- Retail investors’ interest in Bitcoin increased.

- Increase in profitability and potential for increased selling pressure for BTC.

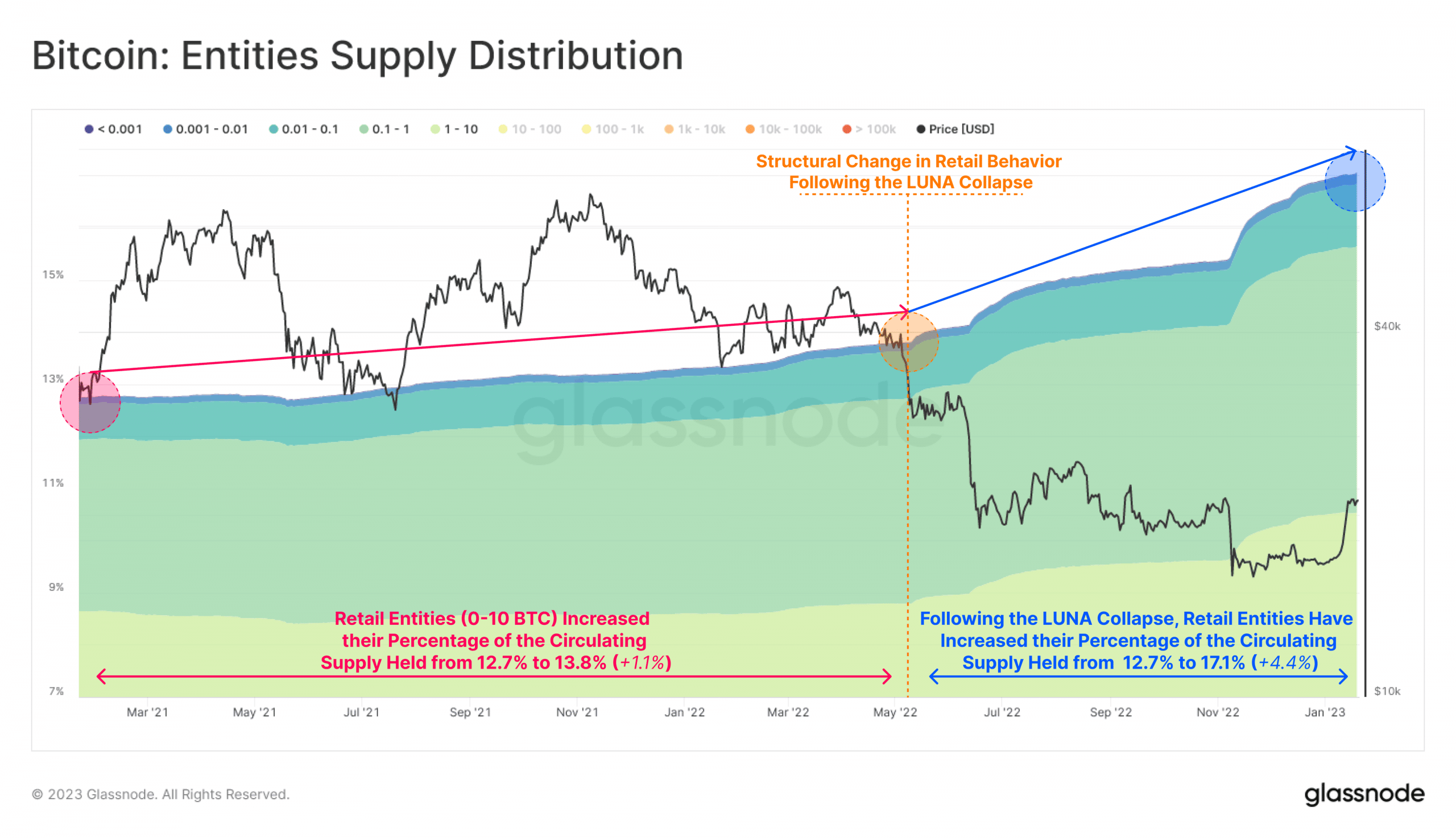

Since the Terra Luna [LUNC] collapse, the number of Bitcoin [BTC] retail investors continued to rise and stood at 17.1% of the total circulating supply at press time, according to Glassnode.

