- Tron caves into the AI hype as Justin Sun reveals AI integration plans.

- TRX soars to new 5-month high but sell pressure was creeping in, at press time.

In the last few weeks, we have seen multiple crypto projects align themselves with the AI hype. The Tron network is the latest blockchain project to pursue this path. Its founder Justin Sun recently revealed his plan to tap into AI.

According to Sun, Tron needs to embrace AI so it can improve the process of information diffusion. Tron’s key target segments are investment management tools and oracle services.

Sun expects the latter to offer more accurate on-chain data when integrated with AI. He also expects the integration of AI with management tools to offer benefits such as boosting smart contract resilience against security risks.

AI is transforming the tech industry and #TRON is at the forefront of this revolution with its #AI-oriented integrations.

– Oracle Services

– Investment Management Tools

– Payment Infrastructure

– Content Creation

????— H.E. Justin Sun????????????????????₮ (@justinsuntron) February 9, 2023

The Tron CEO noted that AI may also be integrated into the content creation space through NFTs. But what does this all mean for Tron’s performance? Tron’s native cryptocurrency TRX has been one of the most consistent coins in terms of maintaining its upside.

Most top coins have experienced a significant slowdown or even some sell pressure since the start of February. This is not the case for TRX which achieved a new 5-month high of $0.071 this week.

Source: TradingView

TRX’s RSI indicator confirms that the cryptocurrency has maintained healthy relative strength. In other words, TRX managed to outperform investor sentiment so far this month.

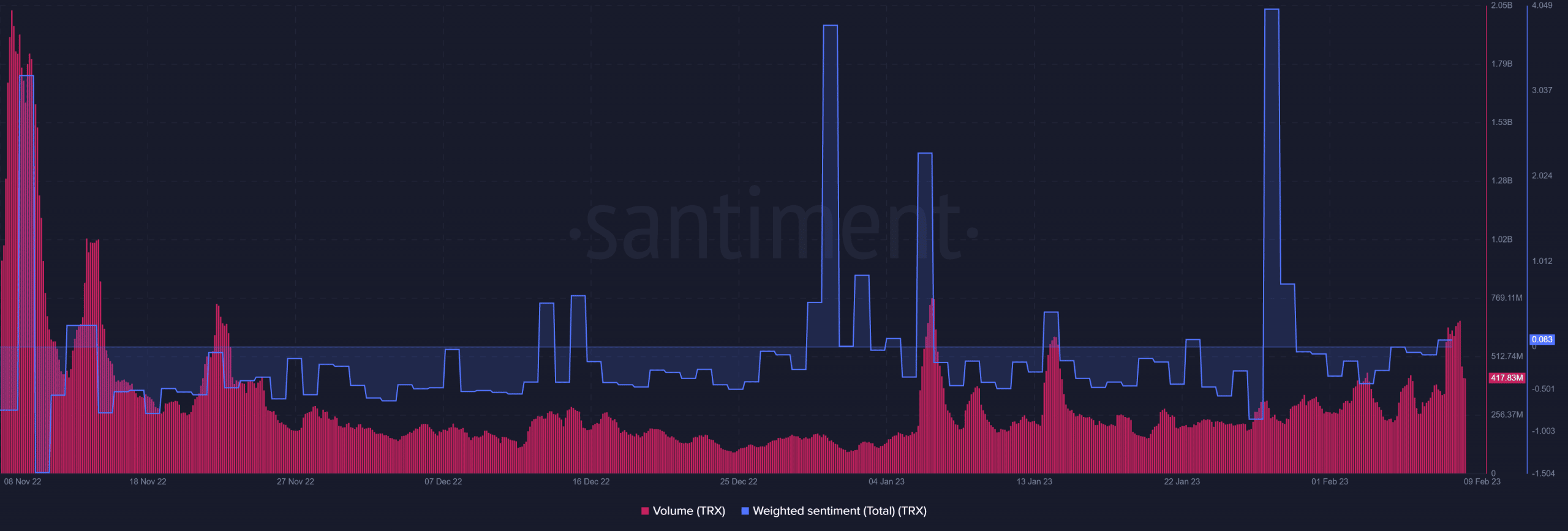

The weighted sentiment ended January with a surge followed by a strong pullback.

Source: Santiment

The TRX on-chain volume also demonstrated a surge since the start of February contrary to the weighted sentiment. This was mostly bullish volume since the price responded with some upside.

