- Miner fees accounted for 4.38% of the block subsidies on average in 2023.

- The hashrate dramatically climbed in September after staying muted during summer.

Bitcoin [BTC] mining remains one of the main foundations on which the edifice of the Bitcoin blockchain stands. Responsible for bringing new coins into circulation and validating transactions on the network, the process has now evolved into a full-fledged industry as of this writing.

Analysts and investors keep a close eye on trends associated with the ecosystem, to speculate on the next moves of not just the native Bitcoin but the broader crypto market.

Read BTC’s Price Prediction 2023-24

Network fees decline QoQ

Hashrate Index recently released its Q3 Bitcoin mining report, providing an overview of changes that happened in the last three months. The report also stated some of the key performance indicators.

The share of transaction fees of all block rewards in Q3 2023 was 2.7%. This represented a sharp decline from 8.17% seen in the last quarter.

Despite the quarter-over-quarter dip (QoQ), 2023 has been more kind to miners. Thus far, miner fees accounted for 4.38% of the block subsidies on average. In contrast, the average during the crypto winter of 2022 was below 1.64%.

Source: Hashrate Index

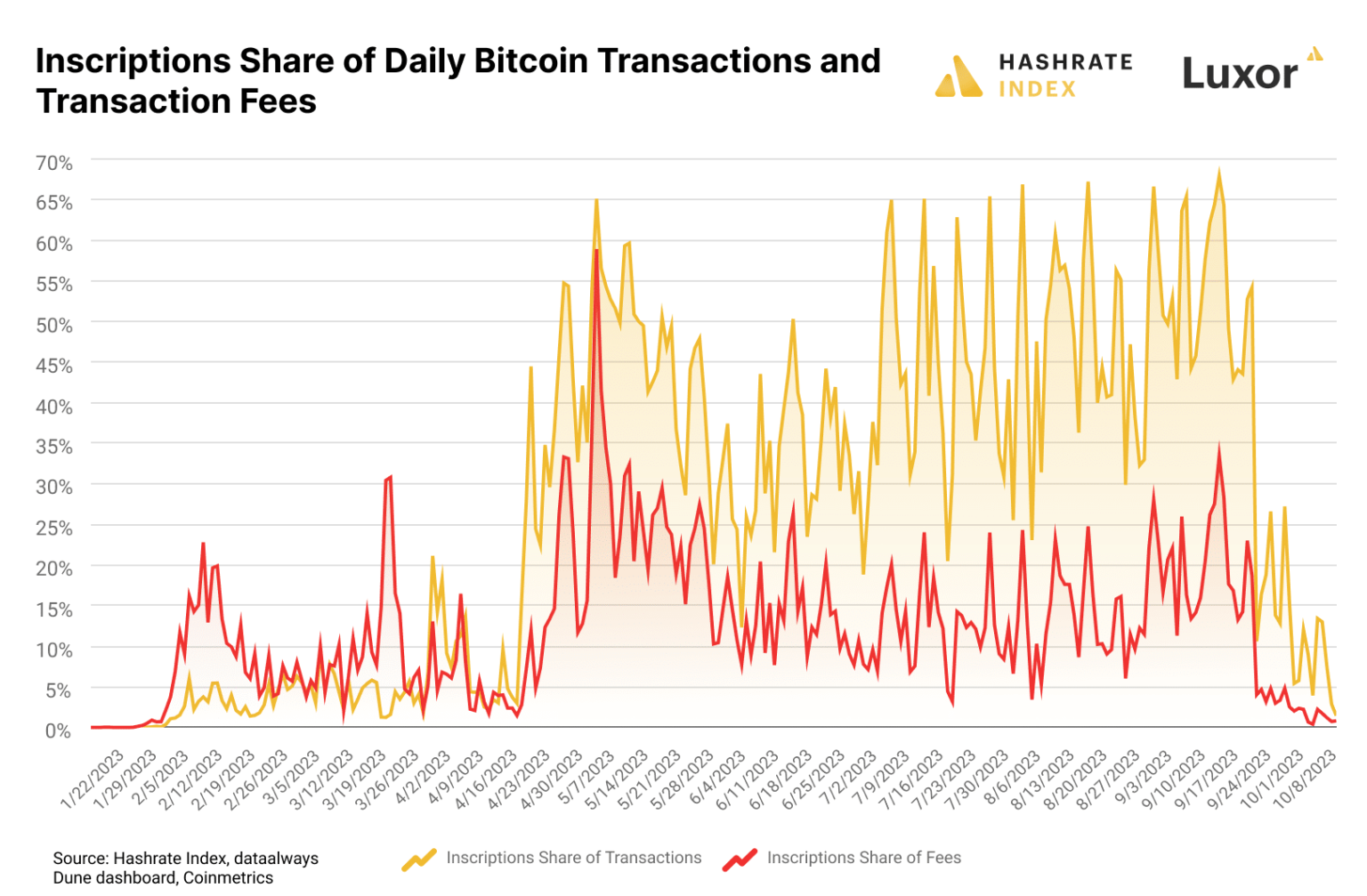

As indicated above, the drop in fees coincided with the steady drop in Ordinals-related transactions. Earnings from last quarter were boosted by the explosive spike of such transactions in early May. However, there has been a marked decline since then. In fact, Ordinals’s share of fees plunged to the lowest levels since Q1 in October.

Fees paid to miners for validating transactions remain one of the barometers of the mining sector. Miners use block rewards to offset the costs associated with mining equipment and electricity. While one component of it is fixed, big fluctuations in the transaction fee part could adversely affect miners’ economics and turn them away from the sector.

Hash Rate jumps after summer shutdown

The hashrate is a function of growing network traffic. A growing hashrate implies that miners have to invest in more computational power to validate blocks.

