- Bitcoin holders indulged in profit-taking as prices tanked.

- The number of short positions taken against BTC also increased.

Even though Bitcoin [BTC] witnessed a price correction earlier this month, many addresses holding the king coin remained positive.

However, the patience of short-term holders seemed to be running out of late, as BTC slipped past its $42,000 support level.

A rise in profit-taking

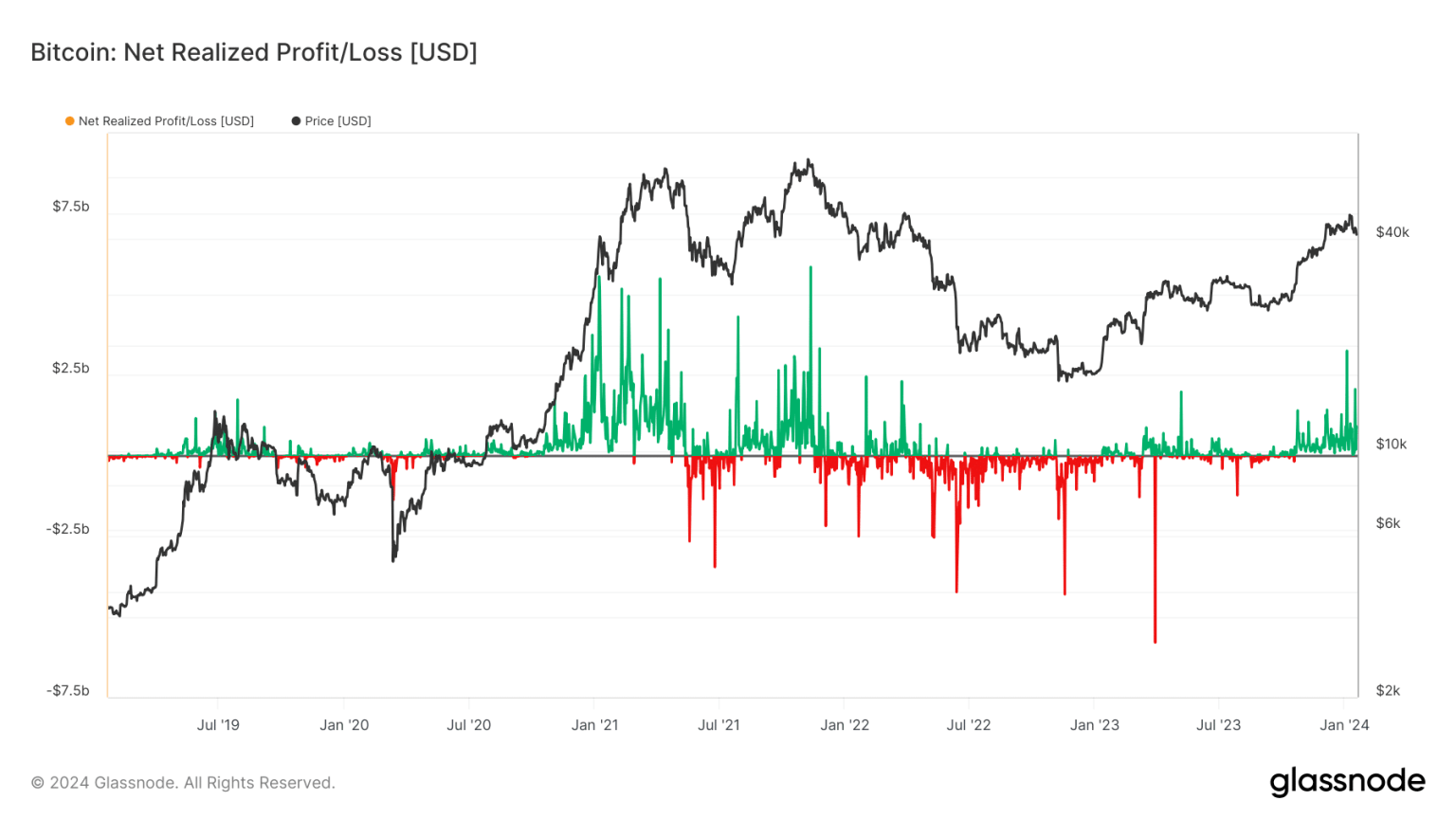

According to analyst James Van Straten, the aggregate profit or loss of all transacted coins indicated a prolonged phase of profit-taking in Bitcoin. This kind of trend has not been witnessed in the past five years.

The only comparable occurrence is the 2021 bull run, which lasted from September 2020 to February 2021, spanning 155 days.

Thus, there was growing anticipation that this trend of profit-taking in Bitcoin, which has persisted around the $40,000 mark, may be approaching its conclusion.

The prolonged streak can also raise concerns about increased selling pressure and a potential bearish sentiment in the market.

Source: Glassnode

As more investors choose to realize their profits in a market characterized by stagnation or declining prices, continuous selling may contribute to downward pressure on Bitcoin’s valuation.

This scenario could lead to a loss of confidence among investors, prompting a reduction in market participation and hindering potential price recovery.

A sustained period of profit-taking might also be indicative of market fatigue or skepticism about Bitcoin’s short-term prospects.

If this trend persists, it could deter new entrants from joining the market, and existing investors may opt to remain on the sidelines, waiting for clearer signals of a bullish reversal.

Will fortune favor the bears?

At press time, BTC was trading at $41,084.39, with its price having fallen by 1.27% in the last 24 hours. The volume at which it was trading had also fallen.

In the last few days, the number of short positions taken against BTC has increased from 48% to 51.52%.

Source: Santiment

Read Bitcoin’s [BTC] Price Prediction 2024-25

However, if the price of BTC does end up taking a positive turn, it could make things worse for these traders. Recent data showed that $1.21b of shorts will be liquidated if BTC manages to push past the $44,000 mark.

A liquidation of this size could trigger a short squeeze which could drive the price of BTC even further up, which would hurt the bears further.