Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- UNI’s downtrend slowed after bulls attempted recovery at press time.

- Funding rates fluctuated, but the 90-day mean coin age rose.

Uniswap [UNI] saw aggressive selling after March 8 (Wednesday), but it was slowly easing at press time. The DEX (decentralized exchange) token dropped from $6.4 to a crucial confluence of support levels that allowed bulls to set it into a recovery path.

Read Uniswap [UNI] Price Prediction 2023-24

Despite the market uncertainty, DEXes registered positive growth. Their weekly volume improved by over 100%, and UNI was one of the beneficiaries, according to DefiLlama.

Is the recovery sustainable?

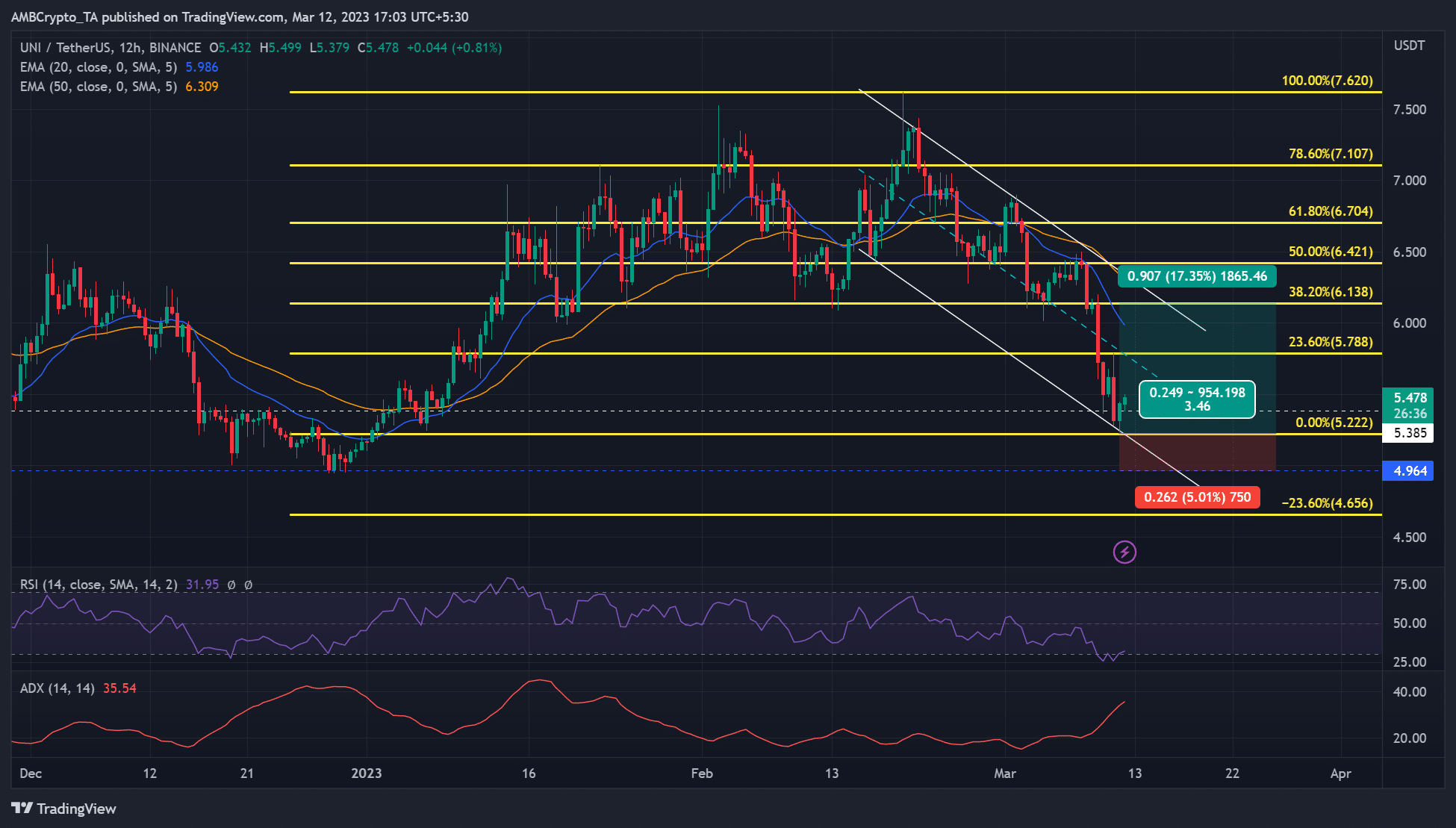

Source: UNI/USDT on TradingView

UNI inflicted a bullish rally after forming a double-bottom in mid-February. However, the price rejection at $7.620 set the asset into an extended correction that formed a descending channel (white).

The rejection invited bears into the market, and the death cross after 20 EMA bearish crossover of 50 EMA led to more selling pressure.

