Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- NEAR must overcome two obstacles to reach its pre-FTX levels.

- NEAR’s Funding Rate stagnated for the past week.

NEAR Protocol [NEAR] posted 118% gains after rising from $1.240 to $2.710. But the uptrend hasn’t been entirely smooth. NEAR experienced an extended price consolidation in mid-January but continued with its uptrend.

At press time, NEAR’s value was $2.534, way below the pre-FTX levels of $3.344. However, if next week’s FOMC announcement is dovish (a 0.25 rate hike), NEAR could attempt to reclaim its pre-FTX levels. But it must clear these obstacles.

Read NEAR Price Prediction 2023-24

Can NEAR Protocol bulls target the pre-FTX levels?

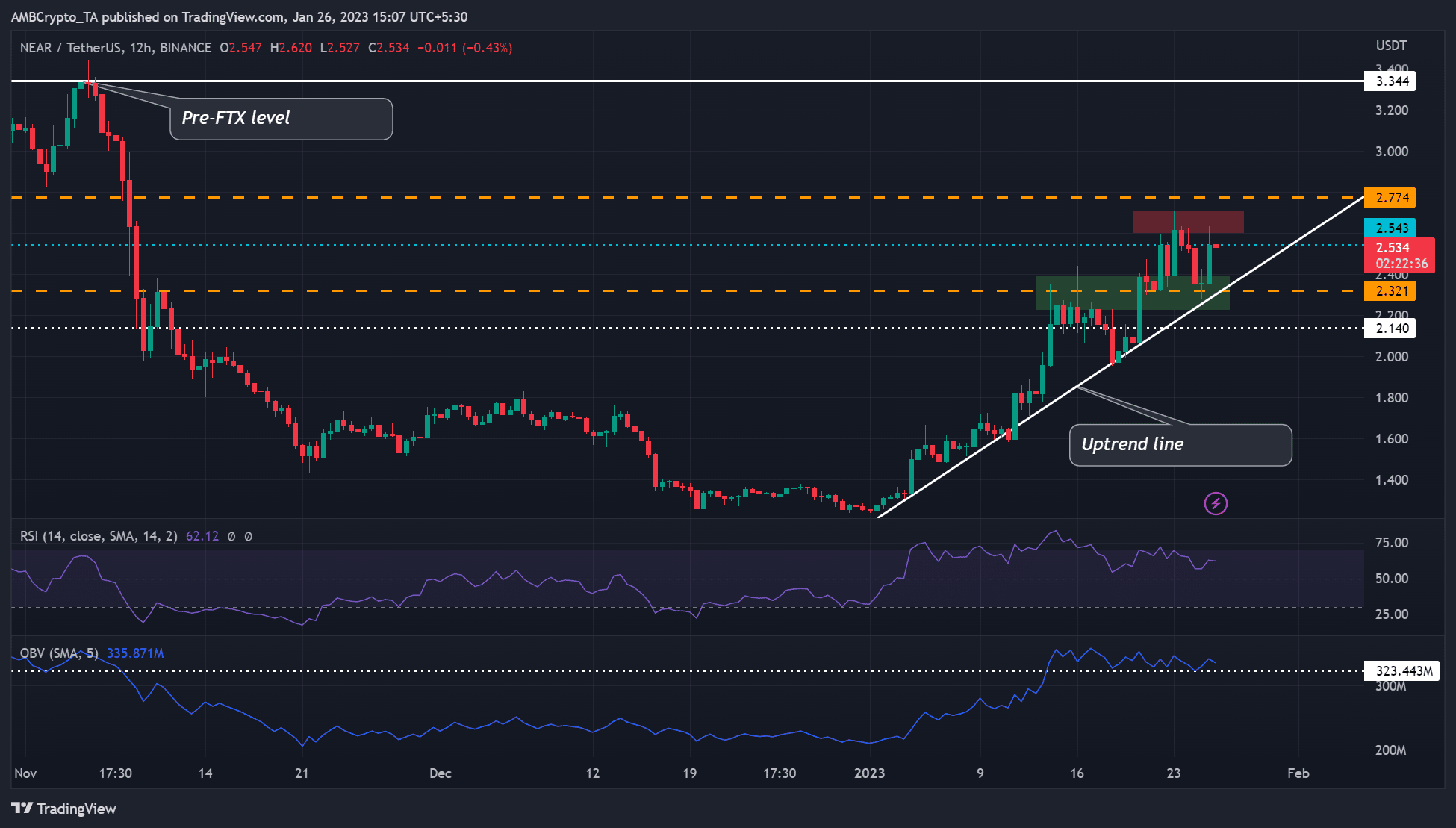

Source: NEAR/USDT on TradingView

On the 12-hour chart, NEAR’s Relative Strength Index (RSI) was 62, thus bullish. The RSI has been hovering around the overbought zone throughout January. Therefore, NEAR Protocol bulls could attempt to target the pre-FTX level of $3.344.

But NEAR bulls must clear the obstacles at the short-term selling pressure around $2.630 (red zone) and the $2.774 level. With the On Balance Volume (OBV) moving sideways since mid-January, NEAR could fluctuate between $2.321 and $2.630 in the few hours before attempting a breakout above the selling pressure zone in the next few days.

However, a break below the $2.321 and the uptrend line would invalidate the bullish forecast. The $2.140 support level could hold the drop.

Therefore, investors should track BTC performance, especially after next week’s FOMC announcement. Any upswing on BTC will tip NEAR bulls to smash the obstacles and target pre-FTX levels.

