- Crypto-focused venture capital investors have advised their portfolio companies to withdraw funds from Silicon Valley Bank.

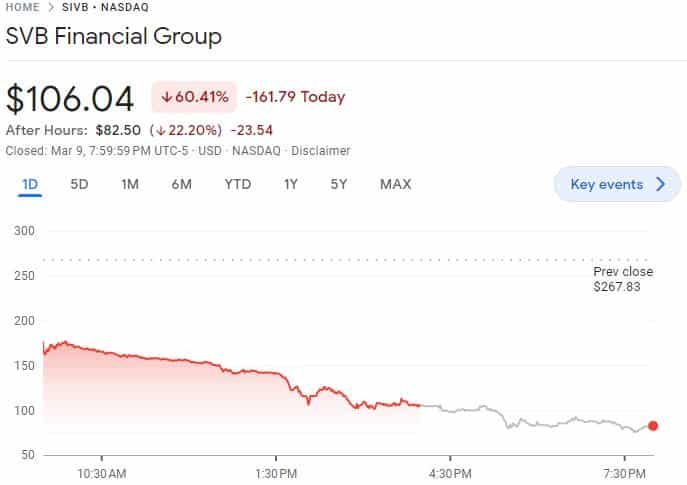

- SVB Financial Group, the parent company of Silicon Valley Bank, lost more than 60% of its value on 9 March.

Crypto-focused venture capital investors have advised their portfolio companies to withdraw funds from Silicon Valley Bank, which is struggling to reassure clients after moves to shore up its balance sheet spooked investors. The warnings arise as startups in the industry look for viable banking options.

Spokespeople for Mechanism Capital and Eden Block acknowledged that they have advised portfolio companies to withdraw funds held at SVB.

Pantera Capital, a hedge fund and venture investor, is advising portfolio companies to look into multiple accounts, according to a spokesperson.

Two other crypto venture capitalists have given similar advice to startups they’ve backed, but have asked not to be named due to commercial sensitivities.

The news follows a sudden decline in the shares of the bank’s parent company, SVB Financial Group, which yesterday fell more than 60%.

The sell-off occurred after the company announced a $1.75 billion stock offering earlier this week, as well as a separate $500 million common stock purchase by private equity firm General Atlantic, in an effort to strengthen its balance sheet.

The parent company of Silicon Valley Bank, SVB Financial Group, lost more than 60% of its value yesterday. In effect, it closed yesterday’s trading session at $106.04. The bank’s assets totaled around $212 billion.

Source: Google Finance

Crypto Twitter concerned

According to a Bloomberg report on 10 March, Peter Thiel’s Founders Fund had already advised portfolio companies to withdraw funds from the failing lender.

After the demise of crypto-friendly Silvergate Bank earlier this week, crypto startups are already looking for banking options.

The Twitter community is still very concerned about the situation. Peruvian Bull, a prominent crypto voice, said that if SVB fails, it could be a Lehman moment for the startup world.

Spark Capital VC Nabeel Hyatt said that SVB has been a more consistent partner to founders in executing their plans. “For the startup ecosystems benefit I really hope SVB gets through this,” said Hyatt.