The Solana (SOL) price has seen a significant rally of over 79% in the past 30 days, despite the recent crisis on FTX and Alameda.

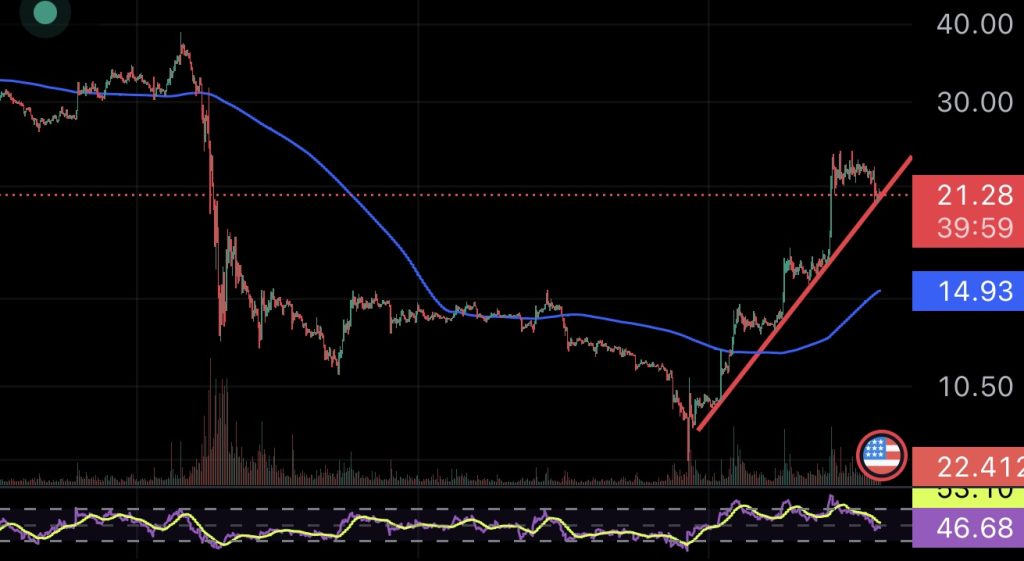

According to current crypto price oracles, SOL is currently trading around $21.33, down approximately 6.1%. Since hitting lows of $7.9 in late December, Solana’s price has been on an upward trend, perfectly respecting the support trend line. The rally in the past two weeks has reportedly been fueled by high liquidations and FOMO traders.

From a technical perspective, Solana’s price has a higher chance of making another outburst from current levels, with minimal resistance toward pre-FTX levels. This is supported by the increased daily traded volume, which currently stands at around $1,545,622,867, compared to $500 million in mid-December.

This increase in trading volume indicates higher demand and reciprocates to an increase in value.

However, the Solana rising narrative may be invalidated if the price drops further in strong bars like the rallying ones. In that case, Solana traders can expect to retest the area around $16, where the 200 4H MA has reached.

The Solana sell pressure is expected to widen as FTX officials liquidate over $1.2 billion worth of SOL to repay creditors. Additionally, the Solana ecosystem may record more sell pressure as FTX officials dump over $500 million worth of SPL tokens. According to aggregate data provided by Coinglass, over $8.7 million has been liquidated in the past 24 hours in the Solana ecosystem.

Nevertheless, DeFi developers on the Solana continue to build with over $257 million locked in the Sol network according to data provided by defillama.