- The inverse relationship meant that when the price of BTC would rally, the bullion market would decline and vice versa.

- BTC has also shown increased decoupling from tech stocks.

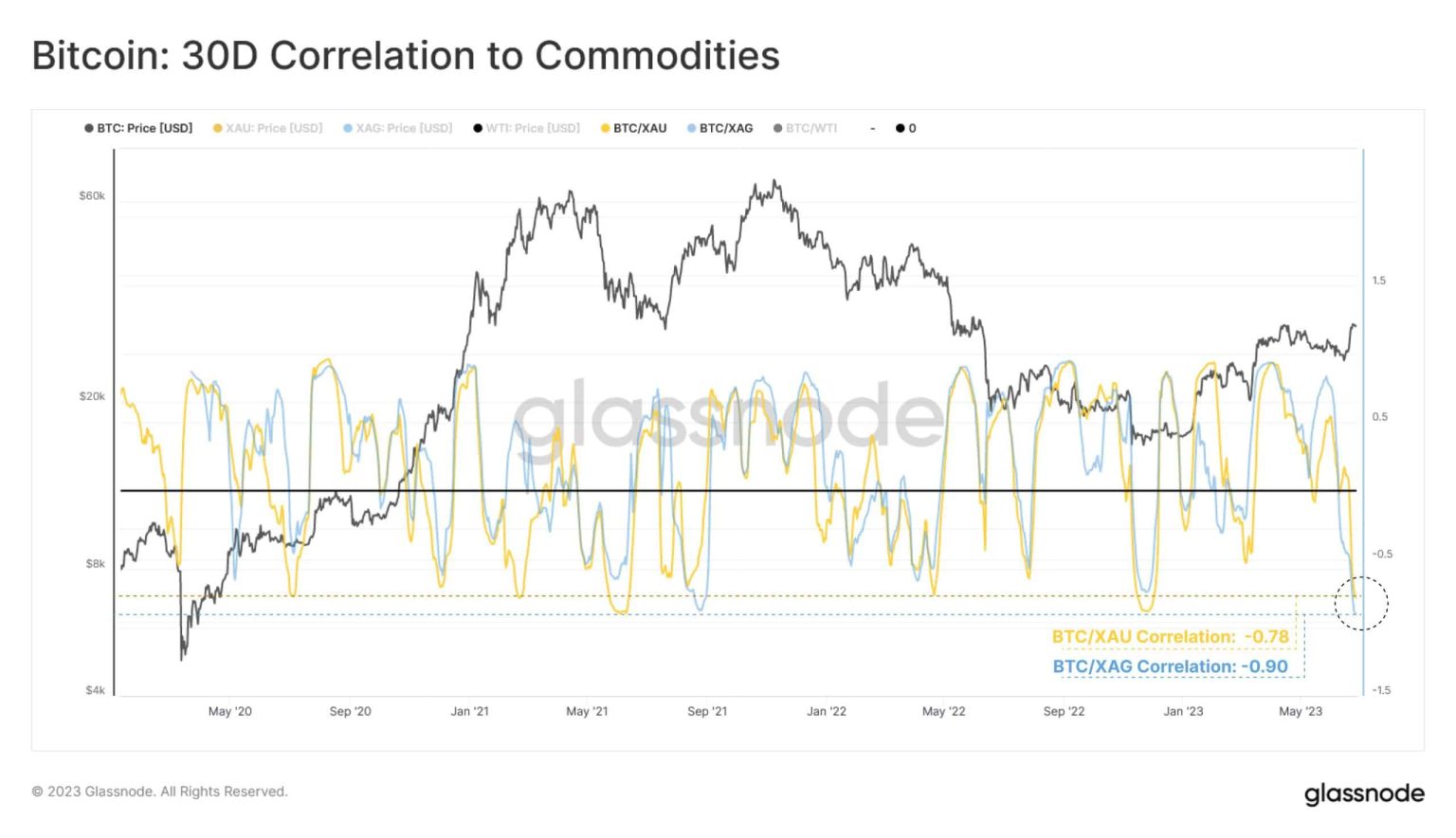

The world’s largest crypto asset by market cap, Bitcoin [BTC], has shown increased decoupling from the major asset classes of the TradFi realm over the last few months. As per a tweet by on-chain analytics firm Glassnode dated 27 June, its 30-day correlation with precious metals like Gold [XAU] and Silver [XAG] tumbled to -0.78 and -0.9 respectively.

Source: Glassnode

How much are 1,10,100 BTCs worth today?

The inverse relationship meant that when the price of BTC would rally, the bullion market would decline and vice versa.

BTC grows while bullion market plunges

On analyzing the recent price trajectories of the three assets in question, it was evident that the digital asset and the real-world assets were moving on separate wavelengths.

While “digital gold” Bitcoin, riding high on institutional interest in cryptos, has pumped 22% over the last two weeks, its real-world counterpart witnessed a decline of 2.3% in the same time period. Silver, on the other hand, experienced a bigger drop of over 5%.

A fascinating aspect of the price trend was how BTC rose in value alongside Gold and Silver after the U.S. banking crisis in March, exhibiting a strong correlation. However, the latest turn of events demonstrated a notable divergence.

Source: Glasssnode

Bitcoin as an independent asset class

To put things into perspective, this meant that the market could start to prefer BTC over precious metals as a hedge against inflation. This could strengthen its long-supported narrative of being a safe-haven asset.

And while detractors could argue that given historical tendencies, BTC would become more similar to stocks as a result of its decoupling from Gold, the reality was quite different.

According to a recent report by crypto market data provider Kaiko, BTC’s correlation with Nasdaq 100 index plummeted to its lowest level in three years in June, implying a significant detachment from traditional risk assets.

Source: Kaiko

Are your BTC holdings flashing green? Check the Profit Calculator

It was evidently clear that BTC was being seen as an independent asset class with its own fundamentals rather than getting impacted by headwinds in the real world.

However, the challenge would lie in maintaining this status in the long term given the growing mainstream adoption of cryptocurrencies in general and BTC in particular.