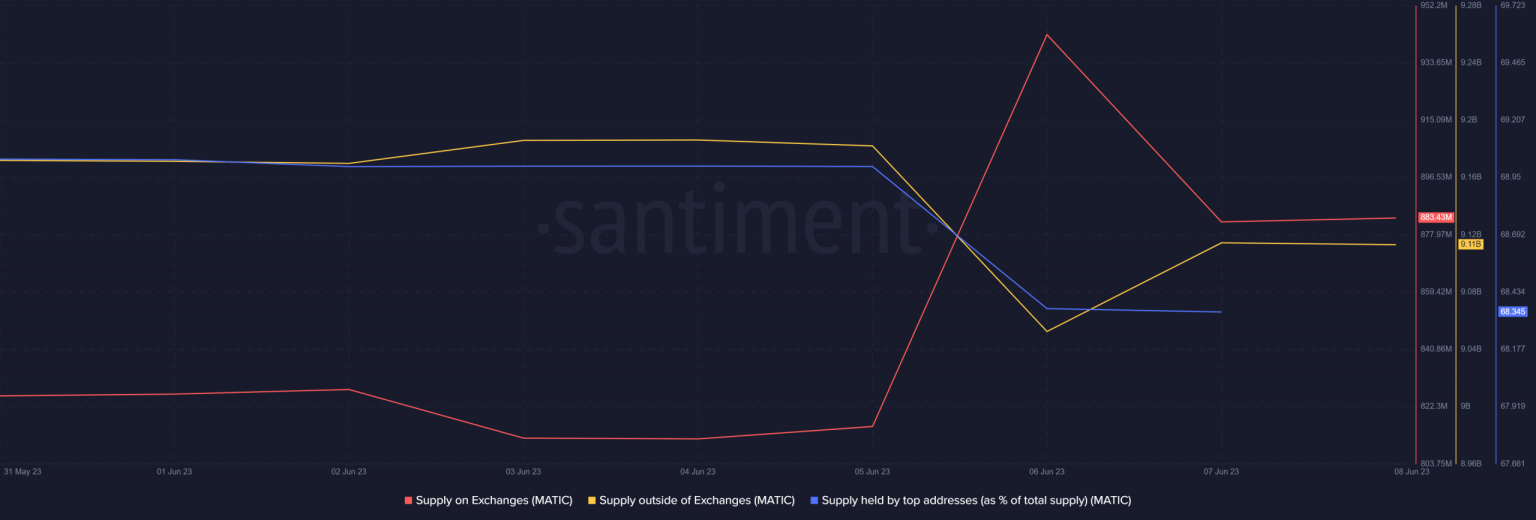

- Polygon’s supply on exchanges increased while its supply outside of exchanges declined.

- Though the RSI was oversold, the rest of the indicators supported the bears.

Several cryptocurrencies rebounded on 7 June after a price correction, but Polygon’s [MATIC] actions were different. According to CoinMarketCap, MATIC’s price declined by more than 14% and 5% in the last week and the past 24 hours, respectively.

Read Polygon’s [MATIC] Price Prediction 202324

Santiment’s latest tweet pointed out a possible reason behind this price trend. However, there was something else to look forward to, as a key metric suggested a trend reversal in the coming days.

Selling pressure on Polygon increases

Santiment’s tweet posted on 7 June revealed that the big players in the crypto space were actually selling their MATIC holdings. About 115 million MATIC were moved to exchanges in one shot.

???? Although many assets enjoyed a solid rebound day, $MATIC has hit a wall of late. The latest setback appears to be a $95M transfer from a whale cold wallet to #Binance as the #10 market cap asset fell below $0.80 for the first time since January 6th. https://t.co/7i2FJI1yIP pic.twitter.com/VHo7FjYV72

— Santiment (@santimentfeed) June 7, 2023

As per the tweet, the latest setback appeared to be a $95 million transfer from a whale’s cold wallet to Binance. The increase in selling pressure resulted in a further price drop.

At the time of writing, MATIC was trading at $0.7627 with a market capitalization of over $7 billion, making it the 10th largest crypto.

Santiment’s chart suggested that the selling pressure was still on. Polygon’s supply on exchanges increased while its supply outside of exchanges went down. Additionally, the supply held by top addresses also declined, suggesting that investors were selling.

Source: Santiment

Is a trend reversal possible?

While the aforementioned metrics looked bearish, CryptoQuant’s data revealed a bullish metric. As per the data, MATIC’s Relative Strength Index (RSI) was in an oversold position.

When RSI becomes oversold, it is generally followed by an increase in buying pressure. However, apart from RSI, the other metrics continued to be bearish.

For instance, MATIC’s exchange reserve was increasing, while daily active addresses declined. MATIC’s MVRV Ratio plummeted sharply. This, coupled with the rise in 1-week price volatility, suggested a further price drop.

Source: Santiment

The current trend might continue

MATIC’s social volume increased, indicating it has been a topic of discussion lately. However, its weighted sentiment was down, which means that negative sentiment around MATIC dominated the market.

Source: Santiment

Is your portfolio green? Check the Polygon Profit Calculator

Coinglass’ chart further revealed that Polygon’s open interest registered a slight uptick. An increase in open interest suggests that the ongoing price trend will continue. Therefore, the chances of MATIC’s price declining further seemed pretty likely.