- MultiversX launched four products in Q1 2023.

- Activity on the chain, however, continuedf to dwindle.

Formerly referred to as Elrond, metaverse-focused project MultiversX [EGLD] confirmed the successful rollout of some new products in Q1 2023 aimed at driving more users to the protocol.

Read MultiversX [EGLD] Price Prediction 2023-2024

In a series of tweets published on 31 March, MultiversX confirmed the launch of xPortal, MultiversX Bridge, MultiversX Wallet, MultiversX Explorer, and MultiversX Explorer in the first three months of the year.

Bi-weekly product releases seem hard to accomplish?

The #MultiversX team made it possible in Q1.

After all, it’s just hard work. pic.twitter.com/nA6f4Q5iUf

— MultiversX (@MultiversX) March 31, 2023

In November 2022, the team behind MultiversX announced its decision to change its name from Elrond and move forward under MultiversX, rebranding itself as a decentralized blockchain network with a focus on the metaverse.

Much ado about nothing?

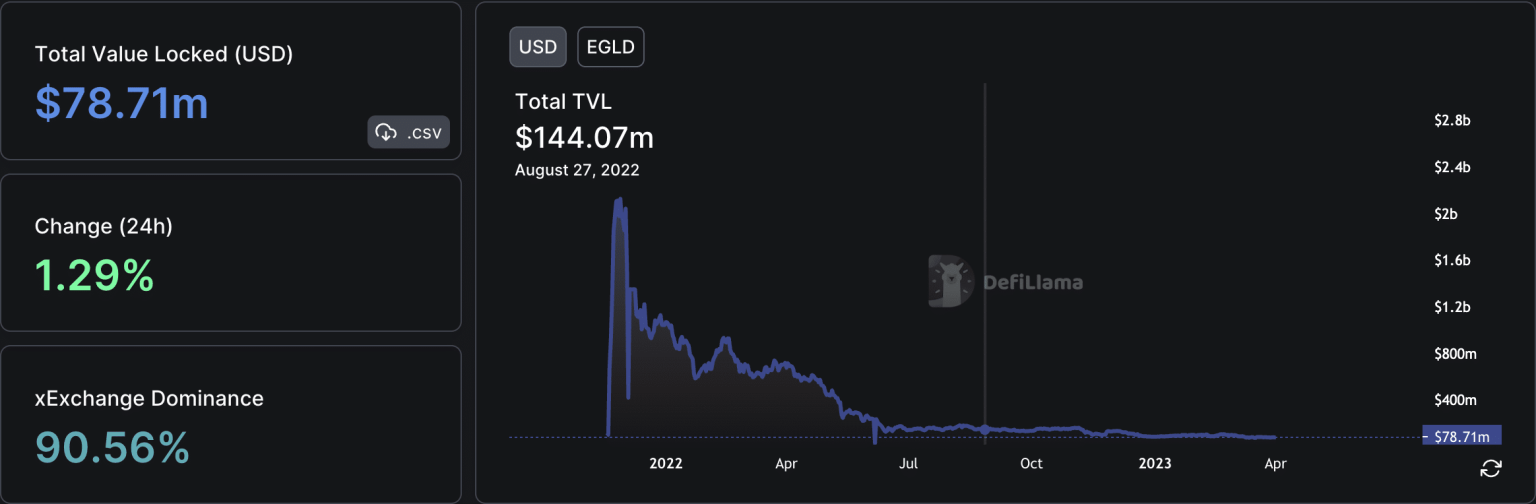

In spite of the new products being launched this year and old products re-launched under new names since the name change in November, MultiversX’s DeFi TVL remained at its June 2022 level, data from DefiLlama revealed. At press time, the protocol’s TVL was $78.71 million, having fallen by 6% since the year began.

Source: DefiLlama

Further, in the past few weeks, user activity on the protocol has seen a steep decline. According to data from Artemis, MultiversX’s daily active addresses count has fallen by 76% in the last month.

Source: Artemis

Moreso, the total number of transactions completed on-chain within the same period decreased by 80%.

Source: Artemis

How has EGLD fared?

While EGLD’s price has increased by 30% on a year-to-date basis, its price has embarked on a descent since 21 February. After peaking at a high of $53 on that day, the altcoin’s value has since dipped. As of this writing, it traded at $42.58 per data from CoinMarketCap.

With the coin’s price oscillating within a tight range in the last two weeks, EGLD’s buying momentum has since fallen. For example, momentum indicators Relative Strength Index (RSI) and Money Flow Index (MFI) were positioned below their respective center lines at the time of writing. While EGLD’s RSI rested at 48.27, its MFI was 43.64.

Is your portfolio green? Check out the EGLD Profit Calculator

Likewise, EGLD’s On-balance volume, in a downtrend at press time, decreased by 4% during that period. At press time, this was 16.927 million. If an asset’s OBV is declining, it suggests that selling pressure is increasing and more sellers are in the market than buyers.

Source: EGLD/USDT on TradingView

At press time, the coin’s weighted sentiment was -0.442. A negative sentiment spanning a two-week period and still subsisting showed the presence of bearish conviction in the EGLD market.

Source: Santiment