- Solana and Cardano get listed as tradable digital assets in Indonesia.

- SOL and ADA experienced price recoveries despite lingering bearish trends.

Solana [SOL] and Cardano [ADA] have found themselves entangled in the scrutiny of the US Securities and Exchange Commission. Yet, a glimmer of hope emerged from the recent developments in Asia, potentially offering respite to the assets and their holders. While the regulatory situation in the US remains uncertain and unclear, the news from Asia brings a fresh breeze of optimism.

Is your portfolio green? Check out the Solana Profit Calculator

Solana and Cardano find respite in Asia

In a notable turn of events, Solana and Cardano were classified as securities by the US Securities and Exchange Commission. This caused a significant blow to their prices and left their future uncertain.

However, a recent development from Asia, particularly Indonesia, has shed a ray of hope on the situation. A report by WuBlockchain revealed that the Indonesian government designated SOL and ADA as tradable assets. This signaled a contrasting perspective compared to the US.

This announcement from Indonesia brings about several positive implications for Solana and Cardano. Firstly, it would grant crypto traders within the country the freedom to trade these assets without the same level of scrutiny faced in the US.

Secondly, it provided a degree of regulatory clarity that was previously lacking, potentially encouraging increased trading activities. Remarkably, the Indonesian government has listed 501 cryptocurrencies, encompassing the majority of assets classified as securities by the US SEC.

Furthermore, the news from Indonesia offered renewed optimism for SOL and ADA and their respective holders. It presented a favorable trading environment and indicated a divergence of regulatory perspectives between different regions. This could thereby impact the market dynamics of these cryptocurrencies.

Immediate reaction?

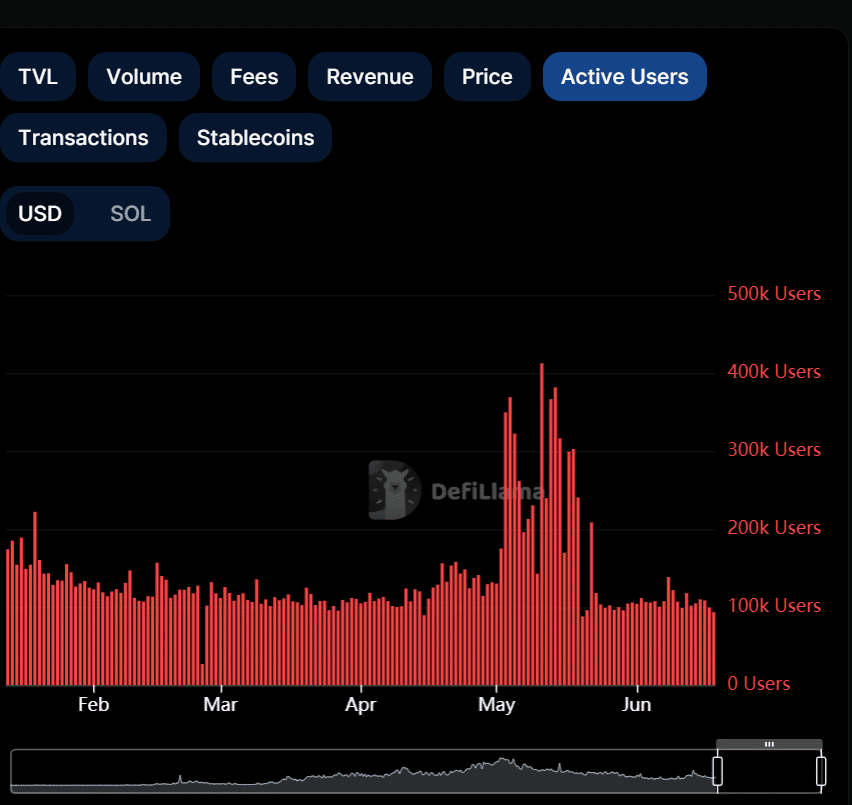

Analyzing the active user’s metric on DefiLlama showed interesting trends in the user activity for Solana and Cardano. Starting with Solana, there was a notable surge in active users during May, but subsequently, the numbers experienced a decline.

On average, the network maintained approximately 100,000 active users. Despite the news of the SEC’s involvement, which usually dampens user engagement, the interaction with the Solana network remained relatively robust. There were around 93,000 active users as of this writing.

Source: DefiLlama

Shifting the focus to Cardano, the active address metric on DefiLlama revealed a more fluctuating pattern. The number of active addresses saw peaks and valleys over time. However, there has been a decline in active addresses recently, with approximately 48,000 active addresses recorded as of this writing.

Source: DefiLlama

Solana and Cardano price trend

Examining Solana’s daily timeframe chart, a notable downtrend could be observed. However, there was currently a recovery underway, characterized by consecutive uptrends.

As of this writing, SOL was trading around $15.7, experiencing a slight increase in value. Despite this positive momentum, the asset’s overall trend remained bearish, as indicated by its Relative Strength Index (RSI).

Source: TradingView

How much are 1,10,100 ADAs worth today

Similarly, a significant decline in its price could be observed on the daily timeframe chart of Cardano. However, like Solana, ADA was also currently in the process of a price recovery.

As of this writing, ADA was trading around $0.26, reflecting a slight increase in value. Despite the recent rise in price, the RSI of ADA indicated that it was still situated in the oversold zone.

Source: TradingView