Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- AAVE oscillated in a range in the past few weeks.

- A recovery could offer significant gains if it overcomes a key hurdle.

AAVE traded in the $73 – $95 range in the past few days. Bitcoin [BTC] sharp decline on Thursday (2 March) sent the AAVE to retest its range support zone.

But it seems investors aren’t exiting the market, which could potentially boost a bullish recovery if demand increases for AAVE at its current discounted prices.

Read AAVE’s [AAVE] Price Prediction 2023-24

AAVE dropped to the key support zone

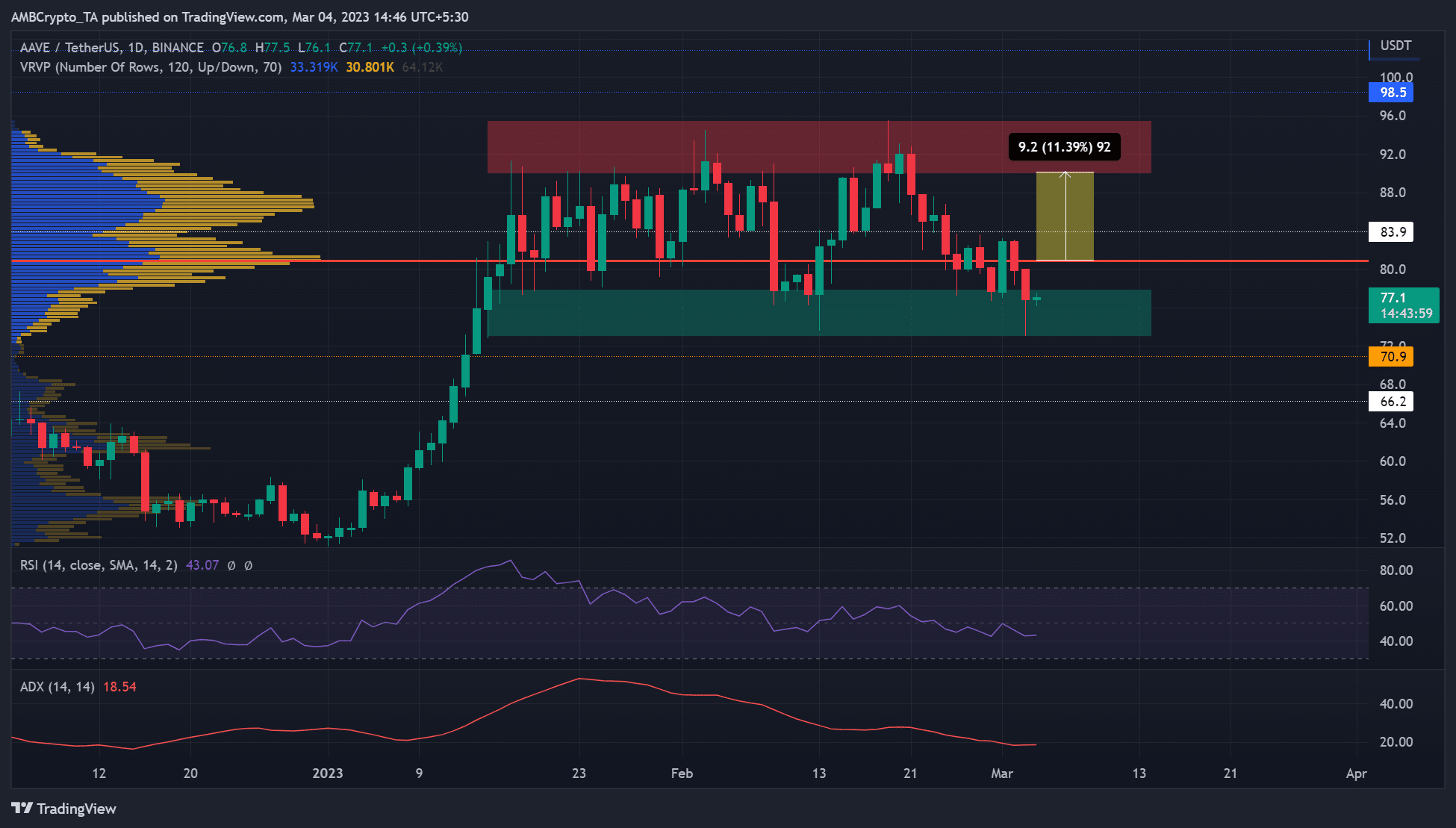

Source: AAVE/USDT on TradingView

The $95 level has become a key resistance, preventing bulls from inflicting further gains after the impressive rally in January. So far, the $90 – $95.5 zone has become a key sell pressure area.

