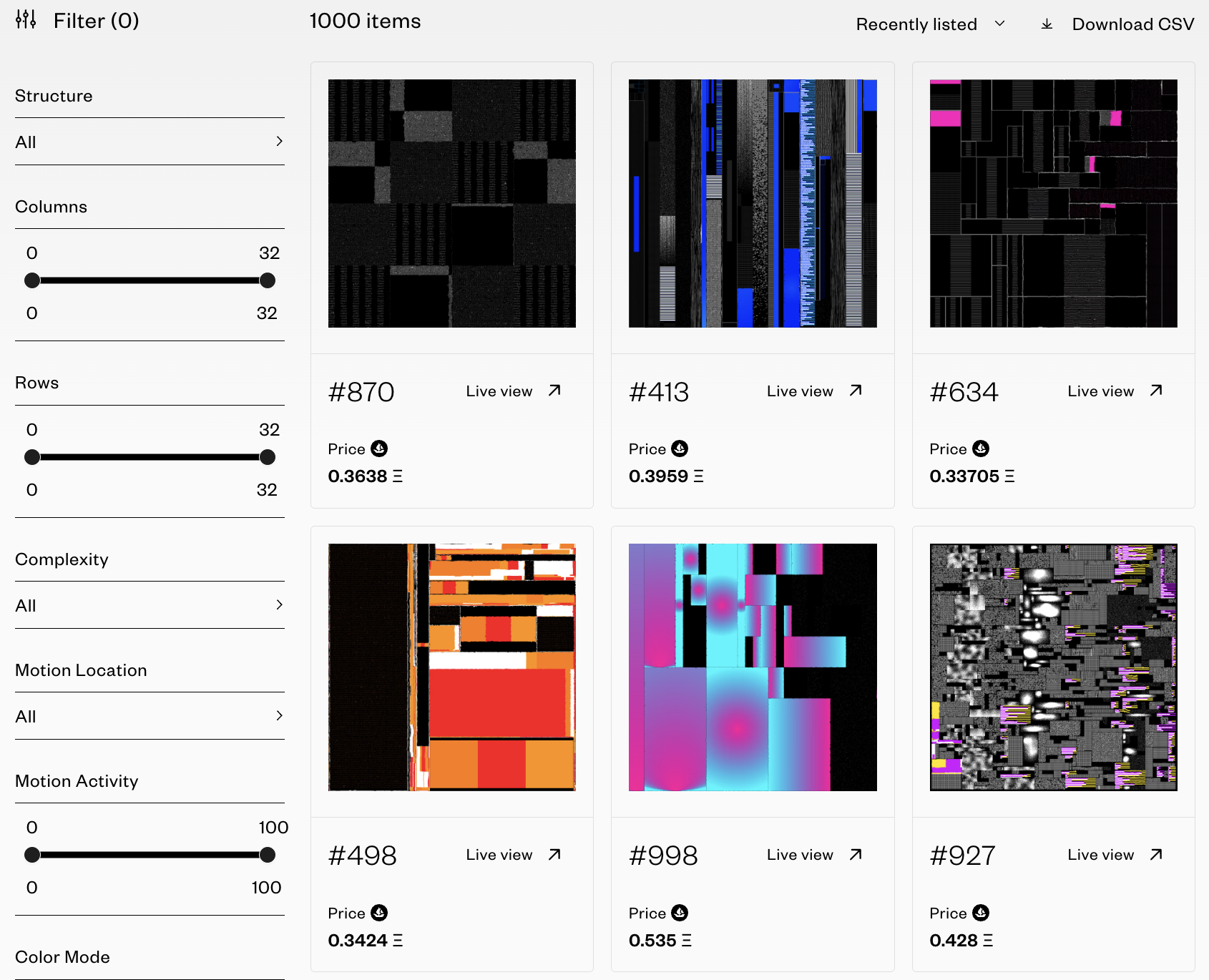

Now integrated within the existing Art Blocks website, the marketplace lets art collectors browse listed NFTs across all existing Art Blocks collections, whether they’re listed natively on the marketplace or aggregated from other major platforms like OpenSea and X2Y2.

