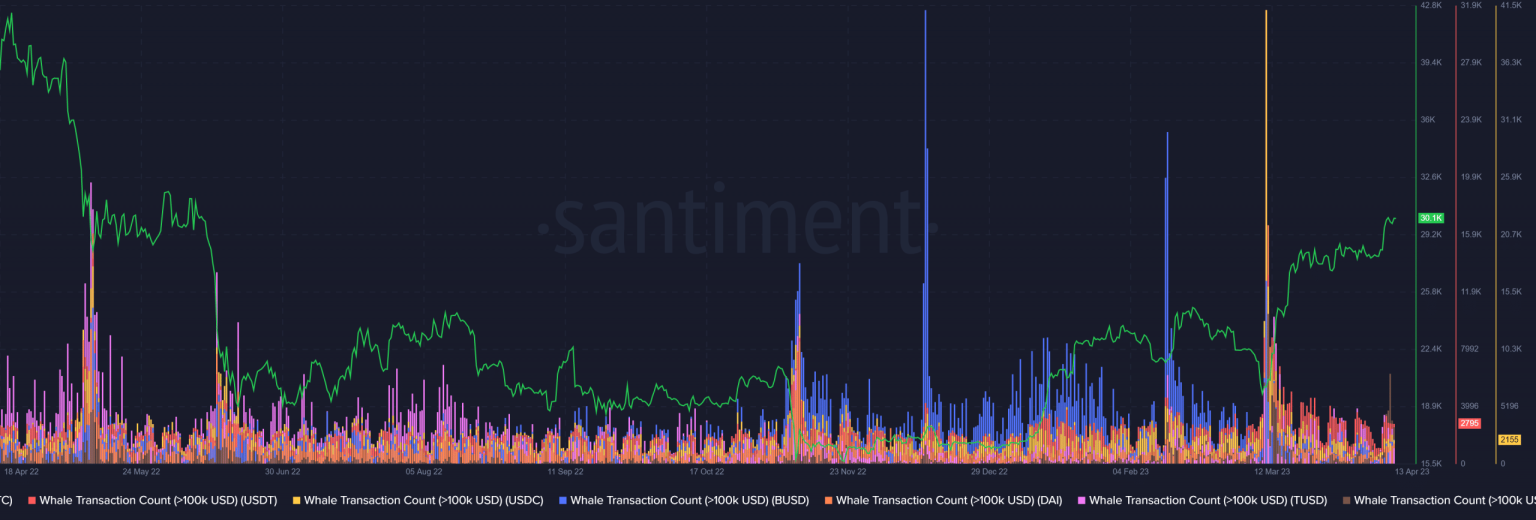

- Recent data from Santiment showed a strong correlation between stablecoin whale transactions and Bitcoin prices.

- Low whale transactions and USDT inflow suggest the unlikelihood of an immediate price rise.

The correlation between stablecoins, Bitcoin [BTC], and the broader cryptocurrency market has been evident, suggesting a cause-and-effect relationship.

But the question is- Can we leverage this information to forecast future price movements?

Stablecoins and Bitcoin price movement correlation

Santiment’s analysis revealed a crucial metric that highlighted the pivotal role of major stablecoins in shaping the broader cryptocurrency market.

Specifically, the analysis of whale transactions—those valued at $100,000 or more—indicates a significant correlation between spikes in stablecoin transactions and corresponding increases in BTC prices.

The correlation was focused on the five major stablecoins by market capitalization: USDT, USDC, BUSD, DAI, TUSD, and USDP.

The observed data clearly illustrates a strong relation between significant Bitcoin price hikes and spikes in stablecoin whale transactions. For instance, on 11 March, Tether [USDT] experienced its most substantial increase, and Bitcoin’s price quickly followed suit.

Source: Santiment

Similarly, on 13 February, a surge in Binance USD (BUSD) transactions led to a brief price recovery. Going back even further, intense stablecoin activity on 10 November (during the FTX crash) marked a local price bottom for Bitcoin in the previous year.

These examples highlight the vital role that stablecoins play in predicting and influencing the movements of the cryptocurrency market.

Current stablecoins move

As of now, there has been no major spike in the whale transaction chart, but there has been a slight increase in USDT whale transactions. Typically, stablecoin whale transactions indicate the movement of significant amounts of money to exchanges for buying purposes.

However, the current uptick in USDT whale transactions should not raise concerns, as it was not enough to cause a potential local peak for the crypto market.

A look at USDT

A closer look at the behavior of investors and the price movements of the largest stablecoin by market cap, USDT, revealed interesting insights. Analysis of the NetFlow chart from CryptoQuant indicated that there was no significant activity from the stablecoin.

As of this writing, the NetFlow chart showed USDT outflow dominating. However, the volume of outflow was relatively small and stood at around 25 million.

Source: CryptoQuant

Bitcoin has successfully crossed the $30,000 milestone, and the rest of the cryptocurrency market seems to be following suit with a rally.

However, the current state of stablecoin whale transactions and inflows suggests that a significant price spike may not be imminent. It is likely that a rally will occur only if there is a surge in inflows and whale transactions, signaling investor readiness to purchase more BTC.