- Bitcoin mining companies slow down on BTC sell-off while miners’ revenue continues to increase.

- Retail investors stay optimistic.

Bitcoin miners have long been subjected to the cryptocurrency market’s volatility. This has resulted in instances where miners have liquidated their holdings.

But in most cases, these miners have preferred to maintain their positions.

Read Bitcoin’s Price Prediction 2023-2024

Stepping on the brakes

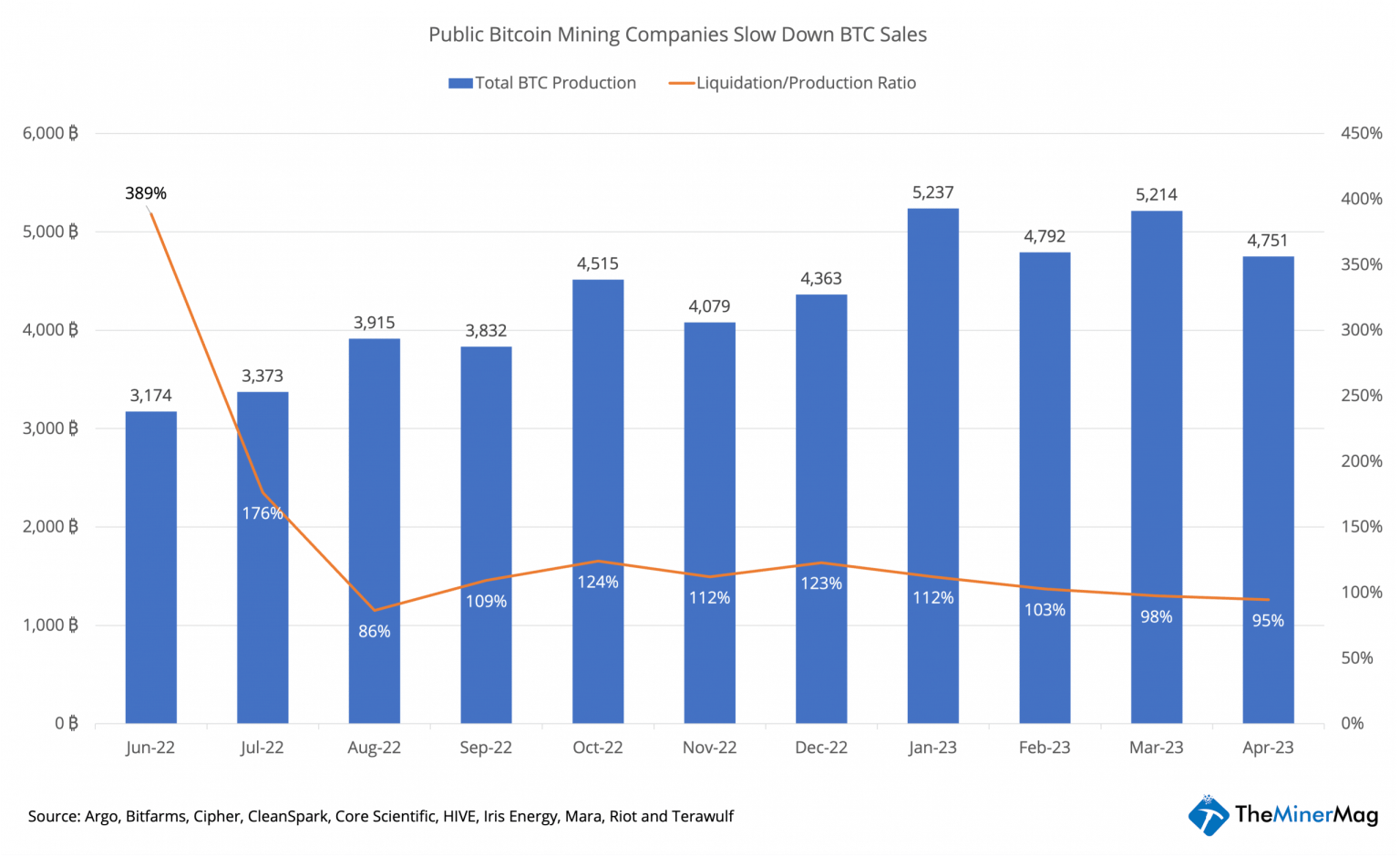

However, public mining companies were observed to be consistent in their behavior. According to Blockridge’s data, all mining companies sold 100% of their holdings, in the latter half of 2022.

However, for the first time in over six months, the liquidation ratio decreased to below 100% in March, subsequently dropping further to 95% in April. Indicating that these companies had slowed down on selling off their BTC holdings.

Source: Blocksbridge

Well, the decline in sell-offs could be attributed to the fact that the companies’ faith in BTC has been restored as the coin’s price has soared over the last three months.

Due to the increase in BTC’s price, the revenue generated by miners also witnessed a spike.

Source: Blockchain.com

Talking about mining pools, Foundry Pool, one of the largest mining pools in the sector, was observed to be having a successful run in terms of mining blocks. According to btc.com’s data, over the last six months, the pool managed to mine 8,060 blocks.

Source: btc.com

The mining companies and pools have just started to hold onto their BTC, and the retail investors show no sign of stopping their accumulation.

Glassnode’s data indicated that the number of addresses holding more than 0.1 coins has reached an all-time high.

Source: glassnode

No pressure

At the time of writing, the selling pressure on these investors was relatively low. According to data provided by Santiment, the 30-day MVRV ratio of BTC had turned negative.

This indicated that most short-term holders were not profitable and did not have an incentive to sell.

Is your portfolio green? Check out the Bitcoin Profit Calculator

On the other hand, the Long/Short difference of BTC continued to increase, indicating that the majority of the addresses on the network were long-term holders of Bitcoin.

Source: Santiment

Despite these factors, short positions on the network continued to increase. Consider the chart below, for instance.

Source: coinglass