- The decline in Ordinals inscriptions has impacted the fees on the Bitcoin network.

- The hash rate and Miner revenue have recently increased despite the drop in fees.

Bitcoin [BTC] made a notable entrance into the NFT scene, demonstrating its significance beyond being just another participant.

The surge in NFT popularity not only influenced transactions but also had a positive impact on fees. Nevertheless, recent data indicates a decline in both inscriptions and fees. However, while the fees went down, the network hash rate hit a new high.

Bitcoin leads NFT sales volume

Recent data from Coin98 Analytics showed that Bitcoin emerged as the top network in terms of NFT volume during Q4 2023.

The statistics indicate a substantial sales volume of 1.27 billion at the close of Q4 2023. This surpasses Ethereum, which has traditionally been the leading network in terms of both NFT projects and volume.

In Q4 2023, #Bitcoin surged to the top with the highest #NFT sales volume, surpassing $1.27B in organic volume pic.twitter.com/pXyeOBUQAA

— Coin98 Analytics (@Coin98Analytics) January 12, 2024

Additionally, insights from Crypto Slam demonstrate that Bitcoin has continued to dominate in the last 30 days.

As of this writing, it boasts the highest NFT sales volume, with over $861 million. This surge in NFT sales is attributed to the popularity of Ordinals Inscriptions. However, it’s noteworthy that the trend in daily inscriptions is on a declining trajectory.

Daily Bitcoin Ordinal inscription declines

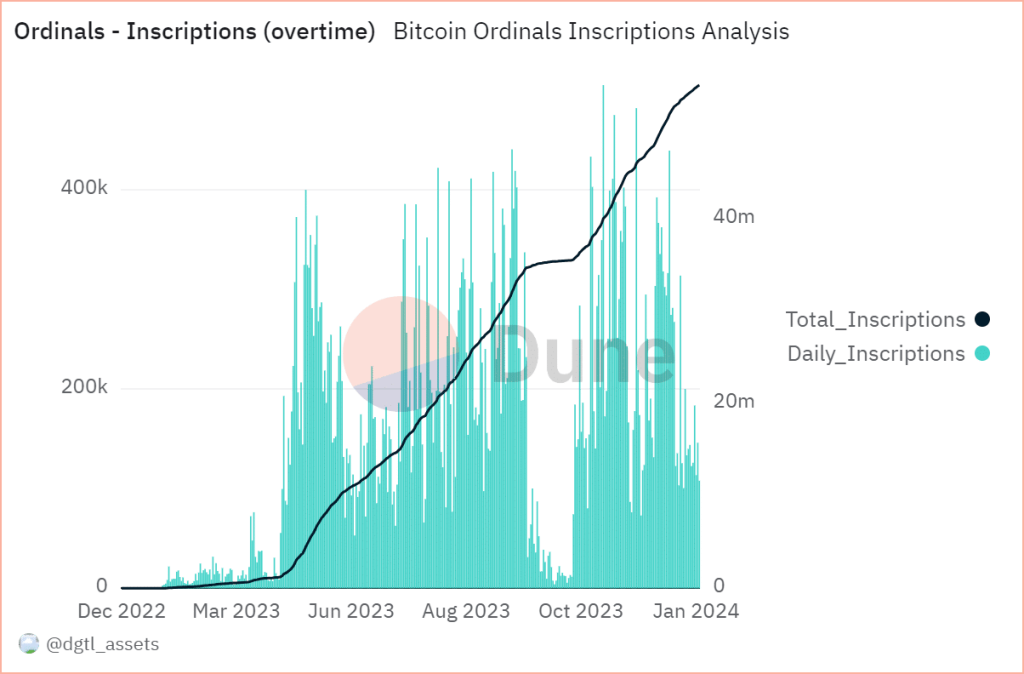

An examination of the Bitcoin Ordinal inscriptions trend on Dune Analytics showed a significant trend shift on 31st December 2023. On that day, the number of inscriptions was over 300,000.

However, following this peak, there has been a consistent decline, with daily inscriptions failing to surpass 200,000. As of this writing, there were around 146,000 daily inscriptions.

Source: Dune Analytics

Furthermore, with the reduction in daily inscriptions, there was a decline in daily inscription fees.

The Dune chart showed a continuous decrease in fees since the onset of the year, with the current fee around 15 BTC. This decrease in inscription fees has, in turn, impacted the overall network fees.

Source: Dune Analytics

Network fees drop by over 50%

Recent data from IntoTheBlock showed a remarkable drop of over 50% in Bitcoin network fees within the past week. The accompanying post attributes this decline to a corresponding fall in inscriptions.

An examination of the fee trend on Crypto Fees reveals a notable decrease in fee volume. As of 31st December, the fee stood at over $15.2 million, but a sharp decline is evident after that.

As of this writing, the fee was around $0.7 million. The prospect of a reversal in this trend looms with the potential resurgence in daily inscriptions. The dynamics of network fees may change once the daily inscriptions regain momentum.

Bitcoin hash rate hits a new high

In a recent update from IntoTheBlock, it was reported that the Bitcoin hash rate achieved a new record high.

Analyzing the hash rate trend on Blockchain.com showed that on 11th January, it reached nearly 630 trillion. This marked a substantial jump from the previous day’s level of around 480 trillion.

As of this writing, the hash rate was over 611 trillion.

Source: Blockchain.com

Read Bitcoin (BTC) Price Prediction 2024-25

Additionally, examining miner revenue demonstrates a significant correlation with the hash rate increase. When the hash rate hit its all-time high, the miner revenue rose to over $55 million.

As of this writing, the miner’s revenue was close to $54 million. This underscored the notable impact of the hash rate on miner earnings in the Bitcoin network.