Reportedly, 2023 saw a repeat of the earlier patterns seen in the hashrate trajectory. For the summer months of June, July, and August, negative growth was observed. However, since September, the hashrate started to climb and maintained the uptrend till May.

Source: Hashrate Index

The report linked the drop in summer months to voluntary curtailment by U.S.-based mining companies.

The country’s Bitcoin mining hub, Texas, generally faces extreme heat during these months. This results in peak demand for electricity. As part of an agreement with the state’s electric grid operator, mining companies power down their rigs during this time so as not to overstress the grid. In return, mining companies receive energy credits from ERCOT which can go into millions of dollars.

Hash price trends lower

Hashprice is a well-known mining metric that measures miner revenue on a per terahash basis. Put simply, it gauges miners’ profitability. It is dependent on two factors — Bitcoin’s market value and the network hash rate. While it is positively correlated to Bitcoin’s price, it responds negatively to changes in hash rate.

According to the report, Bitcoin’s average price in Q3 was $28,100 as compared to the 2023 average of $26,350 thus far. The noticeable increase in market value countered the negative effect of hashrate increase on hashprice.

Source: Hashrate Index

Having said that, hashprice trended downwards from August onwards. The average for September plunged to $61.71/PetaHashes/day, reminiscent of the lows seen during the peak of the crypto winter in late 2022.

Is your portfolio green? Check out the Bitcoin Profit Calculator

ASIC prices hit lows

It is common knowledge that specialized hardware, like Application-Specific Integrated Circuits (ASICs), are used to mine Bitcoins these days. Miners invest in more sophisticated ASIC devices that suck less energy per TeraHash of computing power.

However, due to the decline in hashprice, many mining rigs went into losses, in turn pulling the price of machines down in Q3. Prices for machines in the lower efficiency category plunged even further as miners rushed to cash in.

Source: Hashrate Index

On a bright note, Q3 witnessed the launch of the Antminer S21 by Bitcoin ASIC manufacturer Bitmain. The new model is the first-ever Bitcoin mining ASIC to achieve an efficiency under 20 J/TH.