Source: Glassnode

Read Bitcoin’s [BTC] Price Prediction 2023-2024

This represented a 4.4% increase over the past eight months, which was a positive sign for the decentralization of the Bitcoin network, as it suggested that it was not as controlled by large “whale” investors.

Holders get tempted

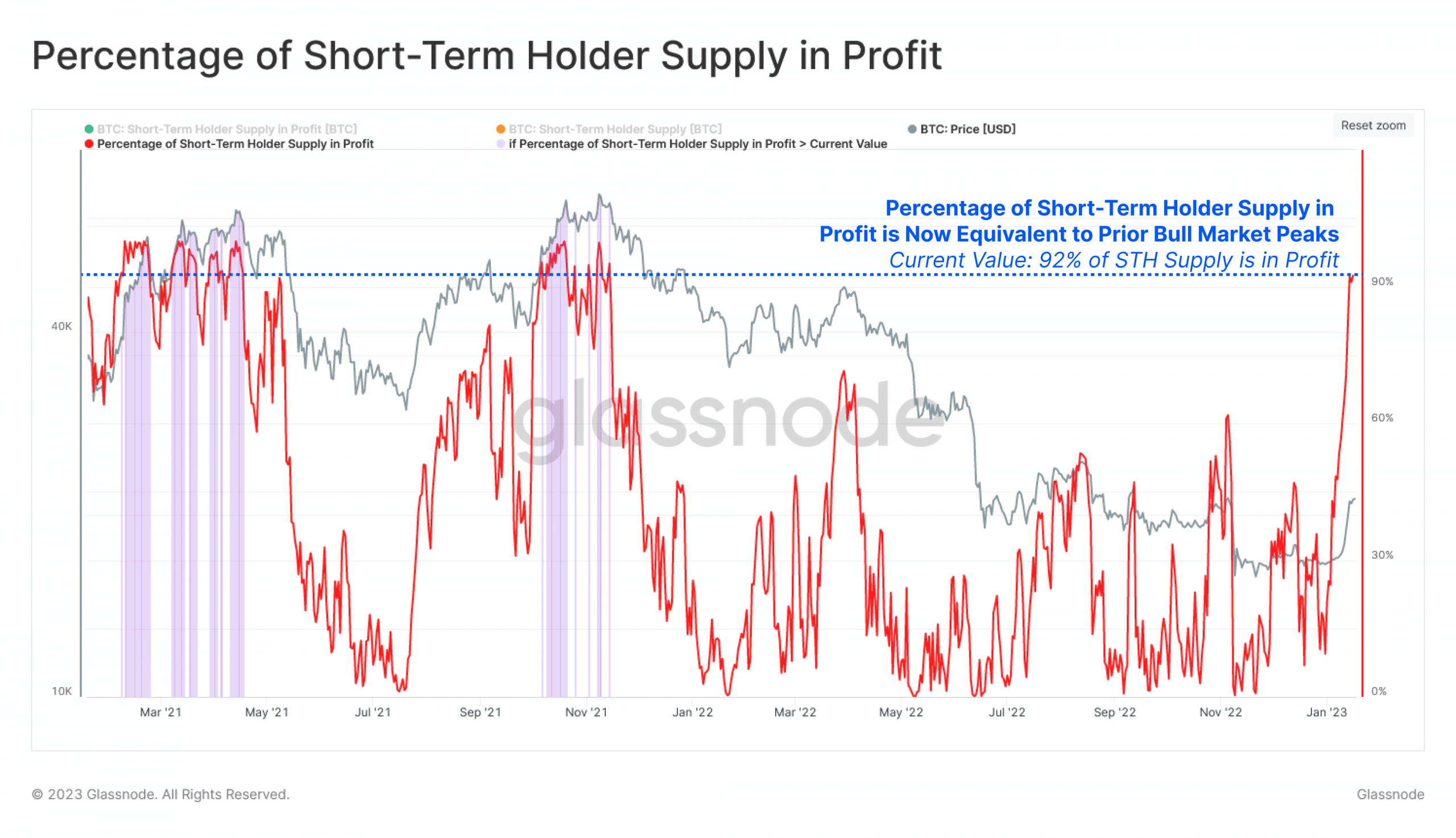

In addition to the growing number of retail investors, the number of investors in profit also increased during this period.