Similarly, the $73 – $77.8 is a key support zone (green) that has seen significant demand in the past retests. If the trend repeats, the retest witnessed at press time could drive demand for AAVE at the current price level. Such a demand could push AAVE toward the sell pressure zone (red).

Bulls could be boosted if the price breaks above the price of control/value area above $80 (red line) and retest it. The Fixed Range Volume Profile (VRVP) shows the traded volume over a price range and highlights the price with the highest volume (red line).

A break and pull-back retest at $80.8 could boost the uptrend to target the supply zone – a potential 11% hike.

On the contrary, bears could undermine bulls’ efforts if they sink AAVE below the support zone. Such a downswing could see AAVE drops further toward $66.

The RSI fell gently over the past few days and was below 50 at press time, reinforcing that bears have leverage in the current structure. Similarly, the Average Directional Movement Index (ADX) moved southwards, showing the rally at the start of the year weakened and could experience extended consolidation or retracement.

The Funding Rate rebounded, but …

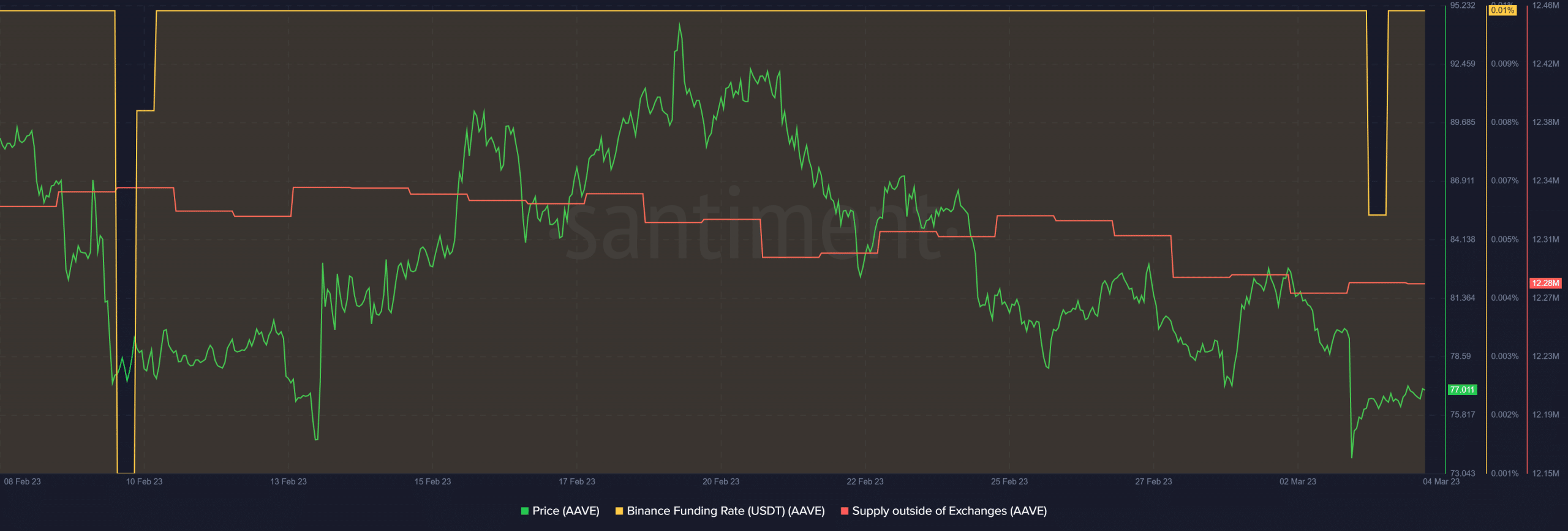

Source: Santiment

AAVE’s Funding Rate dipped and improved later, as shown by Santiment, indicating that demand improved – a bullish signal. Similarly, supply out of exchanges spiked, confirming short-term accumulation, which could tip bulls to enter the market in the long run.

Is your portfolio green? Check out the AAVE Profit Calculator

However, selling pressure came from addresses holding 1k to 10k AAVEs and 10k to 100k AAVEs, which controlled 6% and 18% of the market supply, respectively.

But the dominant whale category (48% of supply) was inactive at press time. Therefore, cautious investors could wait for a pullback retest on the support zone before making moves.