– Bitcoin whales began to accumulate after a period of distribution.

– Short positions taken against BTC started to rise, despite bullish behavior showcased by retail investors.

At the time when there was a surge in retail interest in Bitcoin, it was noted that BTC whales were distributing their holdings. However, after a brief hiatus, these same whales began accumulating the king coin. And, at press time, were exhibiting signs of FOMO (Fear of Missing Out).

Read Bitcoin’s Price Prediction 2023-2024

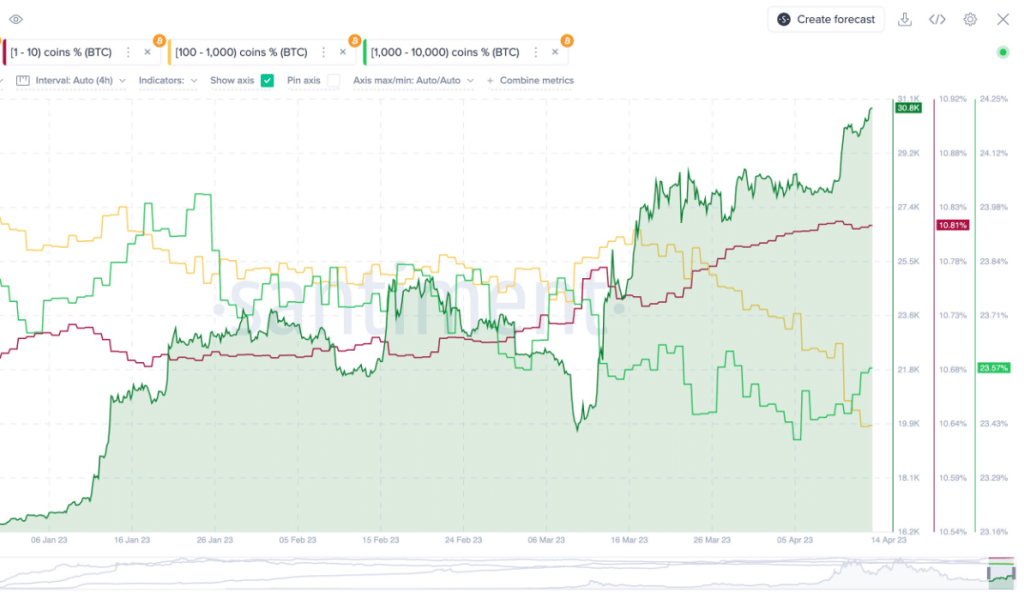

This was showcased by Santiment’s data, consider this- addresses holding 1,000 to 10,000 BTC appeared to show interest in buying Bitcoin.

Now, it is crucial to stay alert and watch for signs of FOMO as the market undergoes changes. Identifying FOMO can assist market participants in deciding between two potential strategies: either follow the trend and opt for “long” positions in the short-term, or take a short or mid-term wager on “short” positions by going against the crowd.

Signs of FOMO include a notable surge in retail investments, a reduction in stablecoin holdings, and a sudden increase in overall network activity.

Source: Santiment

Mistrust on the rise

However, there could be other reasons why addresses are accumulating BTC. According to analyst Will Clemente from Reflexivity Research, there has been a significant decline in trust in the U.S. government over the past few years.

In order to decrease the real value of its debt, the U.S. government may choose to expand the money supply. However, this strategy may have unintended consequences that could exacerbate inequality and erode public trust in the government even further.

According to Will, this mistrust in the government could help increase Bitcoin adoption.

Source: PEW Research Centre

Traders show interest

In terms of traders’ behavior, it was observed that Open Interest in Bitcoin started to rise, at press time. On exchanges such as Bitfinex, Open Interest in BTC reached a 9-month high of $143.49 million.

Is your portfolio green? Check out the Bitcoin Profit Calculator

High open interest for BTC can also significantly impact the cryptocurrency’s price movements by indicating a high level of market activity and a large number of traders speculating on the future price of BTC.

This spike in volatility can be beneficial for traders but can also raise risk and uncertainty for investors.

As per the latest data from coinglass, the number of short positions taken on BTC has grown.

Source: coinglass