- Ethereum developers have finalized the scope for the Cancun upgrade.

- The price showed signs of recovery, but interest in Ethereum NFTs fell.

Despite the volatility in the cryptocurrency market, Ethereum [ETH] has consistently demonstrated progress. Its latest milestone comes with the finalization of the scope for the upcoming Cancun upgrade, which promises to bring significant enhancements to Ethereum.

Is your portfolio green? Check out the Ethereum Profit Calculator

Changes made as Cancun inches closer

During the recent developers call, the Ethereum development team reached an agreement on the specifics of the Cancun upgrade, a major update that will introduce proto-dank sharding to the Ethereum network.

This new feature will increase data availability for rollups, improving the network’s scalability and efficiency.

One important proposal discussed during the call was a code change aimed at preventing slashed validators from being selected as block proposers. By implementing this mechanism, the protocol ensures that these validators, who have been penalized for misconduct, are excluded from the consensus process.

This safeguard reduces the risk of disruptions and malicious activity within the network, further strengthening Ethereum’s security and reliability.

Validator concerns get validated

Another significant change proposed during the discussion revolves around the effective balance of Ethereum validators. Presently, validators’ effective balance is capped at 32 ETH, meaning they do not earn interest on staked balances beyond this threshold.

However, the Ethereum Foundation has put forth a proposal to remove the 32 ETH cap on effective balances, aiming to make staking more attractive and reduce barriers for validators.

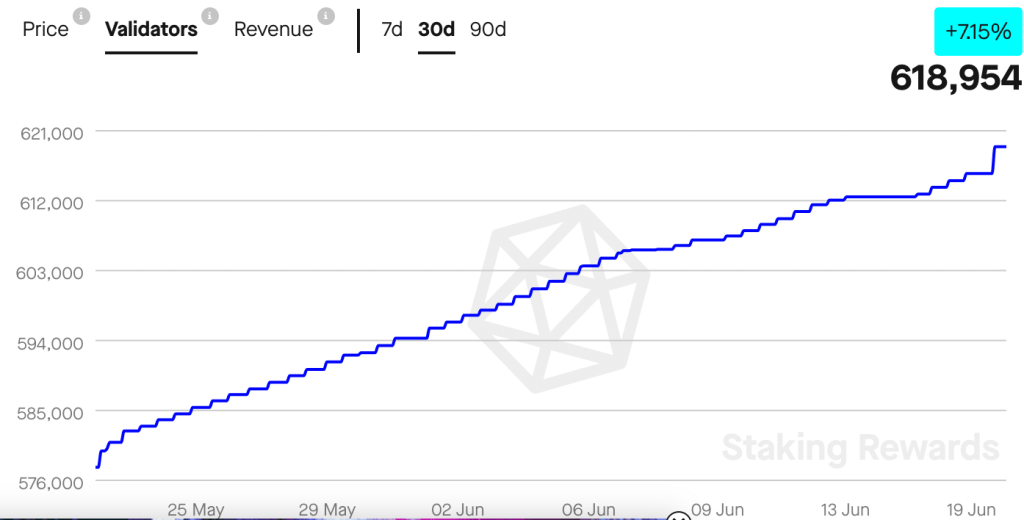

These updates hold the potential to attract more validators to the Ethereum network. At press time, there were 618,954 validators actively participating, showing a 7.15% increase over the last 30 days.

Source: Staking Rewards

Realistic or not, here’s ETH’s market cap in BTC’s terms

State of ETH

At the time of writing, ETH was trading at $1,712, a rise from its previous low of $1,641.33. The consistent gas usage on the Ethereum network indicated ongoing activity and utilization, demonstrating the robustness of the ecosystem.

Source: Santiment

Nevertheless, Ethereum faced a potential challenge with the declining interest in non-fungible tokens (NFTs). Recent data from Messari indicated a significant decrease in NFT transactions on the Ethereum network.

Over the past month, @Ethereum has witnessed a significant decline in #NFT transactions, with a staggering drop of 80%.

This decline in activity highlights a notable shift in the NFT landscape, as users and investors explore alternative platforms and ecosystems. pic.twitter.com/SrUqvNhiUs

— Messari (@MessariCrypto) June 18, 2023