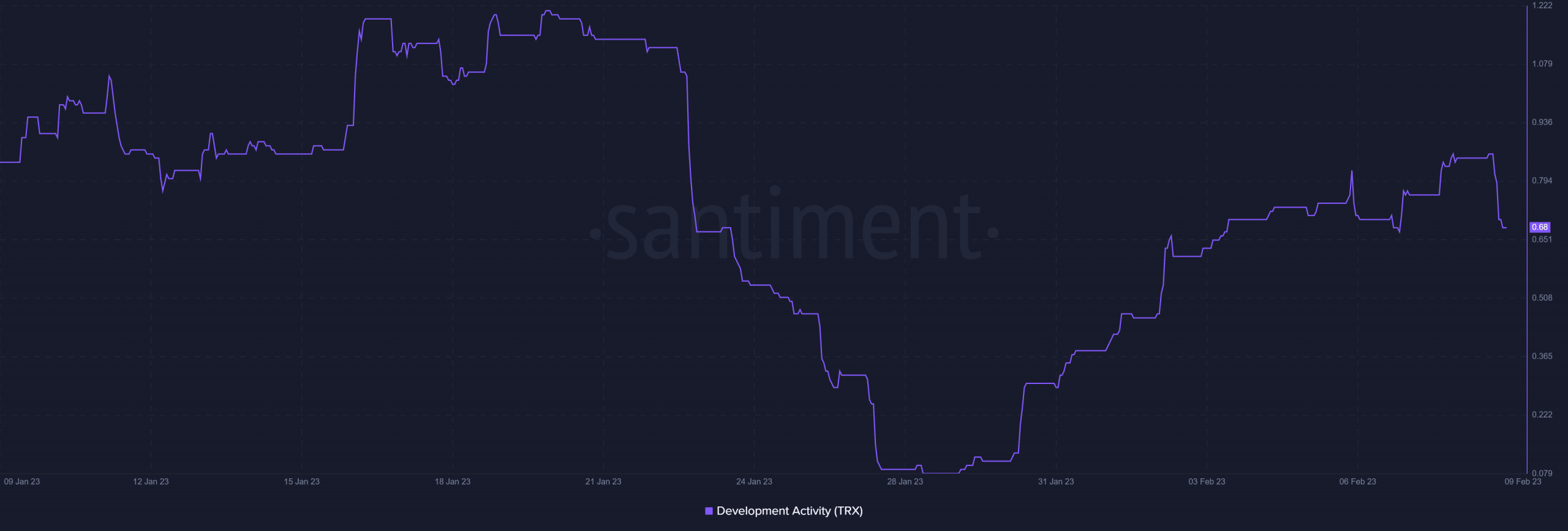

This performance may have been boosted by a surge in development activity. The latter bounced back strongly in the first week of February, after previously registering a sharp drop in the last week of January.

Source: Santiment

Can TRX maintain its trajectory?

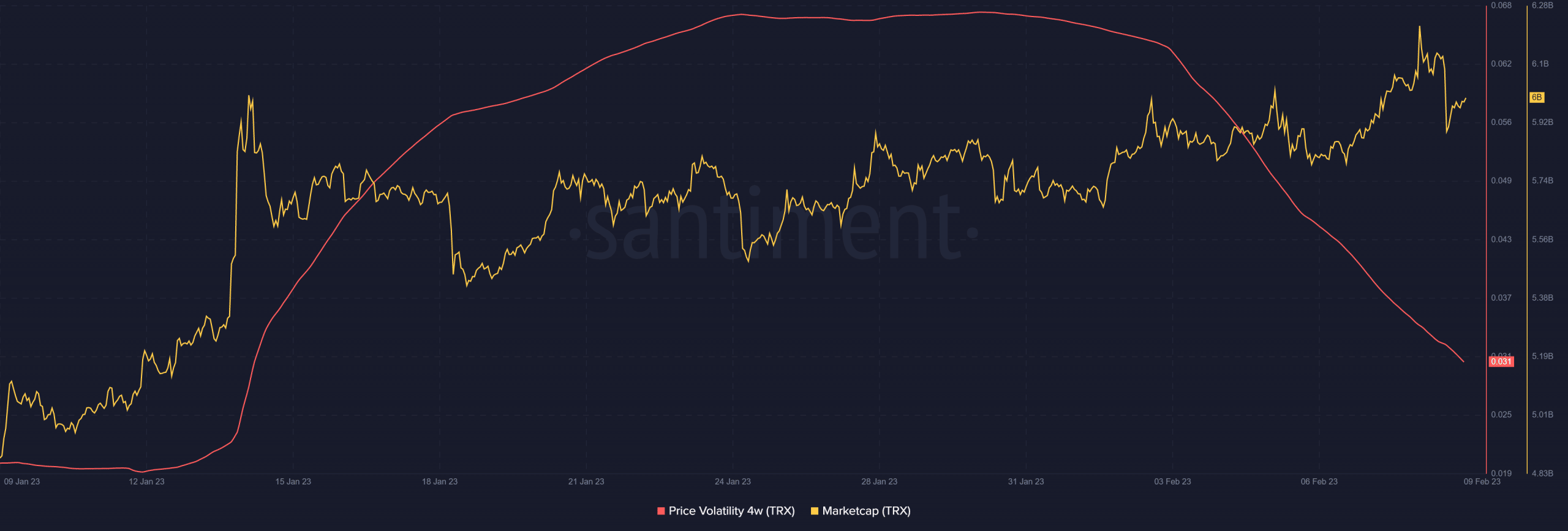

TRX has experienced a drop in volatility since the start of February. This suggests that the market hype previously seen in January is tapering off.

This might result in a situation where there is less demand. Such an outcome might trigger a sizable pivot especially if the market conditions allow.

Source: Santiment

Tron’s market cap is already showing signs of profit-taking. It tanked by roughly $258 million between Wednesday and Thursday (8 and 9 February). Traders should thus keep a close watch on the current trajectory especially as the weekend approaches.