- Over 150,000 ApeCoin was recently accumulated by a wallet.

- The APE market sentiment, however, remains negative.

Over the past few weeks, the story of ApeCoin appears to be revolving around two main activities: dumping and accumulation. According to recent on-chain tracking, there has been a noticeable increase in accumulation during this time, alongside instances of selling. How have these actions influenced the overall sentiment and trajectory of the token?

Read ApeCoin (APE) Price Prediction 2023-24

ApeCoin sees large accumulation

A recent update from Look on-chain highlighted that a wallet associated with Machi Big Brother, a dedicated supporter of the Bored Ape Yacht Club (BAYC) ecosystem, has made a new purchase of ApeCoin. The data from the on-chain tracker revealed that this account acquired more than 154,000 APE tokens, using 135 ETH, with a total value of $222,000.

Furthermore, this fresh accumulation adds to the previous holdings accumulated earlier in the month, resulting in a total APE accumulation of over 3 million for August. These acquisitions were made at an average price of $1.73 per token.

Additionally, this recent action sharply contrasted with the activities observed in the previous week. During that time, a wallet was noted to have sold off over 180,000 APE tokens, incurring a loss exceeding $1.5 million. While these sales could be attributed to market fatigue, the recent purchase presented a bullish move and reflected a positive sentiment.

ApeCoin volume and active addresses flash divergent signals

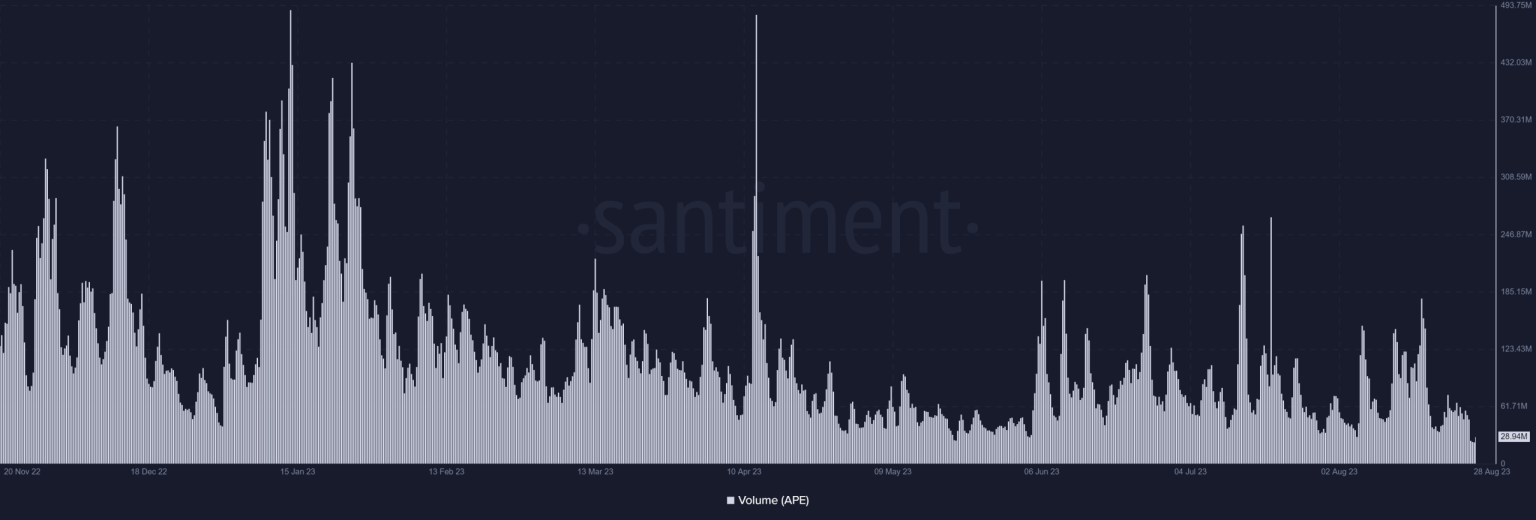

Santiment’s volume metric indicated that the recent sell-off and accumulation activities involving ApeCoin have not had a noticeable impact on its trading volume. The volume trend remained within normal levels, displaying no sudden spikes or significant downward shifts.

As of this writing, the trade volume was approximately 30 million.

Source: Santiment

However, a contrasting situation was evident in the active addresses metric. The seven-day active addresses showed that APE experienced a surge, surpassing 20,000 around 17 August. This elevated level was sustained until roughly 24 August, after which it began to decline.

As of this writing, the count of active addresses was about 6,500.

Source: Santiment

This reduction in active addresses corresponded to a decline in positive sentiments surrounding ApeCoin.

APE funding rate stays negative

Despite the recent accumulation, the market sentiment for ApeCoin has not shifted into a positive state. This conclusion could be drawn from the funding rate of ApeCoin on Coinglass, which, as of this writing, was at a negative value of -0.008. This negative rate suggested that traders were anticipating a decrease in the token price.

How much are 1,10,100 APEs worth today

Observing the daily timeframe chart of APE, it was evident that the token was undergoing a decline, with a loss exceeding 2% as of this writing. The trading price was approximately $1.3.

Source: TradingView