- Bitcoin miners show faith in Bitcoin as their BTC holdings start to grow. Revenue generated rises, however, the difficulty rises alongside.

- Traders become optimistic as put to call ratio begins to decline.

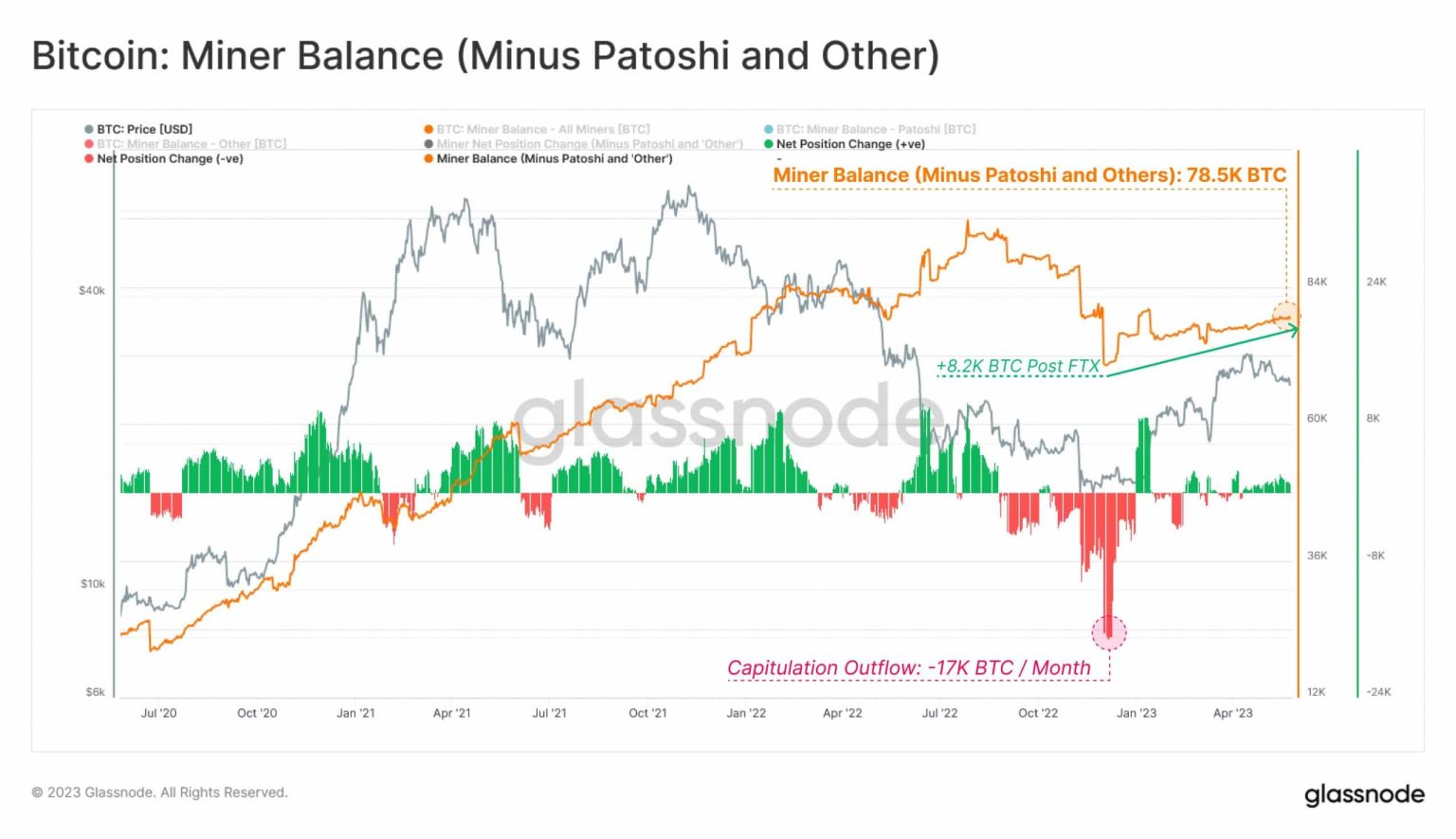

Due to the extremely volatile nature of the price of Bitcoin [BTC], revenues generated by miners have fluctuated massively. Because of this, large Bitcoin miner outflows occurred in the latter half of 2022. However, as Q3 2023 inches near, miners have started to turn optimistic.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

Miner balance turns green

The indication of miners’ confidence in Bitcoin was demonstrated by the expansion of their balance sheet through the acquisition of an additional 8.2K BTC. As a result, their total holdings have grown to reach 78.5K BTC according to Glassnode’s data.

The fact that miners have been able to increase their holdings by acquiring additional BTC suggested continued confidence in the cryptocurrency. This can be seen as a positive indicator for the broader Bitcoin market, as it signifies ongoing interest and support from miners who play a crucial role in securing and maintaining the Bitcoin network.

Source: glassnode

The rising miner revenue also contributed to the positivity showcased by miners. In the last three months, the daily revenue generated by miners has grown significantly from $21,370 to $27,253.

Source; blockchain.com

During the same period, there was a significant increase in mining difficulty. When Bitcoin mining difficulty reaches new highs, it indicates a heightened level of competition among miners, leading to increased computational power and network security.

This trend also highlights the significant resource investment required for mining, potentially impacting block generation rates and the overall supply dynamics of the cryptocurrency.

Source: blockchain.com

Traders make their predictions

Even though the rise in difficulty may pose challenges in the future for miners, their growth also largely depends on Bitcoin’s price. At press time, Bitcoin was trading at $26,463.66 according to CoinMarketCap’s data.

Trader behavior suggested that they were optimistic about BTC’s price and expected it to go up further.

Is your portfolio green? Check out the Bitcoin Profit Calculator

At the time of writing, there were 86,000 BTC options set to expire soon. These options have a Put Call Ratio of 0.38, which means that there are more bullish (Call) positions than bearish (Put) positions.

The maximum pain point, a price level where option holders would experience the most financial loss, is estimated to be around $27,000. In total, these options hold a notional value of approximately $2.26 billion.

Source: The Block