NFT

Donald Trump’s Trump Card NFT collection has earned over $16 million in revenue on secondary NFT marketplace OpenSea, even as the collection’s floor price falls to about 0.5 ETH.

Secondary Sales 4x Primary Revenue of $4.4 Million

According to OpenSea, creator Billy Zanker pockets a 10% royalty from each NFT’s secondary sale, with one recent sale bagging Zanker $4,400. The collection’s floor price peaked at 1.2 ETH on Dec. 15, 2022, before falling to 0.179 ETH on Jan. 10, 2023. It has since risen to 0.59 ETH. The Polygon-based collection has accrued $4 million in primary sales revenue.

Source: Trump Digital Trading Cards

An NFT is an immutable digital ownership record of a physical or digital item on a blockchain network. In the case of digital items, the NFT is a certificate in the owner’s crypto wallet that says they own digital files at a specific URL.

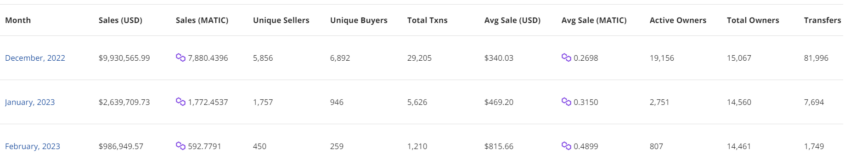

According to NFT market aggregator CryptoSlam, the Trump collection’s number of unique buyers has fallen from 6,892 in Dec. 2022 to 259 in Feb. 2023.

Trump Collection Unique Buyers | Source: CryptoSlam

The Donald Trump NFT project was the brainchild of entrepreneur Zanker, who pitched the idea to the former U.S. president in 2022. Trump launched the collection 30 days after he announced his 2024 presidential campaign with the slogan, “America needs a superhero.” Individual trading cards superimpose the former U.S. president’s likeness on illustrations of a cowboy, an astronaut, and a superhero.

Could Trump’s Real Estate Connections Drive NFT Utility?

While a complex macro backdrop has complicated crypto price predictions, with lower U.S. prices and a tight labor market polarizing recession predictions, past data suggests that Bitcoin’s price benefits from separatist politics exemplified during Trump’s previous stint as U.S. president.

Under Trump’s presidency from 2016-2020, Bitcoin’s price rallied 2,600% from $1,100 to just under $30,000. Trump said in 2019 that he was not a fan of Bitcoin, which can “facilitate unlawful behavior.”

However, his choice of the Polygon for his collection suggests that he sees a nascent technology’s business and political potential. His recognition of the business potential for NFTs could balance a heavy-handed Congressional response to the collapse of FTX. House Financial Services Committee Chair, Republican Patrick McHenry, recently announced a digital assets subcommittee to hold hearings around digital assets.

Given Trump’s history with real estate, we could also see a utility-driven NFT market in 2023 and beyond.

Unlike 2021, where hype turbocharged sales volumes, a recent report suggests that the 2023 NFT collector will be able to access unique communities or real-world experiences. With asset tokenization also becoming a growing business area for institutions, NFT-based real estate title deeds could drive adoption