- Lido observed growth as the LSD sector began to expand despite waning interest.

- TVL and activity rose as LDO’s prices continued to surge.

The DeFi sector has been in limbo since the very controversial SEC lawsuit was filed earlier in June. However, the LSD (Liquid Staking Derivative) space did manage to see massive growth during this period.

Realistic or not, here’s LDO’s market cap in BTC’s terms

Lido plays a part in LSD’s dominance

According to Messari’s data, the LSD sector has started to dominate the crypto markets significantly.

SEC lawsuits against @BinanceUS and @Coinbase cause #DeFi TVL to plummet below $60B. But amidst the chaos, liquid staking protocols are thriving becoming DeFi’s dominating force by TVL. pic.twitter.com/RL9Qy8cwLE

— Messari (@MessariCrypto) July 3, 2023

One of the largest contributors to the expansion of the LSD sector was Lido[LDO], which has been performing quite well over the last few months.

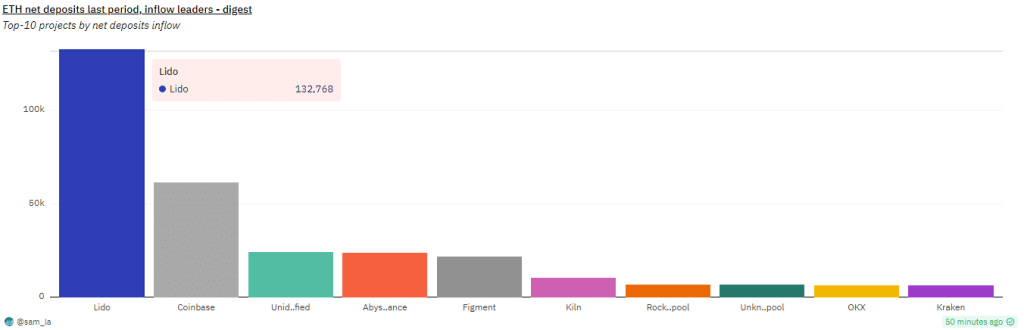

The total value locked (TVL) in Lido has reached a new peak of $14.75 billion, showcasing a growth of 3.84% over the past seven days. This increase was attributed to the combined effect of token price growth and an influx of new deposits. Furthermore, Lido took the lead in net new deposits on the Ethereum Beacon Chain, with a total of 132,800 ETH deposited within the past week.

Source: Dune Analytics

However, despite this growth, there was a decline observed in Lido’s APR (Annual Percentage Return) over the last few days. If the trend of the declining APR continues, users may shy away from using Lido for staking and start to look for alternatives.

Source: Dune Analytics

In the L2 (Layer2) sector, the quantity of wstETH (wrapped Staked ETH) on various platforms witnessed a surge of 2.50%, totaling 111,168 wstETH. On Arbitrum, there were 64,293 wstETH present, showing a growth of 2.06% in the past seven days. On the other hand, Optimism recorded 42,121 wstETH, reflecting a rise of 0.53% in the past week.

However, Polygon had 4,755 wstETH, with a slight decline of 0.42% in the past week.

The LDO token tags along for the ride

The LDO token paralleled the protocol’s growth as its price surged materially over the last few days. With the spike in price, the MVRV ratio of the LDO token also grew. This implied that many addresses holding LDO turned profitable in the last few days.

Is your portfolio green? Check out the Lido Profit Calculator

The highly profitable holders of LDO could be expected to sell their holdings in the future. Moreover, the network growth of LDO also fell during this period implying that new addresses were starting to lose interest in LDO.

These factors could act as a hurdle in LDO’s growth in the future.

Source: Santiment