- Arbitrum surpassed Optimism in the number of transactions.

- Despite growth, decline in active developers and stablecoin network growth raised questions about sustainability.

The Arbitrum protocol recently outperformed Optimism [OP] in terms of the number of transactions made on its network. According to Messari’s data, on 7 February, the number of transactions made on the protocol was significantly higher than Optimism.

L2 Protocol Screener

+Nearly all L2s saw increases in usage, TVL, and valuations

+@optimismFND sees usage drop following the end of “Optimism Quests” incentive program

+@arbitrum processed nearly 5x the number of transactions that @optimismFND did on Jan 29th pic.twitter.com/qcqKy0HL0r— Messari (@MessariCrypto) February 7, 2023

Read Optimism’s [OP] Price Prediction 2023-2024

Users show interest in Arbitrum

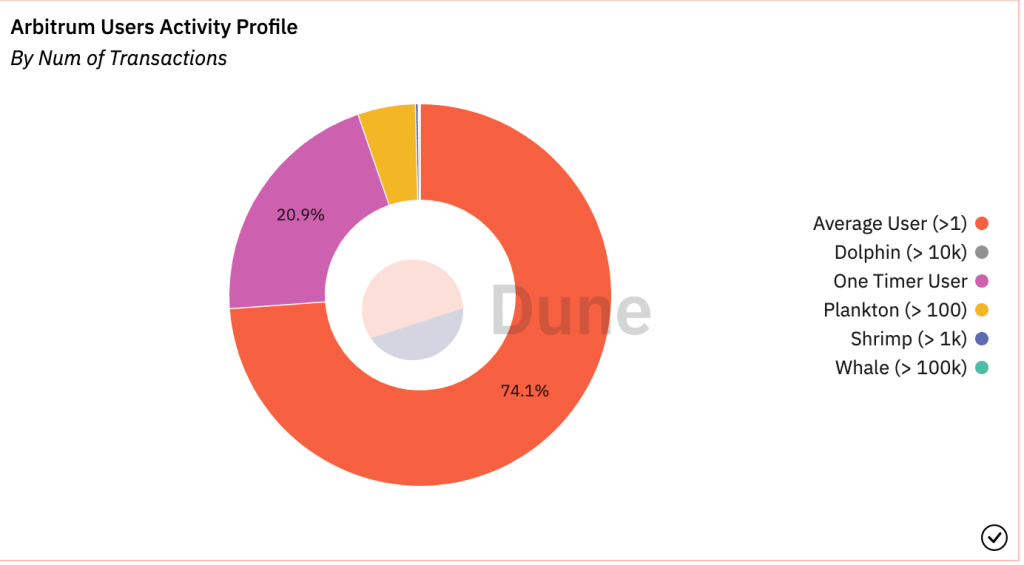

The spike in transactions could be attributed to the growing number of accumulated users on the protocol. Out of these users, 74.1% made more than one transaction, while 20.9% were one-time users.

Despite the average number of transactions per address being lower, the number of active addresses on Arbitrum increased, showing that more people were using the protocol at press time.

