- Waves plans to release an EVM for layer 2 networks, which might trigger a resurgence in network activity.

- Its token struggled to regain momentum after a slow performance since mid-March.

The Waves [WAVES] protocol is looking to spice things up in a move that might rejuvenate the flow of liquidity within its platform. This warrants a look at what the network is cooking as part of its plans.

Is your portfolio green? Check out the Waves Profit Calculator

Waves’ founder, on 21 March, revealed that the network was working towards rolling out a new layer 2 EVM. The platform aimed to use this move to boost transactions with layer 2s while also tapping into other efficiencies, such as scalability.

The announcement meant that Waves might be about to unlock a lot more liquidity into its ecosystem.

L2 EVM on #Waves is coming. Embedded chains! pic.twitter.com/POioU5okZm

— Sasha.waves (@sasha35625) March 21, 2023

Easier connectivity to the Ethereum [ETH] network through smart contract-enabled transactions might provide more exposure to Waves. Consensus is necessary when deploying layer 2 networks.

This might explain why its latest announcement is the TribeDAO. The latter will not only act as a community coordination network but also pave the way for the protocol’s ambassador program.

We have a major community announcement to make!!

Introducing TribeDAO – the community coordination network and the next evolution of the Waves ambassador program!

Join us as we reimagine the possibilities of community in the digital age!

➡️ https://t.co/nXRPQ1u9pJ pic.twitter.com/uO48ZWt97L

— Waves Labs ???? (1 ➝ 2) ????♂️ (@waves__labs) March 21, 2023

On-chain metrics show promise

But what do the updates mean for the network and for its WAVES token? Aside from securing more liquidity, the upcoming changes are also expected to boost the network’s attractiveness.

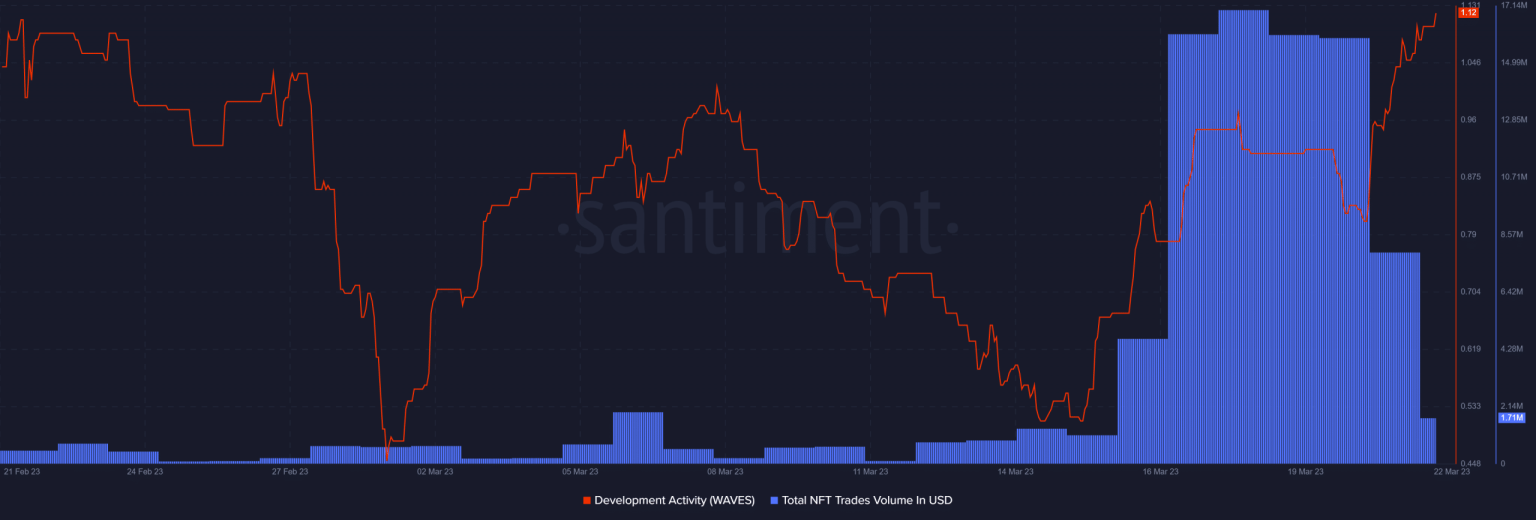

Waves is already demonstrating some interesting observations in line with this new focus. For example, its development activity has notably been up since mid-March.

Source: Santiment

Waves’ total NFT trade volume also registered a surge since mid-March, indicating more network activity. Also worth noting is that the network’s on-chain volumes have improved, albeit slightly.

However, it still has a long way to go before pushing to the highest monthly levels. This reflected the press time situation with its native token.

Source: Santiment

WAVES price action

WAVES has not really achieved much in terms of price movements. It remained within the same range from its mid-month levels despite the strong bounce back in the second week of March. It has been stuck within the $2.11 and $2.40 price range for the last few days.

Source: TradingView

How many are 1,10,100 WAVES worth today

The RSI has been hovering within the mid-level, aligning with the lack of directional momentum. Meanwhile, its MFI indicated a lack of significant inflows or outflows.

The token might overcome its current stalemate if the network succeeds with its aforementioned plans. It remains to be seen whether the recent announcement will allow WAVES to sum up enough momentum.