- Sales for MAYC increased, and interest in BAYC grew.

- Whales show interest in APE, but traders go short.

Over the last few days, the number of Non-fungible Tokens [NFT] transactions in the crypto space witnessed a massive surge. NFT collections on various networks observed higher interest from the crypto community. Yuga Labs, which has one of the largest NFT collections in the crypto space, also capitalized on this opportunity.

Is your portfolio green? Check out the Ape Profit Calculator

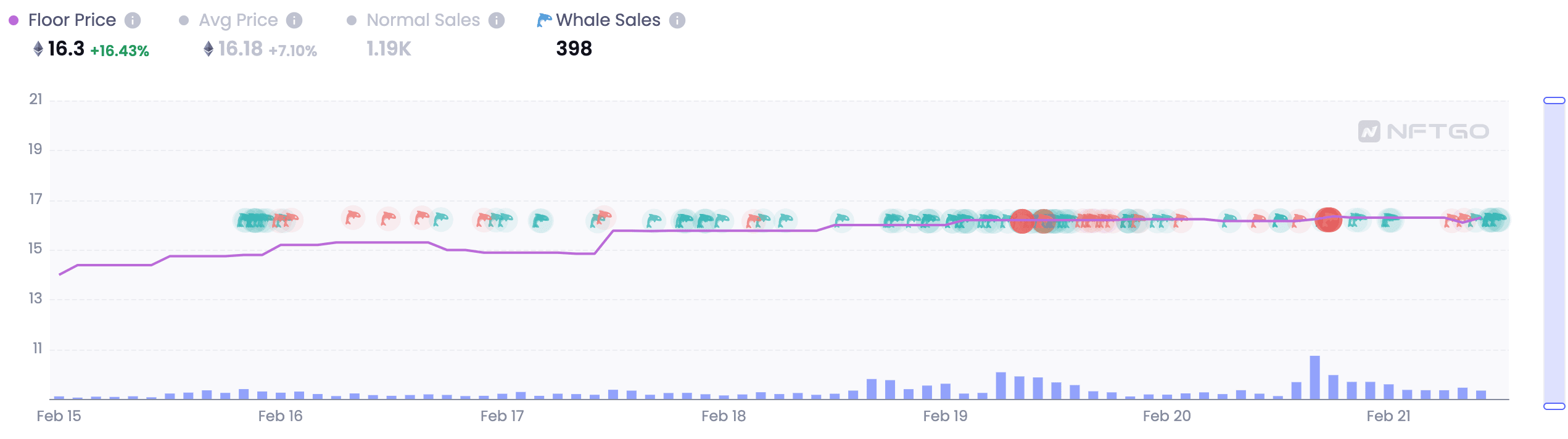

Over the last few days, MAYC’s demand reached an all-time high. According to NFTGO, the number of sales of MAYC increased by 81.81% over the last week. The overall floor price for the NFT collection also surged by 16.43%.

BAYC witnessed similar growth during this period. Its floor price increased by 8.2% in the last week as well.

Source: NFTGO

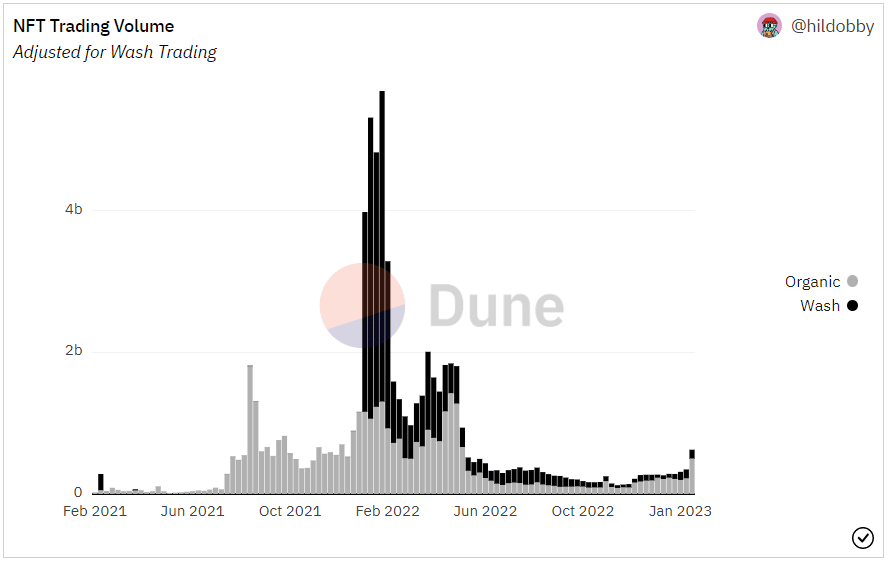

However, there has been an increase in wash trading in the NFT markets. According to Dune Analytics’ data, the amount of wash trades in the NFT space has increased. Due to this, the traction that the Yuga Labs NFT was getting did not translate into ApeCoin’s growth.

