- Top DeFi and GameFi tokens correlated with ETH on most occasions, but the altcoin king continues to outperform them.

- Interest in DeFi tokens has not been reignited.

The Decentralized finance (DeFi) and Gaming Finance (GameFi) sectors operating on the Ethereum [ETH] blockchain have been growing in popularity, according to Glassnode. However, the same data mentioned that the growth of these sectors has not been able to match the hype. It was the same with tokens connected to the projects.

The emerging #Ethereum sectors of DeFi, GameFi, and Staking are gaining momentum, contributing to the value growth of both the sectors themselves and Ethereum as a whole.

Nevertheless, their current representation within the broader Ethereum ecosystem remains relatively modest.… pic.twitter.com/QqAFduW3pp

— glassnode (@glassnode) June 3, 2023

As the leading smart contract platform, Ethereum provides the infrastructure and ecosystem for these innovative applications to thrive.

While Ethereum has faced challenges such as high gas fees and scalability issues, contributions by projects under the aforementioned sectors were relatively scanty. As expected, the DeFi sector accounted for the largest share at 3.04%.

But despite Lido Finance’s [LDO] growth in adoption, the liquid staking protocol aspect took a mild 1.6% share. The GameFi sector, backed by Polygon [MATIC] strides grabbed 1.2%.

The blue chips are no match for ETH

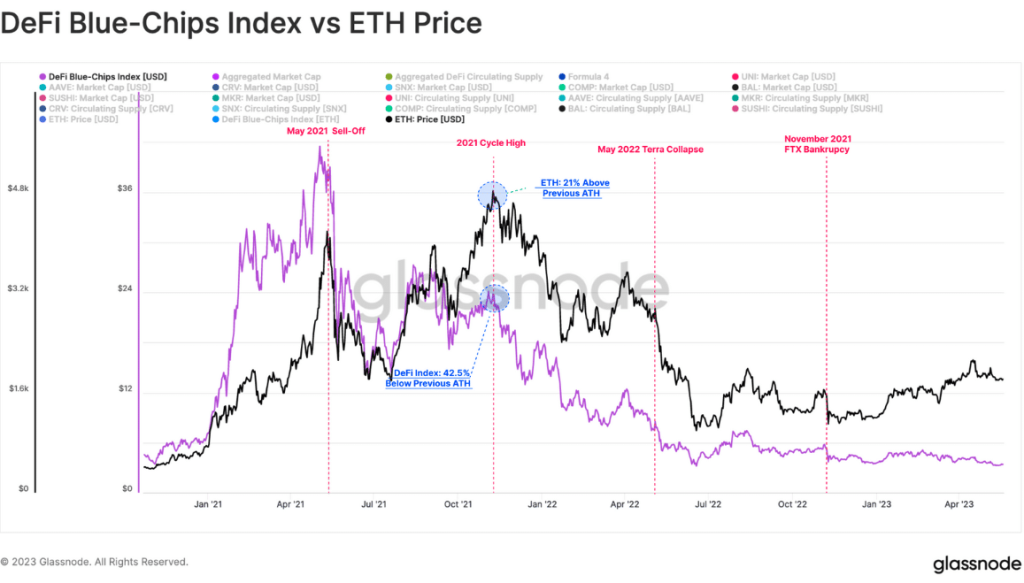

On 31 May, the on-chain analytic platform analyzed ETH’s correlation with the projects using the DeFI blue-chip index. The blue-chip index tracks the real-time market performance of the largest DeFi projects.

According to the report, ETH’s movement alongside the tokens under the group was similar. However, there have been times when the correlation decoupled.

For instance, when ETH reached its All-Time High (ATH) in 2021, the aggregate price performance of the tokens decreased by 43%.

Source: Glassnode

Despite the similarities in trend, ETH continued to outperform the tokens. In backing this claim, Glassnode mentioned,

“In the wake of the 2022 bear market, DeFi tokens have fallen -92.1% below the May 2021 ATH, while ETH is down just 45%”

Furthermore, it seemed that investors had not walked the talk of the FTX collapse aftermath. During that period, there were various conversations about the full adoption of DeFi projects.

However, that has not been the case. According to Glassnode, the Ethereum Mainnet trading volume still surpassed all of the DEXes linked to the sector.

All talk, no action

In fact, centralized exchanges including OKX and Binance had much more liquidity than DEXes like Uniswap [UNI] and pools like Curve Finance [CRV].

Instead of resulting in increased demand, new address creation has been unimpressive. An increase in new addresses suggests the attraction of new investors.

However, when the metric falls to a daily growth of 600 like it was with DeFi blue chips, it means that adoption momentum has decreased.

Source: Glassnode

Realistic or not, here’s MATIC’s market cap in ETH terms

In addition, the majority of the DeFi tokens mostly functioned under their individual ecosystem. UNI, which has a wide range of applications, was the standout token. This was because it operates beyond its home ground.

In summary, ETH plays a major role in the growth or decline of these tokens. But with new models emerging as a result of new proposals on Uniswap and MakerDAO [MKR], a resurgence in interest could be difficult to achieve.