According to Glassnode’s data, the percentage of short-term holders in profit reached 92%. However, this could impact the selling pressure on Bitcoin, as many short-term holders may choose to sell their BTC for a profit, which could eventually affect retail holders.

Source: glassnode

Despite the growing profitability of Bitcoin and the potential for increased selling pressure, data suggested that the selling pressure may not have increased yet.

According to data provided by CryptoQuant, the exchange reserve continued to decline. The exchange reserve is the amount of Bitcoin held by exchanges and is a key indicator of selling pressure. A decline in the exchange reserve suggests low selling pressure.

Source: CryptoQuant

BTC activity declines

However, things could take a turn for the worse for BTC soon. One worrying indicator was the decline in Bitcoin addresses activity. According to information provided by CryptoQuant, the number of active addresses on the Bitcoin network decreased by 27.64% in the last 24 hours.

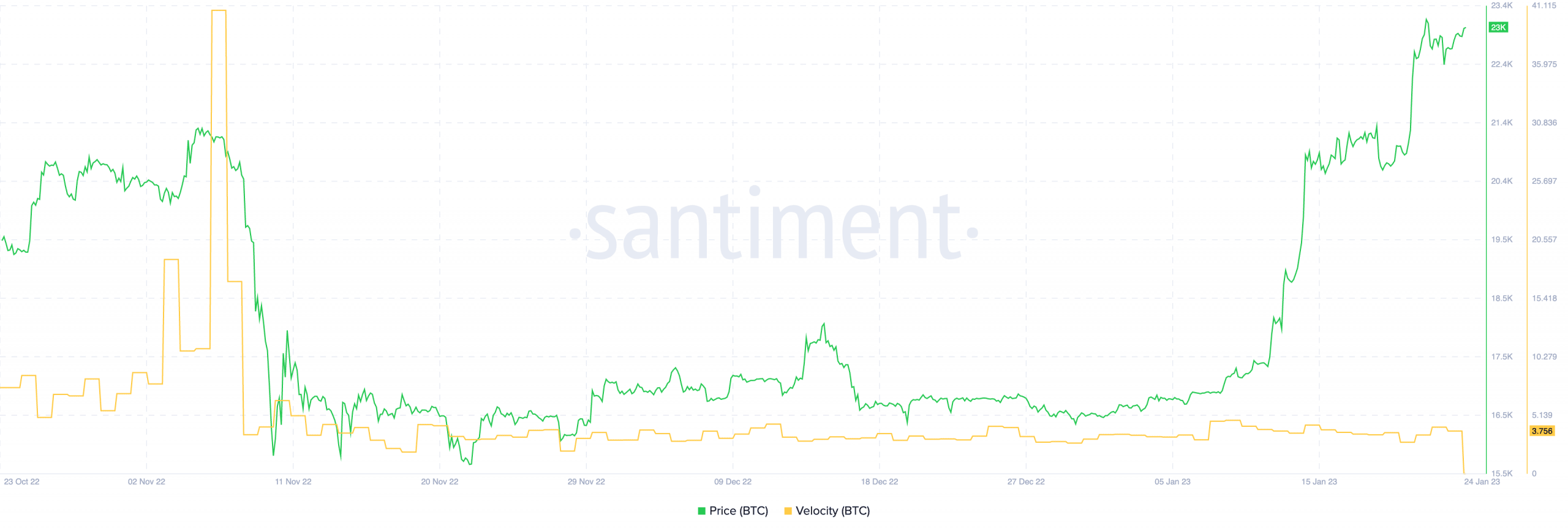

Additionally, Bitcoin‘s velocity fell sharply as well, indicating that the frequency of BTC transfers among addresses has decreased.

How many are 1,10,100 BTC worth today?

Source: Santiment

Despite this decline in activity, traders continued to go long on Bitcoin at press time. According to data provided by Coinglass, trader sentiment towards the king coin turned positive over the last few days, and at the time of writing, 51.92% of all trades were long positions made in favor of Bitcoin.

It remains to be seen if holders cave into the selling pressure or if they continue to HODL BTC. At the time of writing, Bitcoin was trading at $23,082.73 and its price grew by 1.56% in the last 24 hours, as per CoinMarketCap.

![Analyzing retail investors’ growing faith in Bitcoin [BTC] as prices soar](https://patrolcrypto.com/wp-content/uploads/2023/01/FnLBqPzWYAEnisD-1536x884.png)