- Exchange outflow passed inflows, impacting stability in ETH price.

- Activity on the Ethereum mainnet fell.

In an interesting turn of events, Ethereum [ETH] has attracted whales’ interest of late. However, it was uncertain if the activities of whales would favor the ETH price action as it looked more or less gloomy in recent times.

How much are 1,10,100 ETHs worth today?

Not yet time to dump ETH

According to Lookonchain, a particular whale took out 13,301 ETH from OKX after the market experienced a downturn. Although exchange outflow depicts a potential move to keep the asset for a long time, it was important to also note that the same was involved in a similar situation.

On 21 August, the whale in question withdrew $30 million worth of ETH from the same exchange. At the same time, he deposited 57 million USDT and 10 million USDC on Binance.

Sometimes, an action like this suggests that the whale could be getting set to convert the stablecoins into other assets that may increase in value going forward. But what else was happening with ETH?

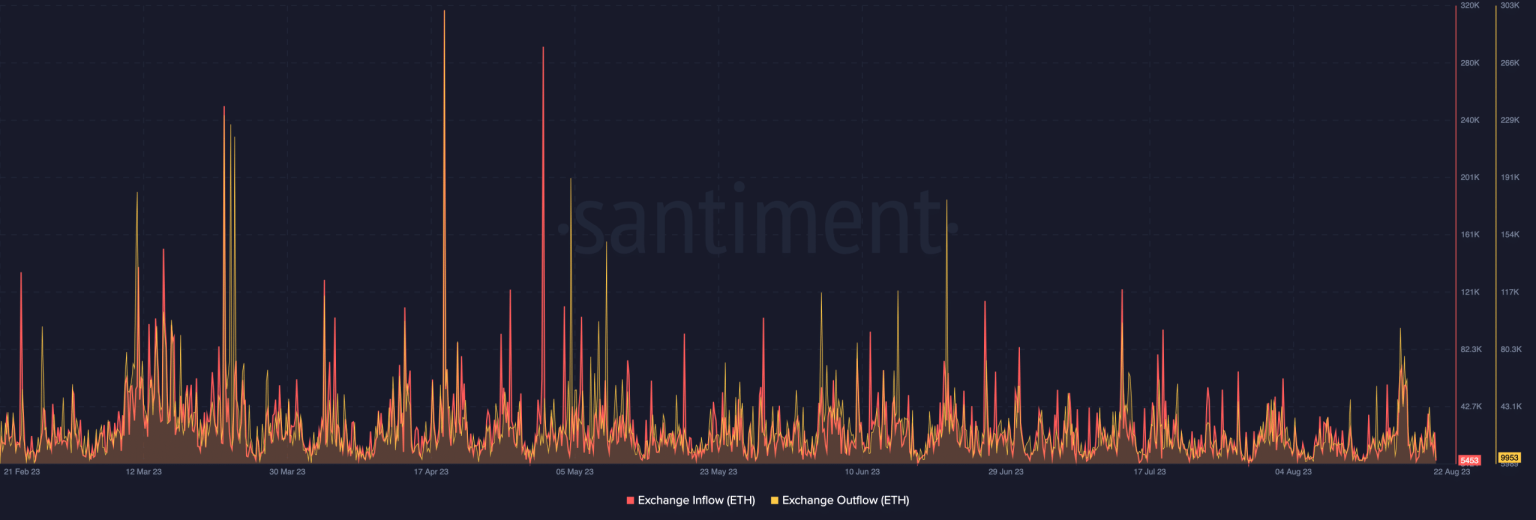

According to Santiment, ETH’s exchange inflow was 5453. The exchange inflow refers to the number of non-exchange-to-exchange transfers. And when it increases, it means that a sell-off could be imminent.

When the exchange inflow decreases, it implies that the asset price could stabilize or rather increase. On the other hand, ETH’s exchange outflow was 9953. Unlike the inflow, the exchange outflow refers to transactions made from exchange addresses to non-exchange addresses.

Source: Santiment

Therefore, the exchange outflow superseding the inflow suggests that ETH’s price may not decrease significantly in the short term. Interestingly, this came after co-founder Vitalik Buterin sent $1 million worth of ETH to Coinbase.

Lesser activity on the mainnet

Previously, Buterin’s action has caused fear in the market that he was willing to sell the asset. But ETH’s price action over the last 24 hours showed that it wasn’t the case. According to CoinMarketCap, ETH exchanged hands at $1,664 at press time.

With respect to active addresses, on-chain data showed that it had decreased to 374,000. Active addresses show the number of distinct addresses participating in sending and receiving a cryptocurrency within a specific timeframe.

Realistic or not, here’s ETH’s market cap in USDT terms

As a reliable indicator of growing utility, the drop in active addresses suggests that ETH has not been increasingly put to use. And this could be linked to the rising adoption of L2s rather than the Ethereum Mainnet.

Regardless, the ratio of the daily on-chain volume in profit and loss dropped to 0.352. This implies that more ETH holders have plunged into the red than the green.

Source: Santiment