How much are 1,10,100 NEARs worth today?

Investor sentiment was positive despite a stagnant Funding Rate

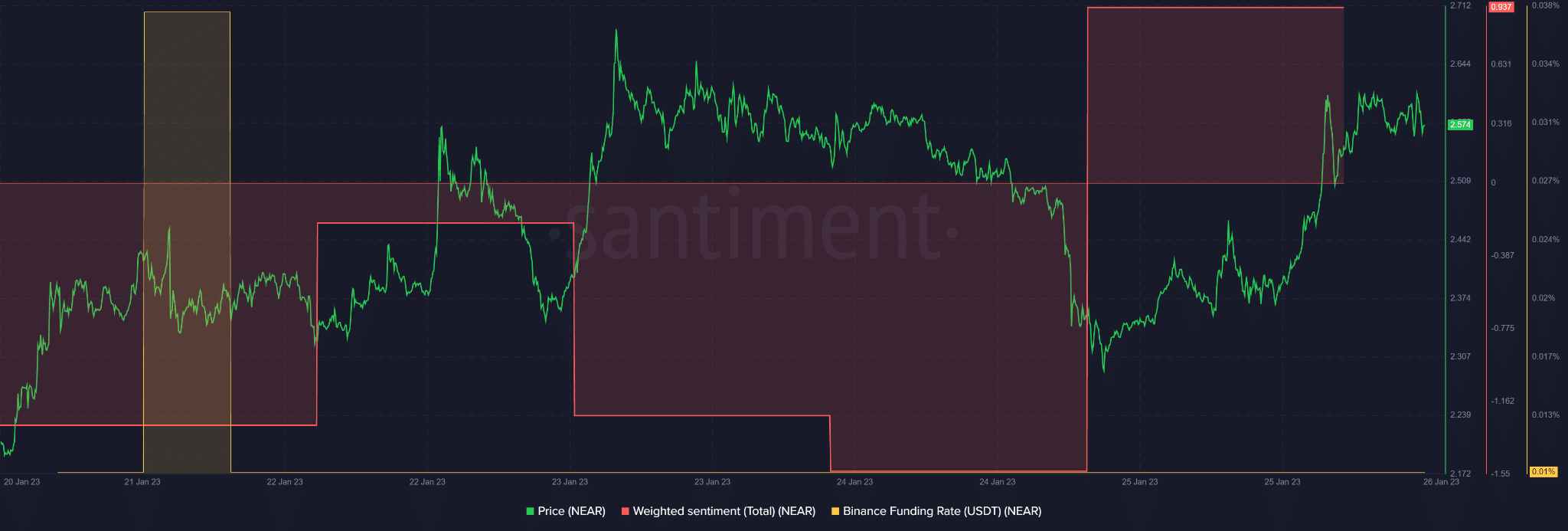

Source: Santiment

According to Santiment, the recent price surge saw NEAR’s weighted sentiment flip to the positive side. However, sentiment data was unavailable at press time.

On the other hand, NEAR’s Funding Rate in the Binance exchange has remained unchanged since 22 January. It rested on the neutral line, showing demand for NEAR in the derivative market stagnated in the past week.

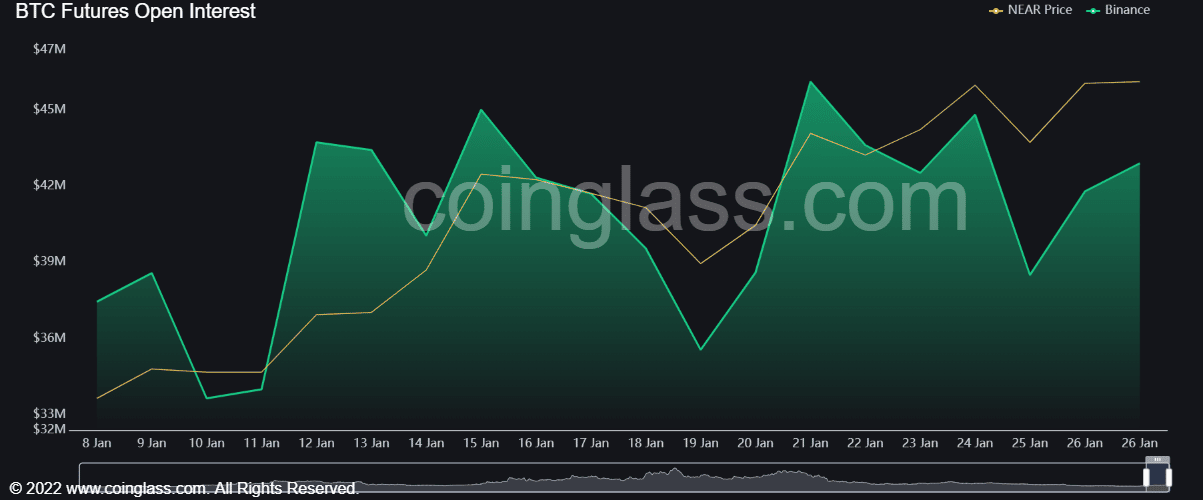

The above trend is also captured by NEAR’s open interest rate fluctuations despite rising prices. NEAR made higher lows from 19 January, but the OI recorded some lower lows in the same period, indicating a hidden divergence.

Although the above trend could have delayed a much stronger uptrend momentum, the OI increased proportionately, at the time of writing. If the trend continues and more money flows into NEAR’s futures market, its uptrend momentum could get a boost to bypass its obstacles.

Source: Coinglass