Source: Dune Analytics

Bored apes, interested whales

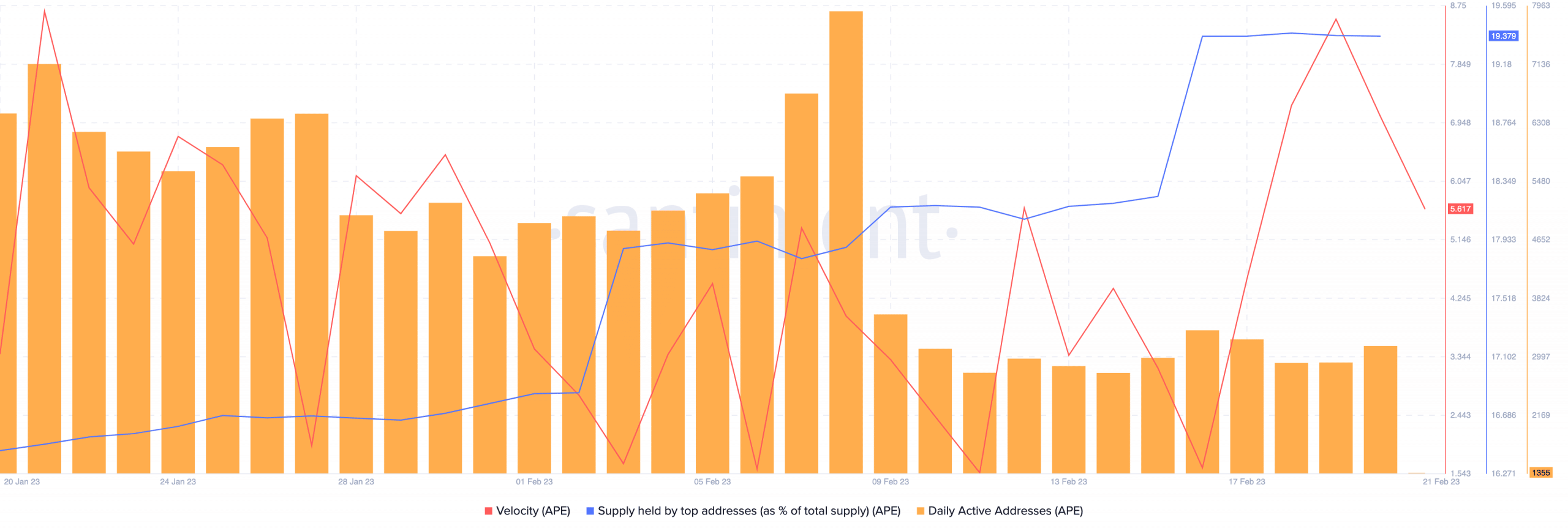

According to data provided by Santiment, the velocity of ApeCoin declined immensely. Along with that, the number of daily active addresses on the ApeCoin network had also fallen, which affected the overall activity of the ApeCoin network negatively.

However, despite these factors, whales continued to show support for ApeCoin. Based on Santiment’s data, the percentage of large addresses accumulating APE surged over the last few weeks.

A sudden interest from whales could improve APE’s prices in the short term. However, a concentration of APE being held by large addresses could make APE vulnerable to massive selloffs, which would impact the price of APE negatively.

Source: Santiment

Realistic or not, here’s APE’s market cap in BTC’s terms

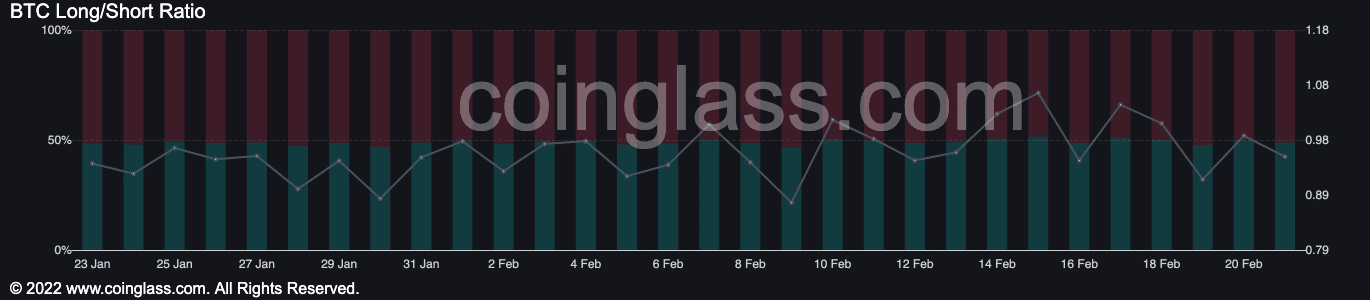

This could be one reason why the number of short positions against APE have been increasing. According to Coinglass’ data, 51.14% of all positions against APE are short.

Source: Coinglass

It remains to be seen whether the traders turn out to be right with their predictions or if the Yuga Labs NFT hype can be enough to keep the bears at bay.