Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

Finally, Bitcoin [BTC] inflicted a bullish breakout above its 2-week range formation. Following a weekend price pump amidst a tentative US debt ceiling deal, BTC secured the $26.2k support and crossed $27k.

The uptrend momentum was extended into the last week of May as the king coin climbed above the $26k – $27.5k range on 29 May.

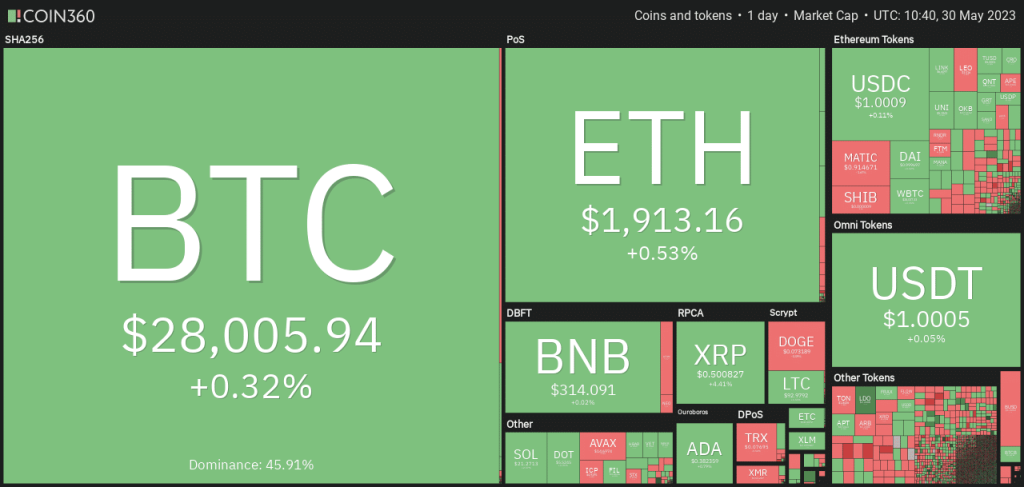

At press time, the BTC’s price was $28k, up 0.32% in the past 24 hours, extending green across most altcoins.

Source: Coin360

However, the move to $28k has previously faced heavy headwinds as long-term BTC holders sought to lock profits at this level.

BTC inflicts a bullish breakout

Source: BTC/USDT on TradingView

Between 11 – 28 May, BTC formed a short-term range of $26k – $27.5k. The pullback of the bullish breakout from the range on 29 May retested the range high at $27.5k.

After the pullback retest, the confirmed uptrend sets BTC bulls to watch out for key resistance levels ahead.

One of the resistance levels is $28.5k, a key price ceiling/range high during late March/early April price consolidation. A retest of $29k or $30k could be likely if BTC clears the $28.5k roadblock.

But a breach of the range high and the 20-EMA ($27.5k) could shove back BTC to the range, derailing bulls’ efforts. Such a retracement could ease at the mid-range of $26.8 or range low at $26k.

The RSI hit the overbought territory while the CMF retraced to the zero mark, denoting an increased buying pressure but easing capital inflows to BTC.

Shorts discouraged

Source: Coinglass

Out of the $1.56 million liquidated positions, $1.5 million were short positions in the 4-hour timeframe. While this paints a short-term bullish outlook, it remains to be seen if BTC will close above $28k at the end of May and extend the uptrend momentum into June.

Is your portfolio green? Check out the BTC Profit Calculator

Recent Glassnode data showed that Bitcoin hit new records regarding new addresses with non-zero holdings or above 0.01 coins.

Notably, addresses holding 0.01 coins hit a new ATH (all-time high) of 12,080,129. Similarly, non-zero addresses hit an ATH of 47 million, with just a few months to 2024 halving.

Source: Glassnode