Source: Dune Analytics

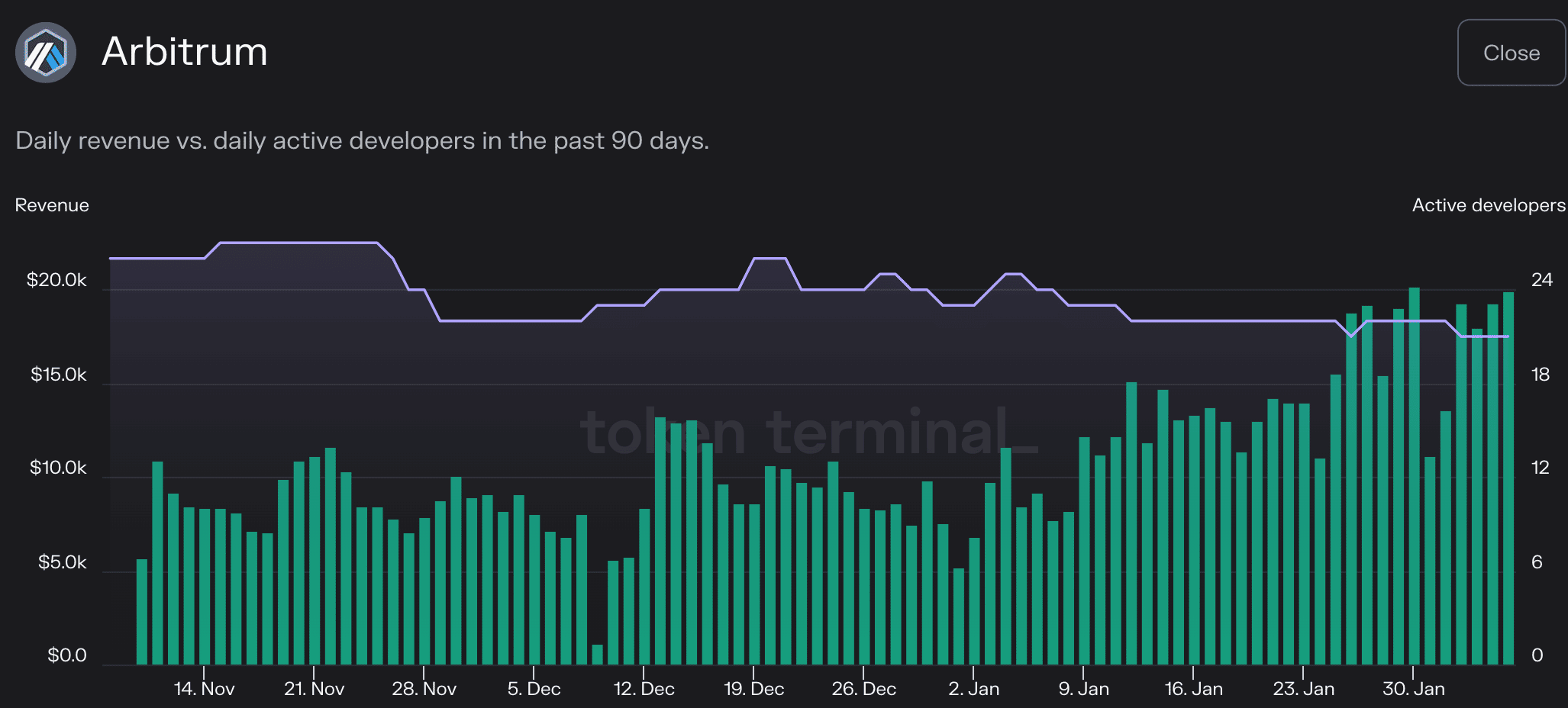

This growth led to an increase in Arbitrum’s revenue. As per Token Terminal, the overall revenue generated by the protocol was $19,900 at press time, after increasing by 61% over the last 30 days. However, while this is a positive sign of growth and popularity, there were also some concerning signs.

One such sign was the decline in active developers, which implied that the development of the protocol may slow down.

Source: token terminal

How much is 1,10,100 OP worth today?

The stablecoin angle

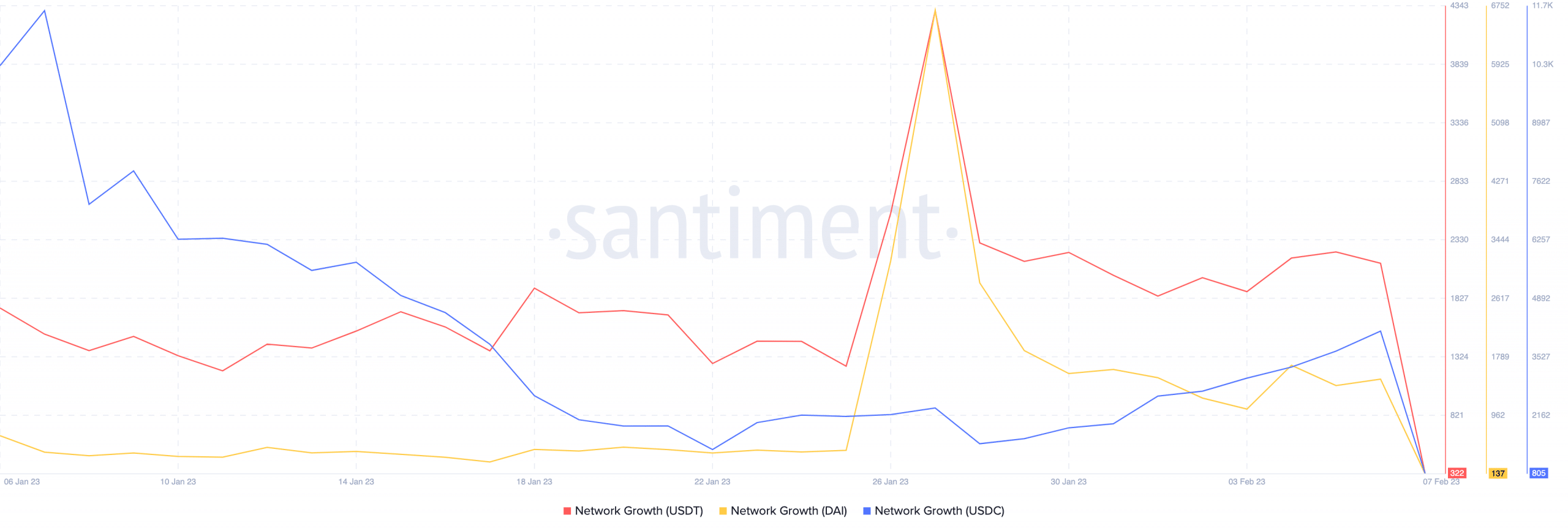

Additionally, the network growth of stablecoins on Arbitrum declined, as stablecoins like Tether [USDT], Dai [DAI], and USD Coin [USDC] all posted disquieting numbers, per data from Santiment. This could further herald an upcoming fall in the protocol’s overall activity.

Source: Santiment

Despite these warning signs, it was important to note that the Arbitrum protocol was still in its early stages of development. It was possible that the decline in active developers and stablecoin network growth is a temporary setback. However, it was also feasible that the decline was a sign of deeper issues that needed to be addressed.