- Optimism’s new Superchain may impact the protocol’s growth positively.

- Polygon and Arbitrum outpaced Optimism in several areas. However, the price of OP continued to grow.

Arbitrum’s recent success and Polygon’s rapid growth have significantly outpaced the Optimism[OP] protocol in the Layer 2 race. Nonetheless, Optimism’s recent developments hold the potential to bolster the protocol’s position and equip it with a competitive edge against other Layer 2 solutions.

Is your portfolio green? Check out the Optimism Profit Calculator

New developments

The Optimism protocol will soon be introducing Superchain, which comprises a unified network of chains built using the OP Stack. These OP chains are interconnected, sharing a security and communication layer, and employ the same open-source standardized technology stack.

As per Messari’s data, Superchain aims to enable atomic and trust-minimized cross-chain rollup communications, thereby reducing the attack surface and eliminating chain reorganizations. Moreover, it promises lower costs by eliminating cross-chain consensus verification.

The low costs and improved security of may drive users to the Optimism protocol going forward. At press time, OP lagged behind its competitors in terms of daily activity.

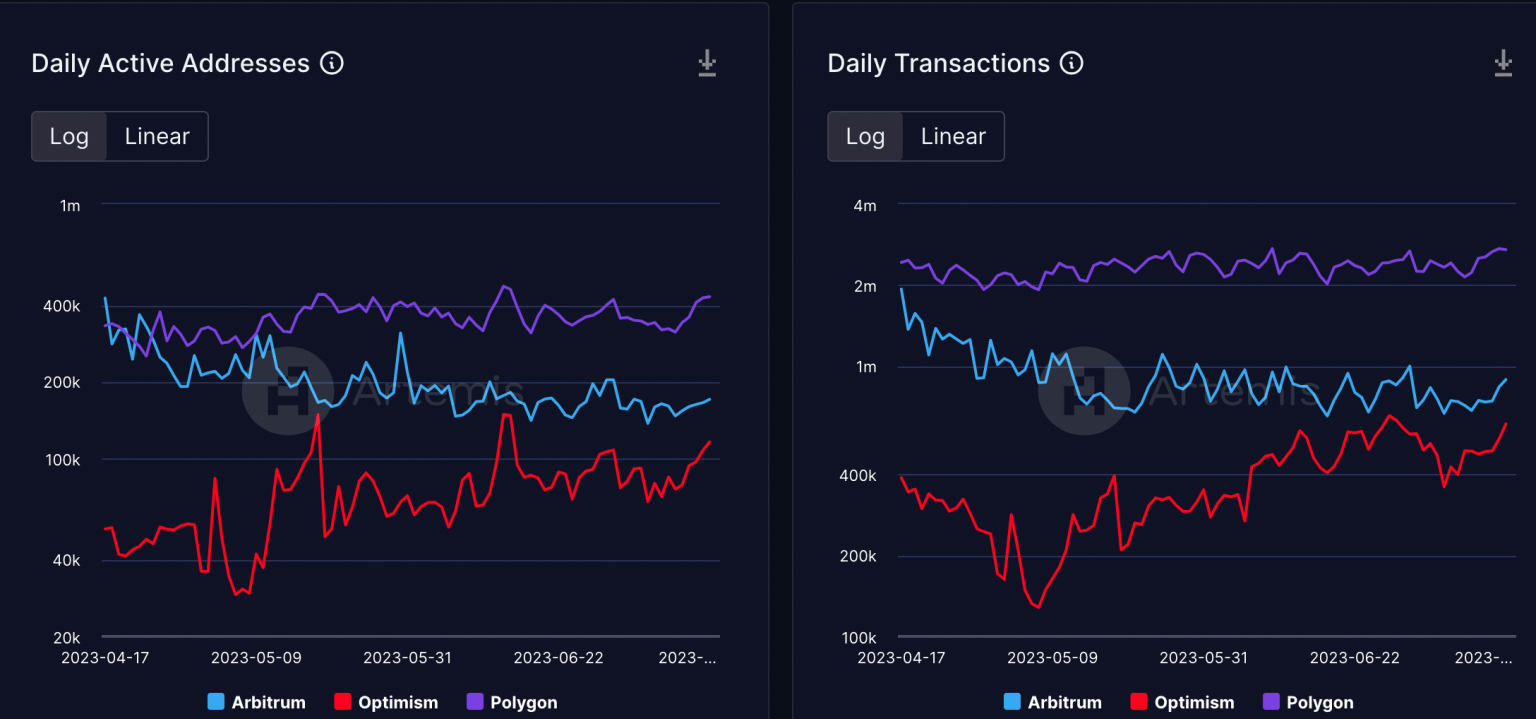

Polygon ranked number one in this regard, with 432,000 active addresses on the protocol. Arbitrum ranked second, with 170,290 daily active addresses on the protocol. Optimism came in last with 116,20 active addresses on the network.

The same pattern was observed in terms of the number of transactions occurring as well, with OP trailing behind the rest of the L2 solutions.

Source: Artemis

Optimism ranked last in the DeFi sector as well. The TVL collected on the network was significantly lower than the other two protocols. This could be attributed to the declining DEX volumes on the Optimism network suggesting that the protocol may have to work on improving the state of DeFi on its protocol.

Source: Artemis

Only time will tell whether new developments in the Optimism protocol pertaining to the Superchain can help improve the state of affairs on the network going forward.

Realistic or not, here’s Optimism’s market cap in BTC’s terms

Looking at the price

The OP token, however, was doing much better. The price grew materially over the last few weeks, and at press time the OP token was trading at $1.452.

The network growth for OP surged significantly over the last week, implying that new addresses were showing interest in the token. Additionally, the velocity of the token improved as well, indicating that the frequency with which the OP token was being traded had grown.

Source: Santiment