However, the price dump hit a crucial confluence of support levels, making a reversal and potential recovery highly likely.

As such, a pullback retest at $5.222 could offer bulls opportunities with primary and secondary targets at 23.6% (5.788) and 38.2% ($6.138) Fib levels, respectively. The targets could offer RR of 1:3 and 1:2, respectively, with a stop loss below $5.

But a close below December’s low of $5 would invalidate the above thesis. A retest of December lows would clear all the gains in early 2023, but the downswing could face a likely barrier at $4.656.

The Relative Strength Index (RSI) fluctuated in the oversold territory showing selling pressure increased. However, the ADX (Average Directional Index) slope rose sharply, showing a substantial trend change to the upside.

The Mean Coin Age rose amidst fluctuations in funding rates

Source: Santiment

Bulls could be hopeful because of the rising 90-day Mean Coin Age, which indicates extensive accumulation of UNI tokens – a signal of a potential rally. However, the fluctuating funding rates could undermine a strong recovery.

Is your portfolio green? Check the UNI Profit Calculator

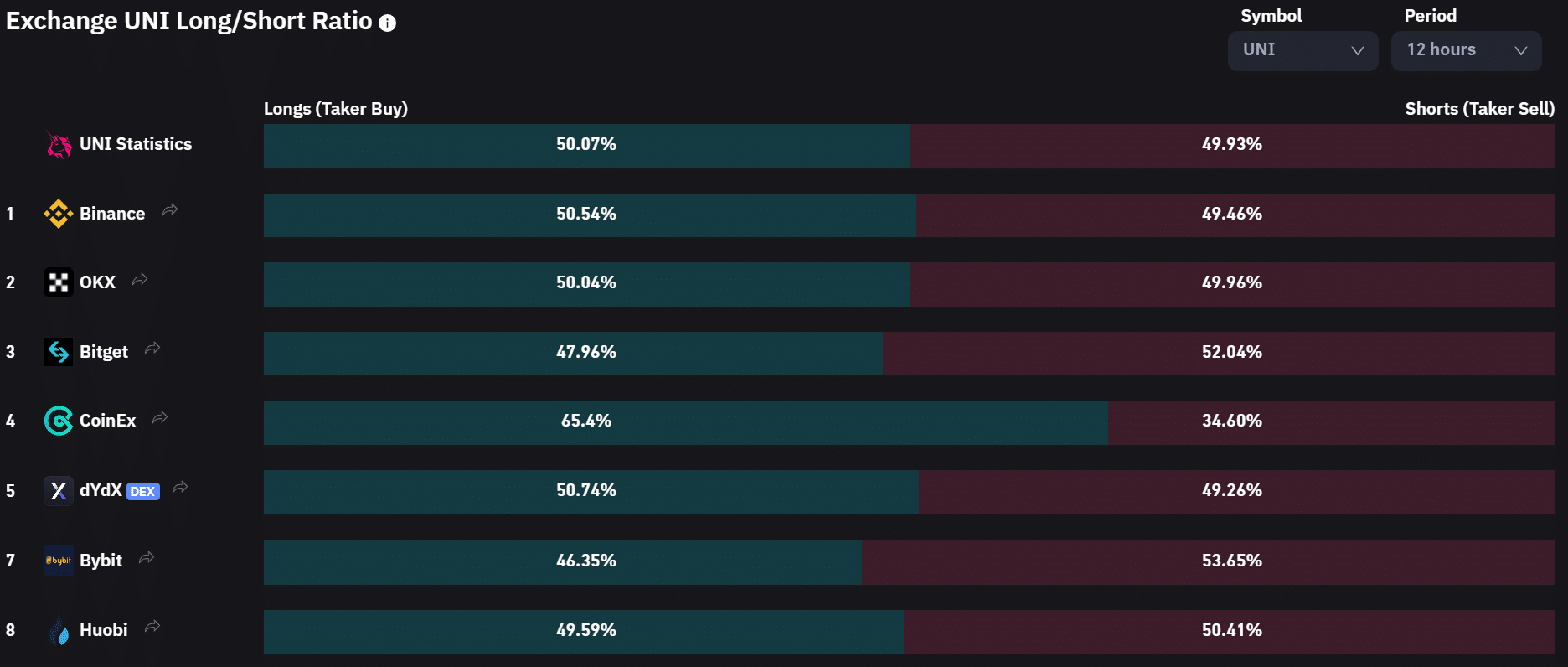

On the other hand, the UNI long/short ratio in the 12-hour timeframe showed bears had little leverage across most exchanges.

But the 4-hour timeframe showed bulls had more leverage than bears. As such, investors’ expectations were positive in the short term but somewhat negative in the medium and long term.

Source: Coinglass

![Uniswap [UNI] attempts recovery; short-sellers opportunities limited?](https://patrolcrypto.com/wp-content/uploads/2023/03/pasted-image-0-63-1536x874.png)