Art Blocks takes no platform fee for secondary trades that occur via its marketplace, and artists’ own specified creator royalty settings are fully honored.

A screenshot of Art Blocks marketplace listings. Image: Art Blocks

That’s a distinct difference from how Ethereum NFT marketplaces like Blur and OpenSea are treating creator royalties nowadays, making them optional for traders above a nominal 0.5% minimum. A royalty is a percentage of the secondary sale price paid out to the original creator, and typically ranges between 5% and 10%.

Erick “Snowfro” Calderon, founder and CEO of Art Blocks and creator of its “Chromie Squiggle” collection, has been outspoken about the need for creator royalties in the NFT world, as well as moves by market leaders like OpenSea to diminish them. He said that the recent trend of declining royalties is harming artists’ ability to pursue creating digital art for a living.

“We are here to support the artists and the artists’ practices,” Calderon said. “How many artists had quit their jobs to be full-time artists because they were just thrilled with the idea of getting to pursue this?”

While that’s a potential key advantage of the marketplace, Calderon told Decrypt that the launch timing wasn’t specifically prompted by the NFT market’s pull-away from creator royalties, which began last summer but really took hold in late 2022.

Art Blocks CTO Jake Rockland said that the launch timing amid the royalties debate was “coincidental,” and that it came down to managing team resources and finding the right tech to enable a native marketplace that also aggregates listings. Ultimately, it’s built on OpenSea’s open-source Seaport protocol with aggregation facilitated by Reservoir.

OpenSea Drops Fees, Cuts Creator Royalty Protections as Rival Blur Rises

Art Blocks is the leading generative art NFT project, and has yielded $1.4 billion worth of sales—including numerous individual artwork sales over $1 million apiece.

With Art Blocks, artists create and deploy custom-designed algorithms to the Ethereum blockchain that generate a unique piece of tokenized artwork with each new mint. Leading projects within Art Blocks include Calderon’s own “Chromie Squiggles” along with Tyler Hobbs’ “Fidenza” and Dmitri Cherniak’s “Ringers.”

Beyond honoring royalties, the goal for Art Blocks’ marketplace was to better spotlight the projects and individual minted pieces, and provide a secure platform free of scam projects and knockoffs.

Rockland described the core Art Blocks experience as the “transcendence of minting—getting to pull mints out of the ether.” However, he acknowledged that some people would rather pick and choose from already-minted pieces, or may ultimately discover projects after the mint.

Part of the appeal of integrating marketplace listings is providing Art Blocks artists a hub to showcase their work after the mint. Calderon said that some artists had asked for the ability to share their work without pointing to a broad NFT marketplace like OpenSea.

What you won’t find at the Art Blocks marketplace, however, is a token. Calderon pointed to the “liquidity grab that happens” when a platform debuts—Blur, which recently overtook OpenSea as the leading NFT marketplace in terms of trading volume, did this with its BLUR token. But Art Blocks has “always fought against having a token just because it was a shiny thing,” he said.

How Much Wash Trading Is Really Happening on Blur?

Rockland also sees an opportunity to utilize “more carrots than sticks in terms of incentivizing behaviors we want to see,” adding that the marketplace can put “power in creators’ hands directly” over time to reward collectors who pay royalties.

What that ultimately looks like remains unclear, but Calderon clarified that he has “zero interest in anyone ever feeling punished for not participating” in a patronage-style model by paying royalties on NFT sales. But he’s excited about the idea of positive reinforcement instead, ensuring that creators are compensated and can in turn potentially reward those collectors.

“The creator economy is empowering the creator with control over their own creation,” Calderon said. “And I do think that the most compelling thing that’s going to happen is a creator that eventually provides a meaningful reward.”