- The total value locked (TVL) on Lido went past $11 billion on 5 April – Its highest level in 11 months

- Lido’s share in ETH staking has declined from 61% towards the start of February to 31% at press time

Ethereum liquid staking solution Lido Finance’s [LDO] upcoming V2 upgrade will be a significant milestone in its preparedness for the much-awaited Shanghai Hard Fork, also called Shapella. As Shapella is less than a week away, the Lido ecosystem shared an important update with regard to Ethereum [ETH] withdrawals, one of the main features of V2.

A Lido V2 update ????

TLDR:

Withdrawal key-rotation ceremony completed: all withdrawal credential messages have been successfully signed (from 0x00 to 0x01), and are now ready to be broadcasted to the Ethereum network post Shapella hard fork (April 12th).????

— Lido (@LidoFinance) April 5, 2023

Is your portfolio green? Check out the Lido Profit Calculator

One step closer to Shapella

As part of the V2 upgrade, Lido completed a key rotation ceremony for its withdrawal credentials. This involved signing up of withdrawal credential messages from 0x00 to 0x01. These changes are ready to be implemented on the Ethereum mainnet.

The Lido DAO’s first set of withdrawal keys were generated in December 2020. 0x00 withdrawal credentials have to be migrated to 0x01 to enable partial and full withdrawals after the Shapella hard fork.

A key component of Lido’s V2 upgrade will be withdrawals. With the use of this function, Lido users will be able to get ETH at a 1:1 exchange rate for their Staked Ether [stETH].

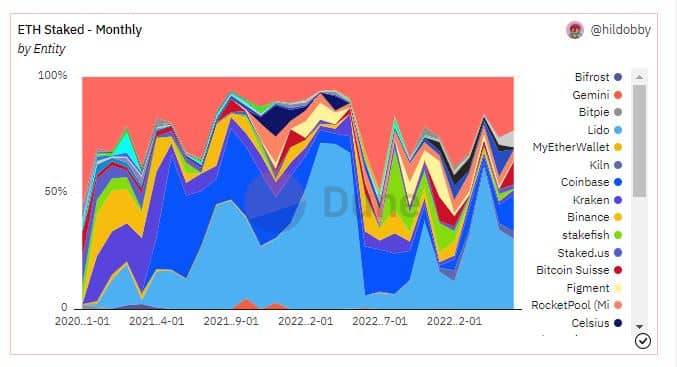

There is presently 5.66 million ETH staked with Lido’s liquid pools, accounting for over 31% of the total ETH staking marketshare. This, as per a Dune Analytics dashboard. Interestingly, Lido’s share has declined considerably from 61% towards the start of February.

Source: Dune

TVL goes north

The total value locked (TVL) on the DeFi protocol’s smart contracts went past $11 billion on 5 April – Its highest in the last 11 months. Additionally, the TVL jumped by 25% over the previous month, as per data from DeFiLlama.

A big reason behind this growth was the surge in ETH’s price, with the altcoin recording its 8-month high after breaking past $1900 on the charts. Furthermore, an overwhelming majority of Lido’s liquidity, more than 98%, is constituted by ETH deposits.

Source: DeFiLlama

Realistic or not, here’s LDO market cap in BTC’s terms

As far as LDO is concerned, its network growth has gone downhill since February. This is a sign that new addresses are not interested in the token.

Though the 30-day MVRV ratio fell considerably in March, it was still positive, suggesting that there was incentive for LDO holders to dump the coin and earn profits. The hike in transaction volumes lent credence to this argument.

At the time of writing, LDO was down 5.53% over a 24-hour window.

Source: Santiment